Updated 23 December

Ethereum Accumulation Addresses Increase Holdings by 60% Since August

During a recent general crypto market decline, Ethereum (ETH) experienced a correction exceeding 19.5%, finding support at $3,100. The altcoin has since shown minor recovery with a rise of over 5% in the last two days. However, data on wallet activity suggests a positive long-term outlook for Ethereum.

Ethereum HODL Addresses Increase Supply Dominance to 16%

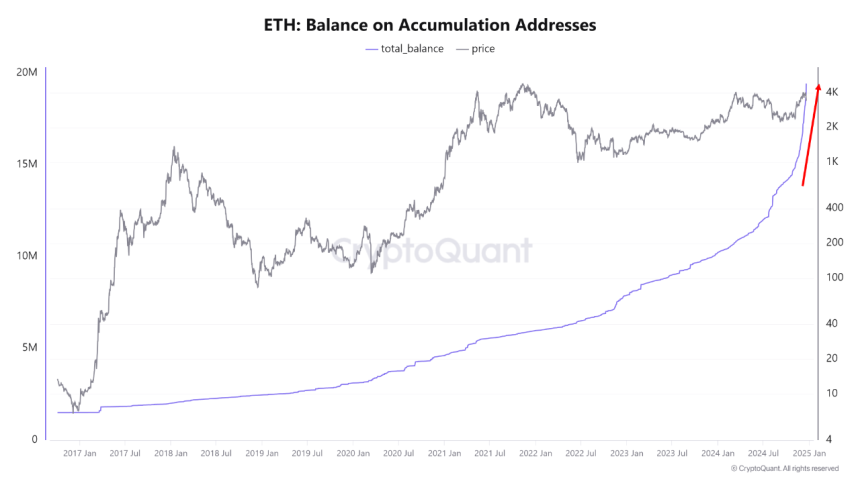

CryptoQuant analyst MAC_D reported that Ethereum Accumulation Addresses increased by 60% from August to December. These wallets now hold 16% of ETH supply, amounting to 19.4 million ETH out of 120 million ETH. Accumulation Addresses are characterized by holding Ethereum without frequent transactions, indicating long-term investment confidence.

The rise in these HODL wallets is notable compared to previous bull cycles. MAC_D links this accumulation to bullish expectations regarding potential regulatory changes under the incoming Donald Trump administration, which could positively impact the DeFi industry, a key sector within the Ethereum ecosystem. This suggests that long-term holders are likely to continue increasing their holdings despite current price fluctuations.

MAC_D highlights that Ethereum's price has never fallen below the realized price of these Accumulation Addresses, indicating a strong potential for future price appreciation due to ongoing purchases by these wallets.

What's Next for ETH?

MAC_D warns that macroeconomic factors will likely dominate Ethereum's short-term price movements, as evidenced by a recent drop linked to anticipated interest rate cuts in 2025. Currently, ETH trades at $3,352, reflecting a 3.07% decline in the past 24 hours, with daily trading volume down by 53.25% at $31.15 billion.

Recent price trends show Ethereum's negative performance, with losses of 14.74% and 1.05% over the past seven and thirty days, respectively. Nevertheless, the asset's price remains significantly above its initial rally point of $2,397 following the US elections, indicating sustained long-term sentiment.

With a market cap of $401 billion, Ethereum maintains its position as the second-largest cryptocurrency and the largest altcoin in the digital asset market.