1 0

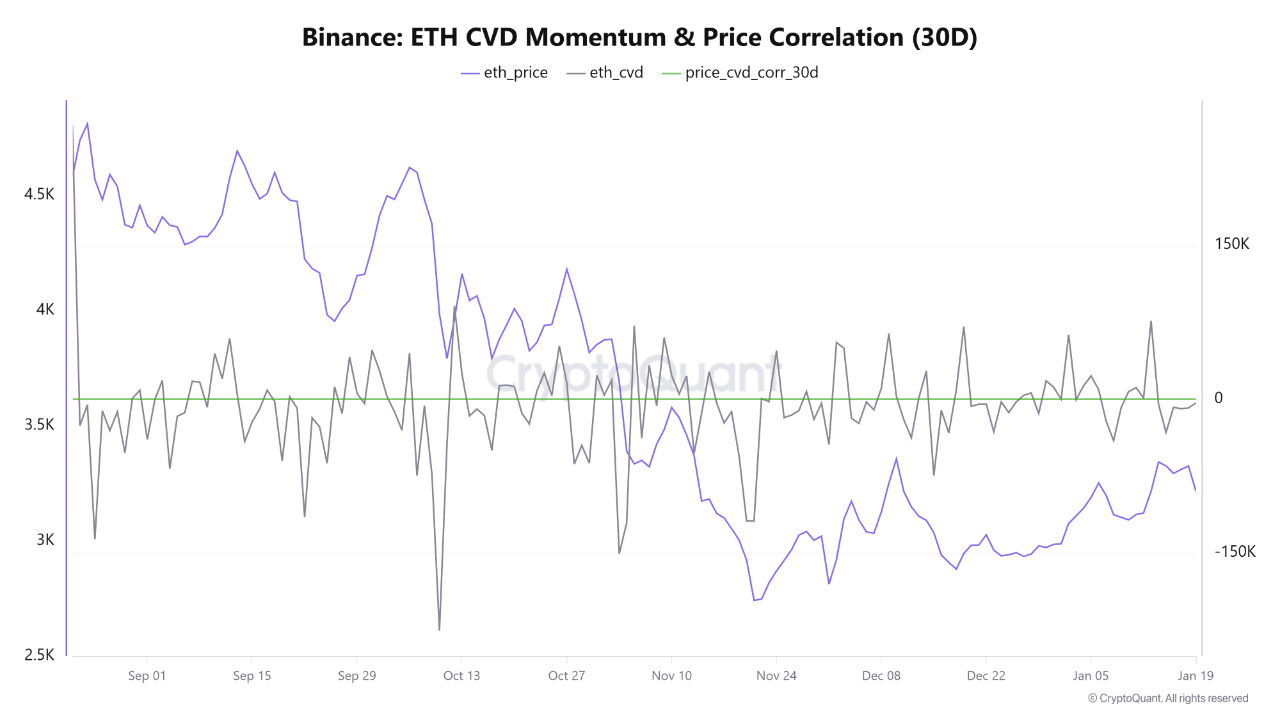

Ethereum Holds Above $3,100 Despite Negative Binance Order Flow

Ethereum is attempting to stabilize above the $3,100 level after failing to break through $3,400 resistance. The broader crypto market is struggling to regain momentum, with sellers still present on rallies.

- Ethereum is trading near $3,200, with market conditions showing a downside tilt.

- The Accumulated Order Flow (CVD) indicator is approximately -3,676, indicating net selling pressure.

- The price stabilization versus negative flow suggests a lack of strong demand despite holding support levels.

- ETH's correlation with CVD is around 0.62, suggesting some alignment with volume behavior.

- Current price action signals a correction phase rather than a trend reversal.

- Support at $3,000 is limiting downside acceleration despite weak volume momentum.

Technically, the $3,300–$3,400 region remains a key resistance cluster. Ethereum is holding above its short-term moving average near $3,050–$3,100 but is capped below mid-term moving averages acting as dynamic resistance.

- Volume during the rebound is muted, indicating a lack of aggressive follow-through.

- Ethereum is in consolidation, needing a breakout above $3,400 to shift sentiment positively.