3 0

Ethereum Faces Bearish Pressure Amidst Bullish On-Chain Supply Shift

Ethereum is experiencing renewed selling pressure amid growing market uncertainty. After several failed recovery attempts, ETH struggles to attract demand, leading analysts to caution about a potential bear cycle.

- Volatility and weak sentiment persist, with traders hesitant to invest due to increased downside risks.

- Technical analysis from CryptoQuant shows Ethereum is forming a descending triangle pattern, indicating distribution rather than accumulation.

- Price remains below a downtrend line, with key moving averages acting as resistance, suggesting that sellers hold control despite stabilization efforts.

On-Chain Analysis:

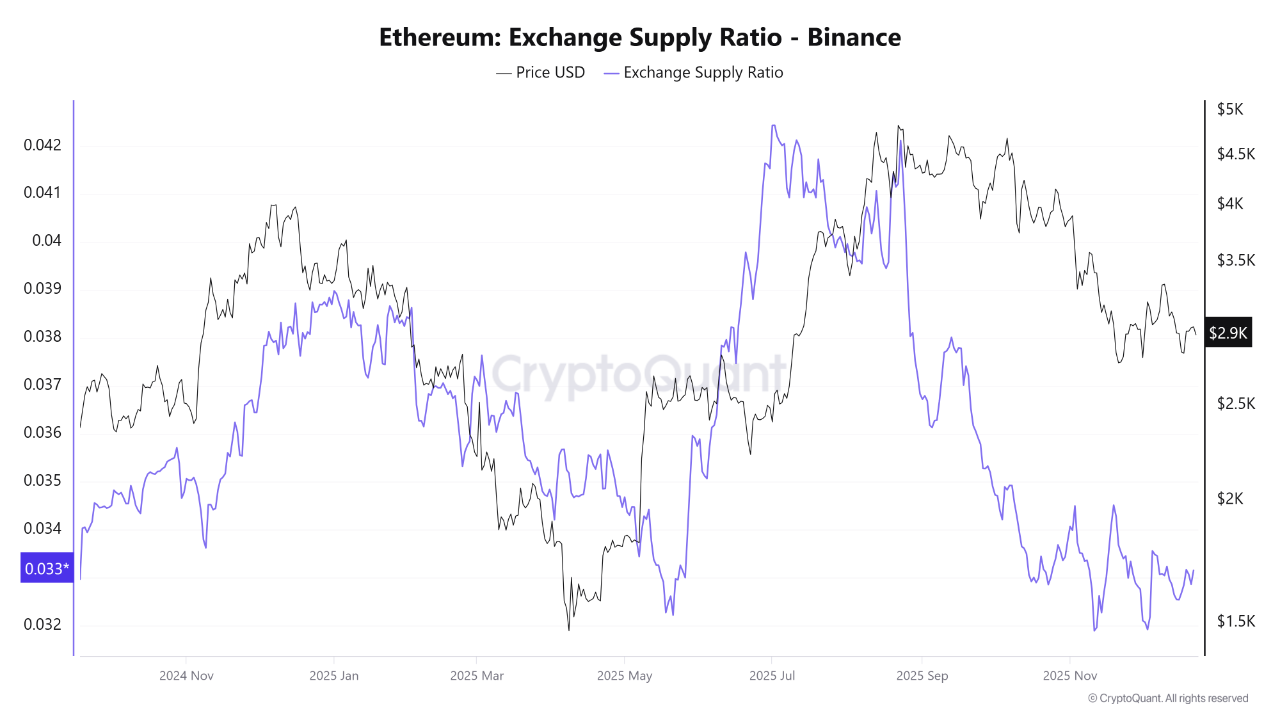

- While technical indicators suggest bearishness, on-chain data reveals a contraction in ETH supply on exchanges like Binance.

- The Ethereum Exchange Supply Ratio on Binance is at its lowest since September 2024, indicating reduced liquid supply.

- This behavior suggests long-term positioning by market participants, potentially reducing immediate sell-side pressure.

The market is at a critical point. A break above the downtrend line could indicate accumulation over distribution, altering the current bearish outlook.

Current Technical Outlook

- Ethereum is consolidating around $2,930 after declining from its late-summer highs.

- The structure remains weak, with lower highs and lows since failing to maintain above the $4,500–$4,800 zone.

- Key daily moving averages act as resistance, with convergence in the $3,400–$3,600 range indicating strong selling pressure.

The $2,800 level is crucial for maintaining support. A breakdown could lead to further losses, while reclaiming the $3,200–$3,300 range would improve the technical outlook.