7 0

Ethereum Approaches $2,800 Amid Increased Selling Pressure from Investors

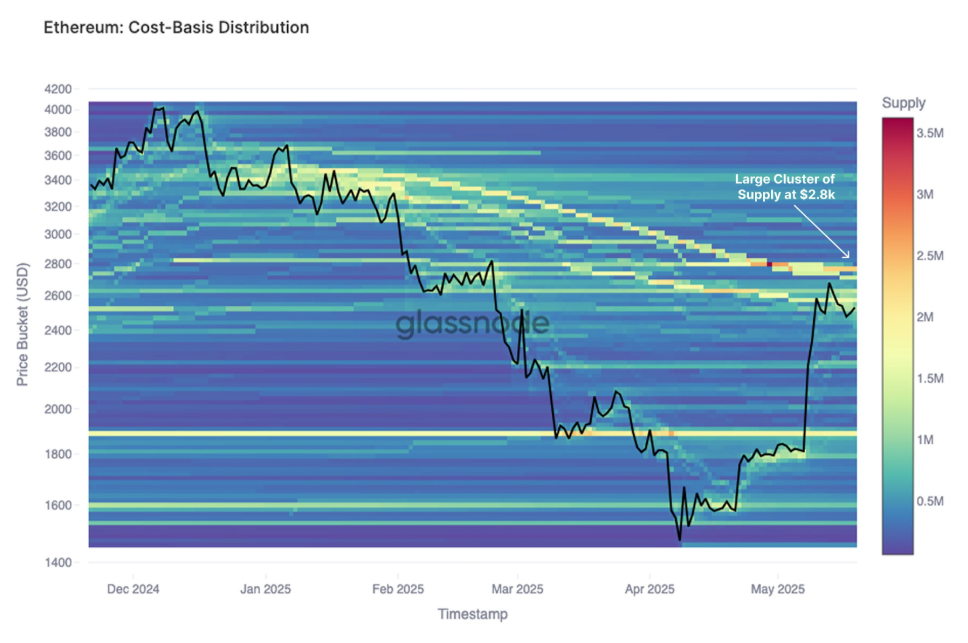

Ethereum's price approached $2,800, with significant resistance at $2,750. On-chain data indicates a cluster of buy levels around $2,800, which may increase selling pressure as many investors are now able to exit at breakeven.

$2,800 Zone Heats Up With Investor Cost Basis Cluster

- Ethereum rebounded from a low of $1,600 in April, recovering over half of its losses from a peak near $3,800 in December 2024.

- Glassnode's analysis reveals a high concentration of wallet activity near the $2,800 level.

- Investors underwater since early 2025 may sell their holdings as the price nears $2,800, increasing sell-side pressure.

- A strong supply density is noted below $2,800 that Ethereum must overcome to approach $3,000.

Some Resistance Above, But Strong Support Below

- On-chain data shows strong support for Ethereum between $2,330 and $2,410, with 2.58 million addresses holding over 63.65 million ETH.

- At present, Ethereum trades around $2,500, down 2% in the last 24 hours, positioned between selling pressure and demand support.

- No major resistance exists above aside from the $2,800 cost basis levels, suggesting potential for a quick rise to $3,000 if broken.

- The outcome hinges on whether bullish momentum can breach the resistance or if a pullback occurs toward $2,370.