Updated 15 December

Ethereum Approaches Critical $4,000 Resistance Amid Strong On-Chain Metrics

Ethereum is approaching the critical $4,000 level, nearing its all-time high. Market skepticism exists regarding Ethereum's performance in this cycle, with some analysts predicting underperformance compared to past bullish phases. Despite doubts, Ethereum has shown resilience, maintaining demand at key support levels and a bullish price structure.

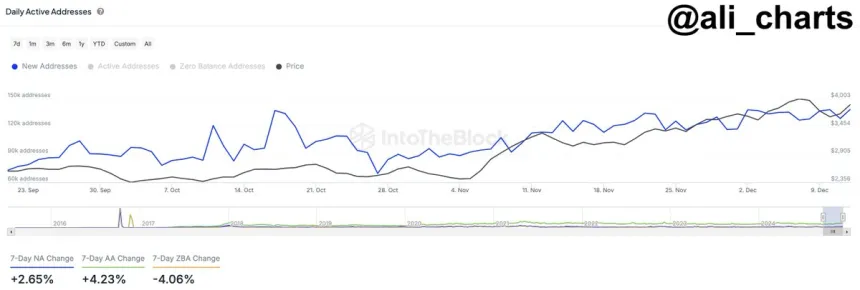

On-chain data from IntoTheBlock indicates strong network activity for Ethereum this week. Metrics such as active addresses, transaction volumes, and net flows suggest a healthy ecosystem, indicating increasing participation and growing investor confidence despite broader market uncertainties.

Ethereum Data Signals Strength

Ethereum has been on an upward trajectory recently, driven by a bullish trend initiated earlier this month. Analysts are observing closely for a breakout above yearly highs as ETH approaches its all-time high (ATH). This moment is viewed as crucial for Ethereum's position in the current bull cycle.

Analyst Ali Martinez shared on-chain metrics revealing a positive outlook for Ethereum’s network. Active addresses increased by 4.24%, new addresses rose by 2.65%, and zero-balance addresses decreased by 4.06%, suggesting heightened user engagement and reactivation of dormant wallets.

These metrics indicate building momentum for Ethereum, with potential for a significant price move if it surpasses yearly highs. Conversely, failure to maintain upward momentum could lead to further consolidation before another breakout attempt.

With strengthening fundamentals and market conditions favoring a breakout, Ethereum appears positioned for a major move. The next few weeks will be crucial in determining Ethereum’s trajectory in the ongoing bull cycle.

ETH Testing Supply

Ethereum (ETH) currently trades at $3,920, showing resilience after multiple attempts to breach the $4,000 resistance level, which serves as both a psychological and technical barrier essential for confirming its bullish trend.

The focus remains on Ethereum’s ability to reclaim the $4,000 level, which could catalyze a rally towards new yearly highs. However, failing to decisively break this resistance may keep ETH in a consolidative phase, leading to uncertainty about future movements.

If Ethereum cannot maintain momentum and exceed $4,000 soon, increased selling pressure could arise, potentially retracing to lower demand levels around $3,500, which has previously served as robust support.

As the market anticipates a decisive move, Ethereum stands at a critical juncture. A breakout above $4,000 could restore bullish sentiment, while failure may indicate further consolidation or correction before significant price action occurs.

Featured image from DALL-E, chart from TradingView