Ethereum Active Addresses Increase 36% Following US Elections

After briefly surpassing $4,000 on December 6, Ethereum (ETH) has entered a consolidation phase with minimal price movement. Analyst Burak Kesmeci from CryptoQuant suggests that a sustained price rally may follow.

US Election Results Impact Ethereum Active Addresses

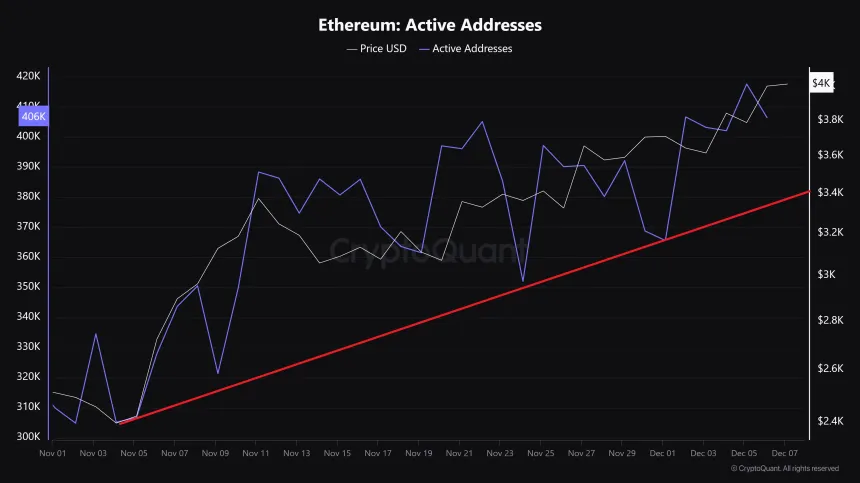

Following the November 5 US elections, Ethereum and other cryptocurrencies saw significant price increases, largely attributed to the election of pro-crypto candidate Donald Trump as President-elect. According to Burak Kesmeci, the election results alleviated uncertainty in the crypto market, encouraging investments and contributing to a 70% price increase for Ethereum since November 5, peaking at $4,077.

Kesmeci also noted a 36.26% rise in active Ethereum addresses during this price surge, increasing from 306,000 to 417,000. This growth indicates that the price increase correlates with rising organic demand and interest from investors and blockchain users.

Kesmeci concludes that the increase in active addresses supports the notion of a "healthy and sustainable" price rally for ETH, suggesting potential for long-term price appreciation.

ETH Price Overview

Current data from CoinMarketCap reports Ethereum trading at $4,006, reflecting a slight decrease of 0.54% over the past 24 hours. Long-term investors see profits with gains of 7.36% and 39.31% over the past seven and thirty days, respectively.

If Ethereum breaks out of its current consolidation, it faces resistance at $4,100. A successful breach could lead to a target of $4,900, nearing its all-time high of $4,891.

In addition to the rise in active addresses, bullish sentiment is reinforced by increased inflows into Ethereum spot ETFs, totaling $1.41 billion. The altcoin season is anticipated to gain momentum, with expectations for further gains in early 2025.