5 0

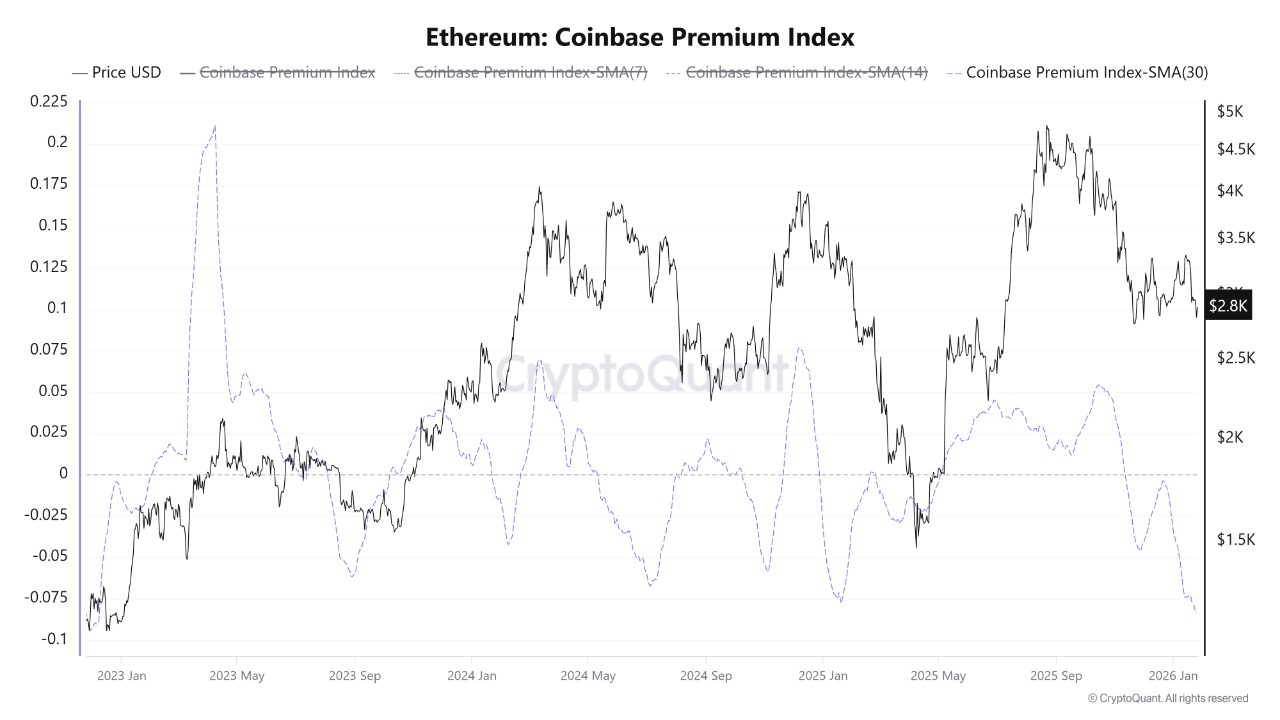

BEARISH 📉 : Ethereum faces pressure as Coinbase Premium hits multi-year low

Ethereum's price recently dropped below $2,800 but quickly rebounded to approach $2,900. However, this recovery appears fragile, as demand at key support levels remains thin. Current volatility and defensive sentiment suggest Ethereum is in a critical period that could influence its 2026 trend.

- The 30-day simple moving average (SMA30) of the Ethereum Coinbase Premium Index has fallen to −0.08, indicating ETH is trading at a discount on Coinbase. This signals weaker demand from US institutional buyers.

- A negative premium index suggests less buying pressure from US institutions, which historically supports major ETH rallies.

- The report identifies the low premium as a warning sign that without US-backed demand, Ethereum's recovery attempts might not sustain.

Currently, Ethereum trades near $2,897 after recovering from a dip below $2,800. Despite this bounce, the overall market structure remains weak, with ETH trending lower since late 2025 highs. Recovery attempts have not led to sustained reversals.

- ETH is trading below key trend averages, indicating bearish pressure. The 50-period and 100-period moving averages are above the current price, signaling weak momentum.

- The 200-period moving average provides long-term support, suggesting a corrective phase rather than a full breakdown.

- Bulls aim to reclaim $3,000 and move toward $3,150–$3,250, challenging resistance zones. If unsuccessful, risks remain for further drops to $2,750–$2,800.