1 March 2025

4 0

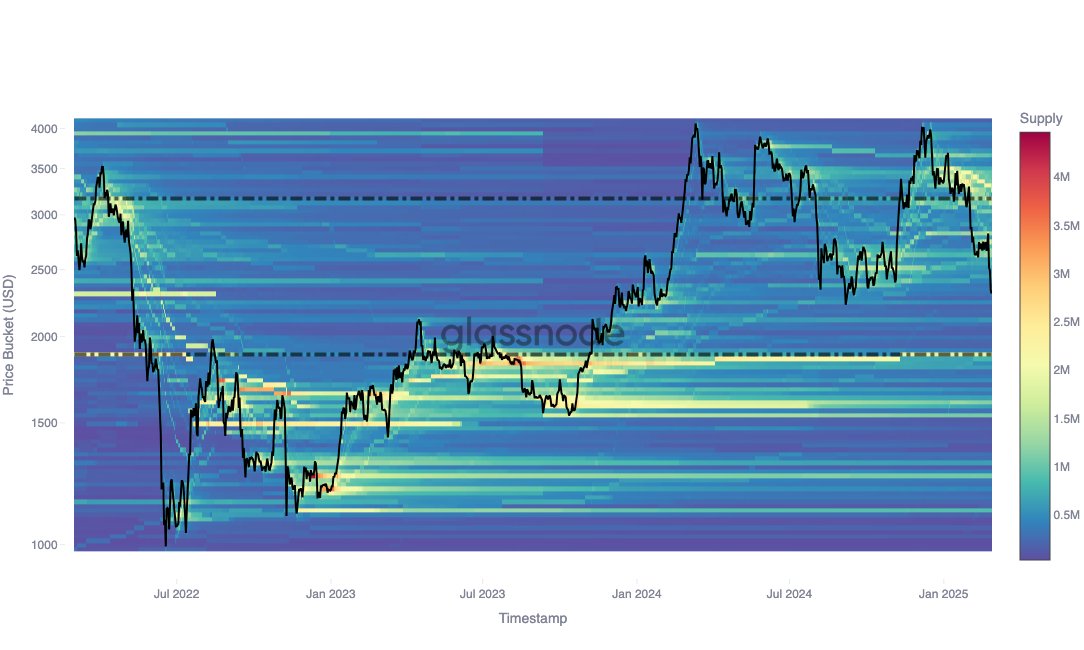

Ethereum Market Correction Points to $1,890 as Key Support Level

Ethereum (ETH) has decreased by 17.08% over the past week, reaching a low of $2,104. Despite minor gains in the last 12 hours, market sentiment remains bearish.

Potential Price Correction to $1,890

Analysis from Glassnode indicates ETH may decline to $1,890, a key accumulation zone where approximately 1.82 million ETH was acquired in August 2023. Important points include:

- Cost Basis Distribution (CBD) data highlights $1,890 as a major support level.

- $2,100 is identified as a short-term support zone, holding around 500,000 ETH.

- A significant drop below $2,100 could lead to further declines toward $1,890.

Investor Activity Amid Price Drops

Glassnode's six-month analysis shows strong investor activity at cost basis levels above $3,500. Key observations are:

- Investors are absorbing market supply instead of selling during price declines.

- Current ETH trades at $2,250, with a daily gain of 3.84%.

- Monthly losses for ETH now stand at approximately 30.48%, while market activity has increased by 7.74%, valuing it at $29.91 billion.