1 0

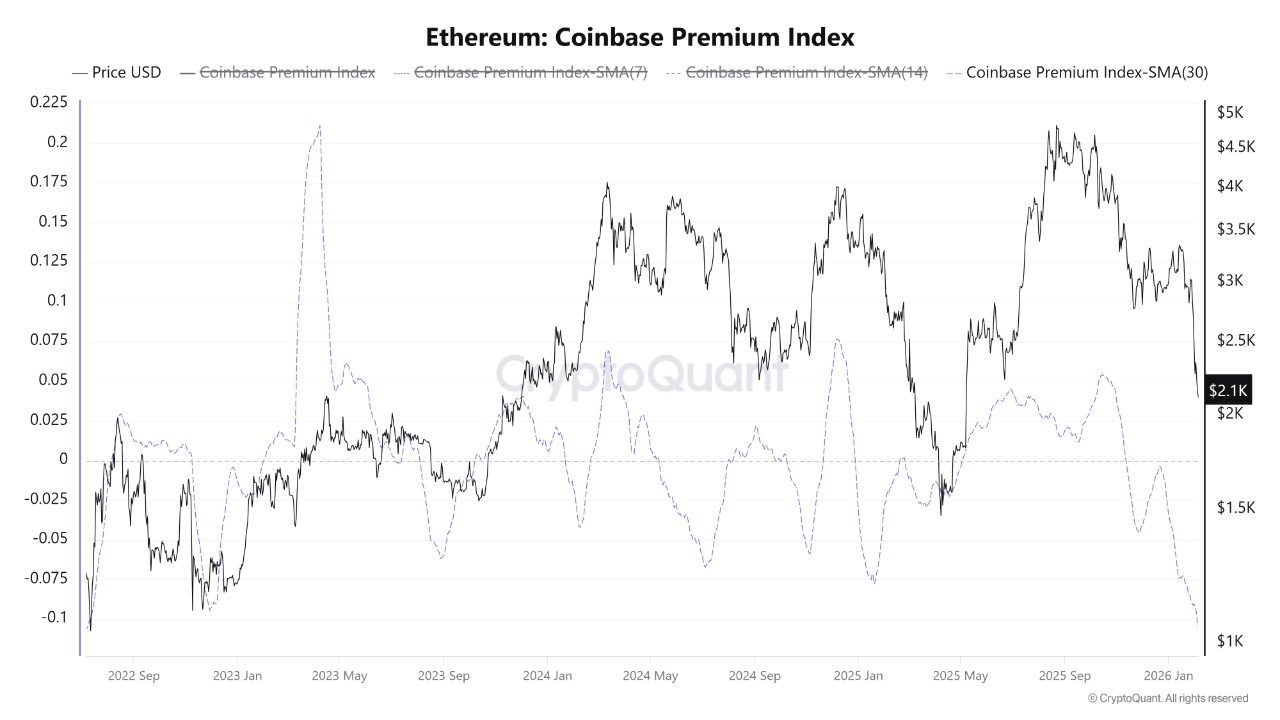

BEARISH 📉 : Ethereum Coinbase Premium Hits Lowest Since July 2022

Ethereum is experiencing significant selling pressure, with prices struggling to stabilize around the $2,100 mark amidst broader market weakness. Despite occasional rebounds, momentum remains fragile.

- The Ethereum Coinbase Premium Index, a measure of institutional demand, has dropped to its lowest point since July 2022, indicating weaker US-based institutional flows compared to global markets.

- This drop suggests subdued institutional demand, reflecting volatile macroeconomic conditions and reduced crypto risk appetite.

- Historically, negative premiums often appear during market stress, which can precede stabilization but do not guarantee immediate recovery.

The $2,100 level is critical, acting as both psychological and structural support. Holding this level could indicate demand absorption despite negative sentiment. A return to positive territory in the Coinbase Premium would signal renewed institutional interest.

Technically, Ethereum's price action shows deterioration following rejection from the $4,000–$4,800 range in late 2025. The continued downtrend is marked by lower highs and selling pressure.

- The recent fall below $2,300 has increased bearish momentum, with prices now testing the $2,100 support area.

- Short-term moving averages crossing below medium-term ones confirm structural weakness, suggesting rallies may be temporary rather than trend reversals.

- If $2,100 fails, the next support level could be near the $1,800–$1,900 zone.