Ethereum Faces Challenges with Rising Blob Fees and L2 Operations

Running an Ethereum Layer 2 (L2) was historically costly, requiring millions in data availability costs to the Layer 1 (L1). The Dencun hardfork (EIP-4844) in March 2024 introduced "blobs," allowing L2s to post batched data to the L1 at significantly reduced costs. Blob space operates in a separate fee market from L1, making it approximately ten times cheaper than traditional L1 blockspace. This change is crucial for Ethereum’s rollup-centric roadmap.

For example, Base reported expenses of $9.34 million in Q1 2024, which dropped to $699k in Q2 and $42k in Q3 2024, according to TokenTerminal.

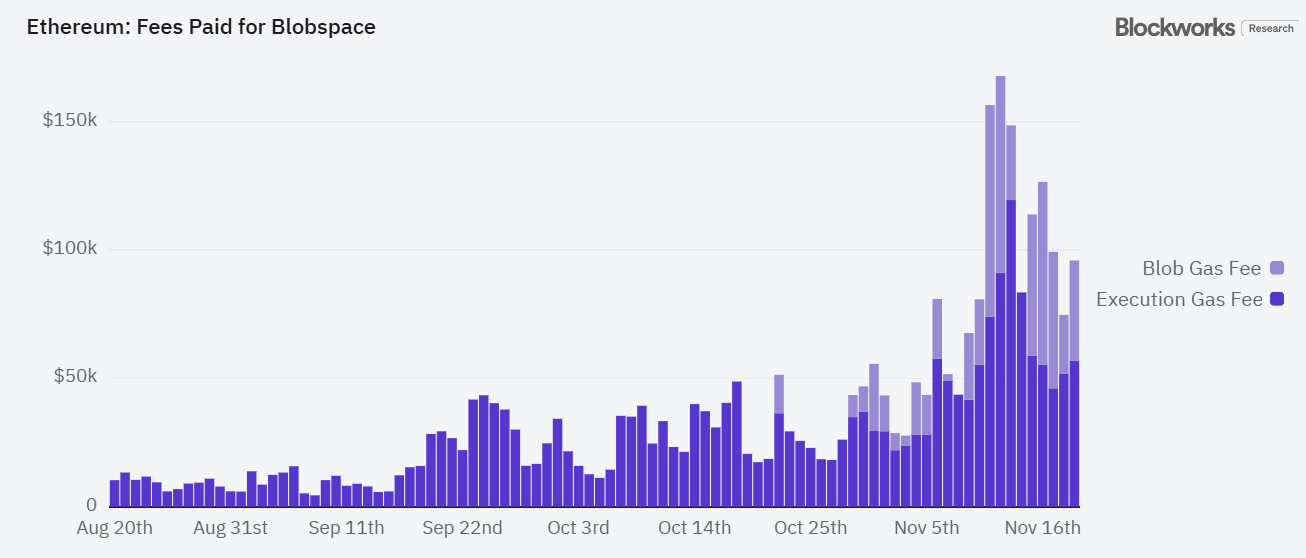

However, blobspace costs are rising as on-chain activity increases during the current bull market. Each mainnet block can contain six blobs. A base fee is triggered when blob usage reaches 50%, and further increases occur with higher usage levels.

Blob fees have generated substantial revenue for the Ethereum mainnet, with a recent burn approaching 212 ETH over the past month, as reported by ultrasound.money.

While blobs reduce operational costs for L2s, concerns arise among ETH holders regarding the perceived lack of value return to the L1. Critics argue that L2s may prefer cheaper data availability options or delay posting data when blob costs rise.

During a debate at Devcon, Ethereum researcher Ansgar Dietrichs acknowledged these misaligned incentives but emphasized the importance of Ethereum's data availability in the long run as more L2 networks converge around it.

Tim Robinson from Blueyard suggested that while blobs currently yield low revenue, their economic design could lead to significant future returns for Ethereum. His simulation indicated that a hypothetical Ethereum L1 processing 10,000 TPS with larger blob sizes could burn 6.5% of ETH annually.

The core debate revolves around whether Ethereum should prioritize L2 user experience or value accrual for ETH. Researchers caution that focusing solely on ETH value might drive users to cheaper chains, while expanding blob space could enhance user engagement in the long term.

Recent discussions indicate a push for increasing blob limits, with proposals for adjustments in upcoming upgrades. Ethereum researchers face a complex decision-making scenario, balancing immediate economic perceptions against long-term growth potential.