0 0

BEARISH 📉 : Ethereum faces persistent stress as price remains below $2,000

Ethereum is trading below the $2,000 mark, indicating ongoing market pressure. This level remains a psychological threshold affecting trader sentiment and market stability. The current market conditions suggest that Ethereum may soon experience a decisive movement.

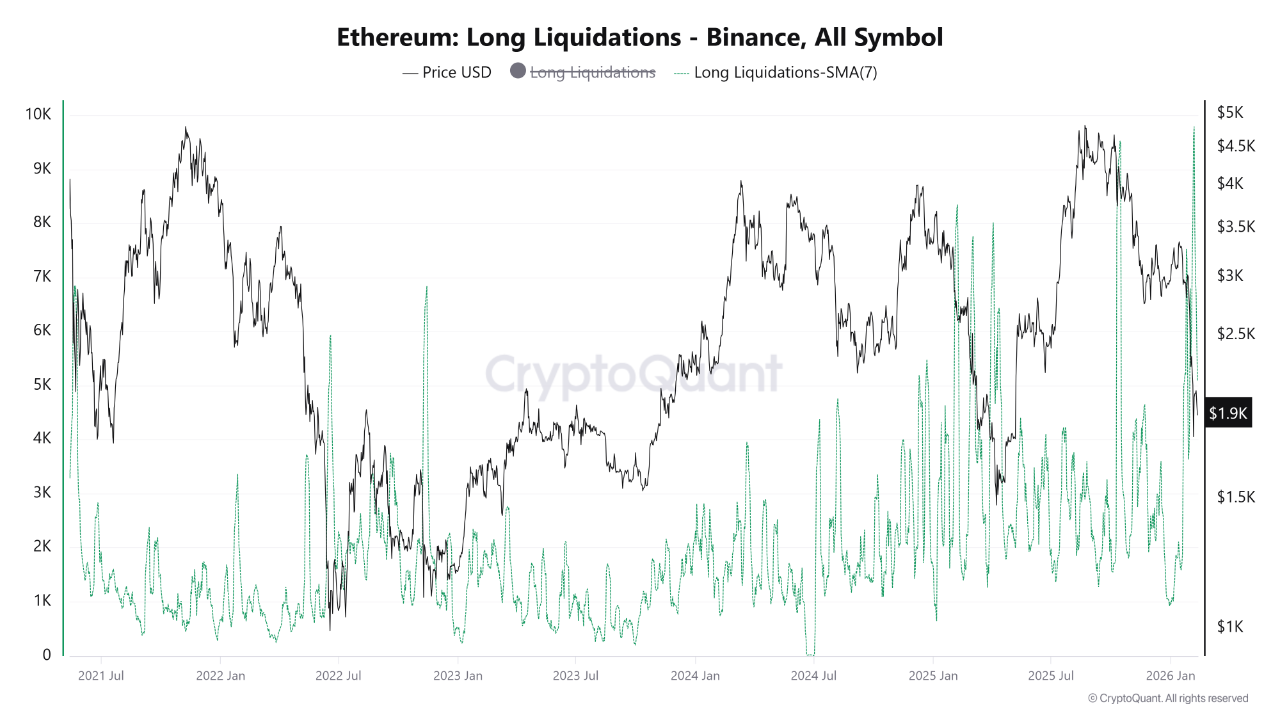

- The 7-day simple moving average of long liquidations on Binance reached approximately 9,000 ETH as of February 6, 2026, highlighting sustained market stress since mid-2021.

- This pattern suggests gradual unwinding of leveraged positions, hinting at ongoing deleveraging rather than sudden liquidation events. This can reset market leverage but also reflects fragile sentiment.

Sustained Liquidations Signal Derivatives Market Reset

- Ethereum's move from $3,000 to $2,000 did not trigger capitulation; instead, it saw prolonged margin calls. This indicates persistent derivatives market stress.

- The extended liquidation phase exceeds previous major capitulation periods, suggesting a broad deleveraging cycle that reduces speculative volatility.

- This reset could signal seller exhaustion and potential stabilization if macro liquidity conditions improve and investor confidence returns.

Ethereum Tests Long-Term Support: Weekly Structure Weakens

- The loss of the $2,000 level weakens Ethereum's technical structure, with price action showing rejection from the $3,000 region and forming lower highs.

- Increased trading volume during recent declines suggests distribution rather than accumulation, reinforcing market stress.

- Key support lies between $1,500 and $1,700. Holding this range is crucial for maintaining a bullish outlook; falling below may indicate a deeper correction.

- Ethereum's recovery depends on macro liquidity, derivatives positioning, and crypto market sentiment.