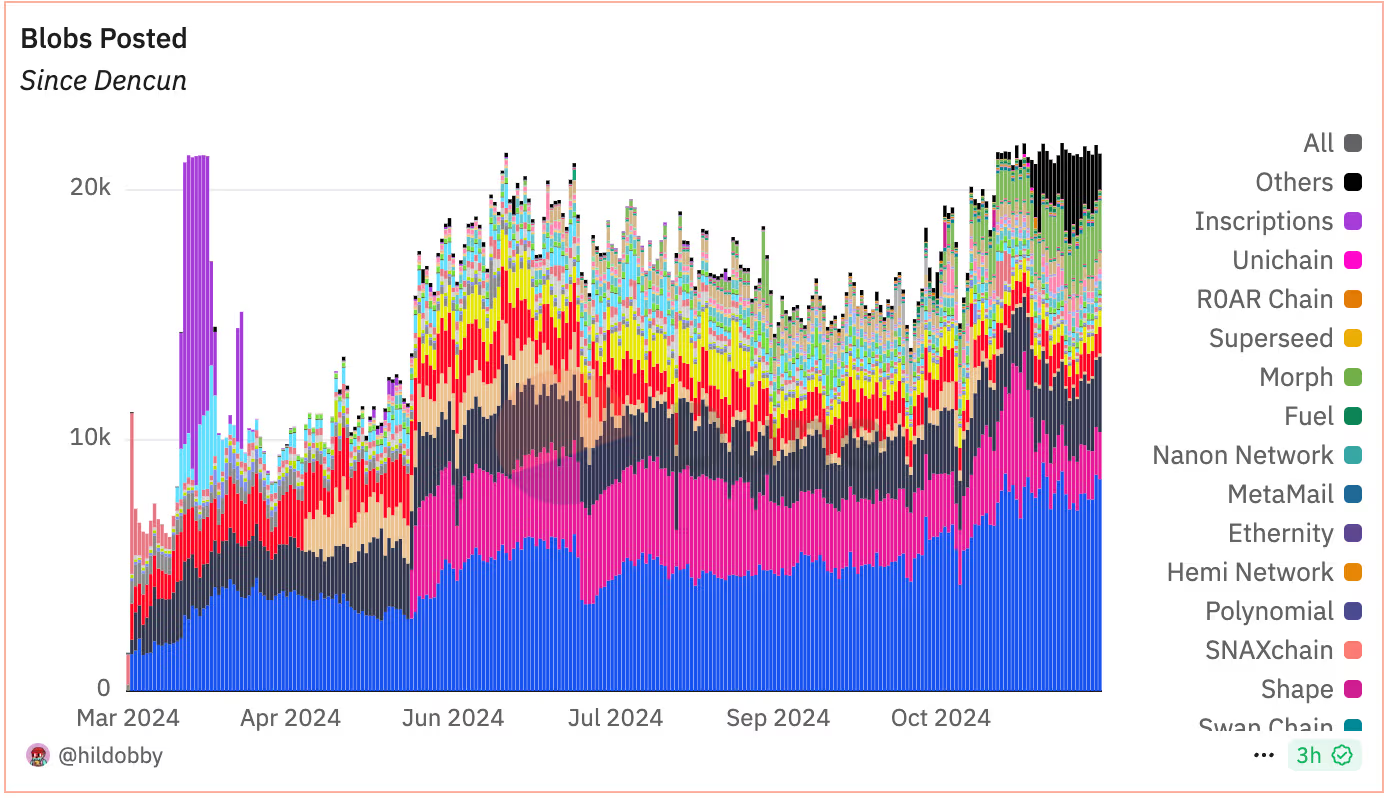

Ethereum Blob Usage Exceeds 21,000 Daily Transactions in November

The Ethereum blockchain network has experienced significant growth in the use of its data management tool "Blobs," launched earlier this year. This reflects the increasing adoption of Layer 2 scaling solutions that provide faster and more cost-effective transactions.

In November, the daily average number of blobs or binary large objects posted to Ethereum exceeded 21,000, marking record activity not seen since March 2024.

Blobs were introduced with the Dencun upgrade, allowing large data chunks to be attached to regular transactions. This mechanism stores data off-chain, alleviating congestion on the mainnet.

-

Courtesy: Hildobby / Dune Analytics

The increase in blobs indicates a rise in the use of Layer 2 protocols such as BASE, Arbitrum, and Optimism. These protocols utilize blobs to bundle and process transactions off-chain before submitting them for verification on the Ethereum mainnet. Matthew Sigel, head of digital assets at VanEck, noted that transactions for ETH and its Layer 2s are reaching all-time highs, with blob counts rising approximately 20% and driving Layer 2's Blob Fees to a 30-day peak.

Rising Demand for Ethereum Blobspace

Blobspace is a dedicated section within Ethereum blocks where Layer 2 protocols temporarily store their data. Blob fees, paid in ether, are burned similarly to transaction fees, reducing the circulating supply of ETH. This counters claims that Layer-2 protocols hinder Ethereum's growth.

Recently, the blob base submission fee rose to $80, the highest since March, while the average number of blobs per block increased to 4.3. In the past week, blob fees have burned over 166 ETH, valued at approximately $560,000. Artemis highlighted that blob fees had remained low since EIP4844 but have begun to enter price discovery due to increased on-chain activity.

-

Courtesy: Dune Analytics

ETH Price Action

Following Donald Trump's announcement regarding increased tariffs on imports, Bitcoin and the broader crypto market faced selling pressure, leading to a 5% decline in Ethereum's price, dropping to around $3,300.

Here’s the plan:

Bullish on $ETH until May, aiming for 10k.

Then, take profits and step back.

The real play is for 20k by the end of 2025.

Ride the early wave, then let the long-term gains roll in. pic.twitter.com/ScDVznnJ1e— Wolf 🐺 (@IamCryptoWolf) November 25, 2024

Despite recent declines, analysts maintain a bullish outlook for ETH, predicting a potential rally to $10,000 by mid-2025, with market analyst Crypto Wolf forecasting a target of $20,000 by the end of 2025.