9 0

Ethereum Correction Over as Binance Funding Rates Signal Potential Surge

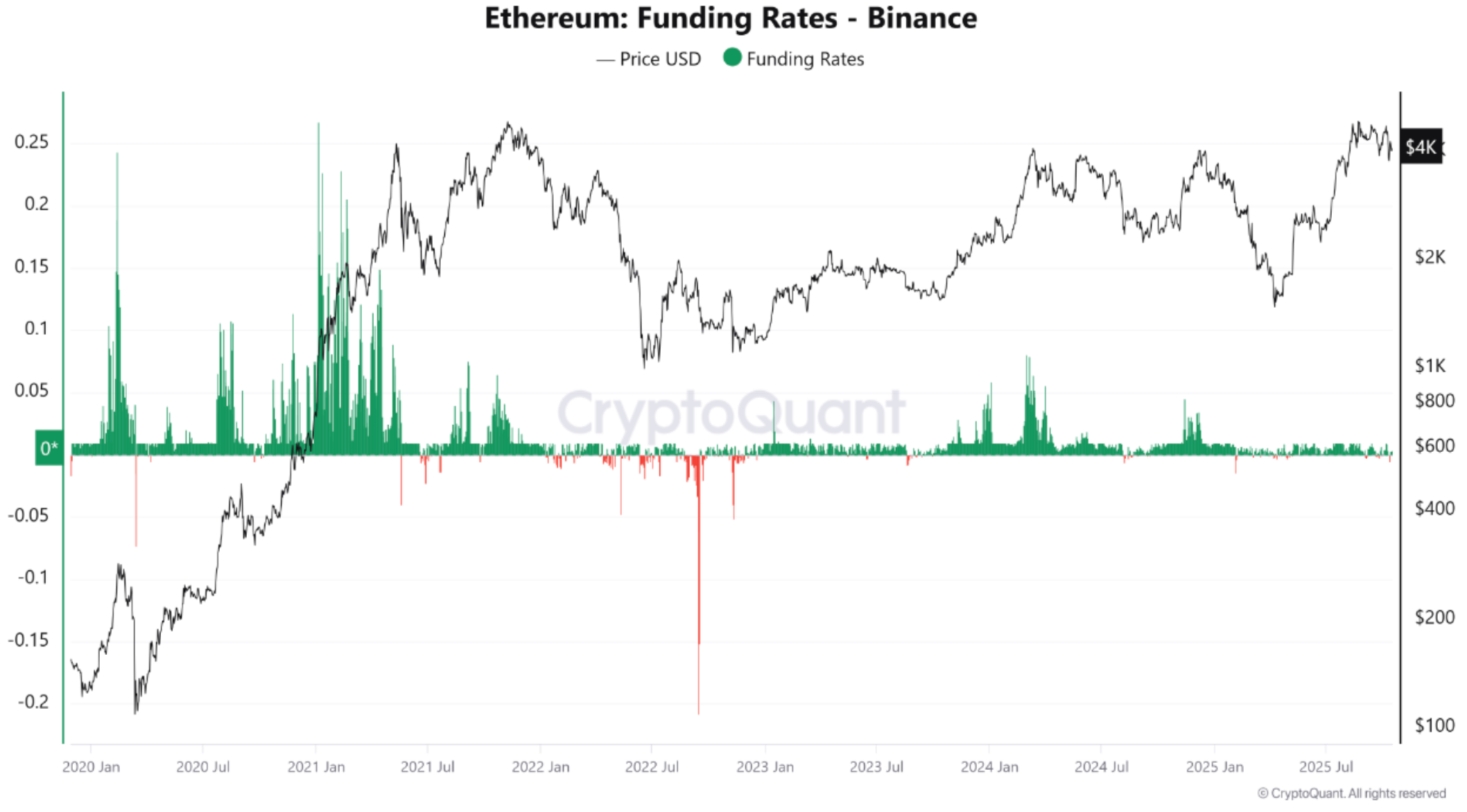

Ethereum (ETH) is showing signs that its recent price correction may be ending as it stabilizes above $4,000 after a significant drop to $3,400. Key indicators suggest continued bullish momentum:

- ETH funding rates on Binance remain positive, indicating dominance of long positions.

- Current funding rates are between 0.01% and 0.03%, suggesting the market is not overheated.

- The lack of negative funding rates points to decreased short positioning and increased risk appetite.

- Analysts predict possible short-term consolidation between $3,600-$3,800.

- A rise in funding rates above 0.05% could signal a short-term pullback.

The combination of moderate leverage and increasing spot demand suggests a potential ETH rally towards the $4,500 to $5,000 range, with a long-term target possibly reaching $6,800 by the end of 2025.

Additional factors supporting an upward trend include:

- ETH's Spent Output Profit Ratio (SOPR) indicates potential for price increases.

- Exchange reserves of ETH are at multi-year lows, hinting at a possible "supply crunch."

However, there are risks of another sell-off that might push ETH below $4,000. Currently, ETH is trading at $4,053, with a slight increase of 0.2% in the last 24 hours.