9 1

Ethereum Declines to $4,280 After Approaching All-Time High

Ethereum (ETH) has experienced a decline after approaching its all-time high, reflecting a broader market correction. The price peaked at $4,776 but has since retreated to $4,280, marking a 5.7% drop in the last 24 hours.

Market Trends

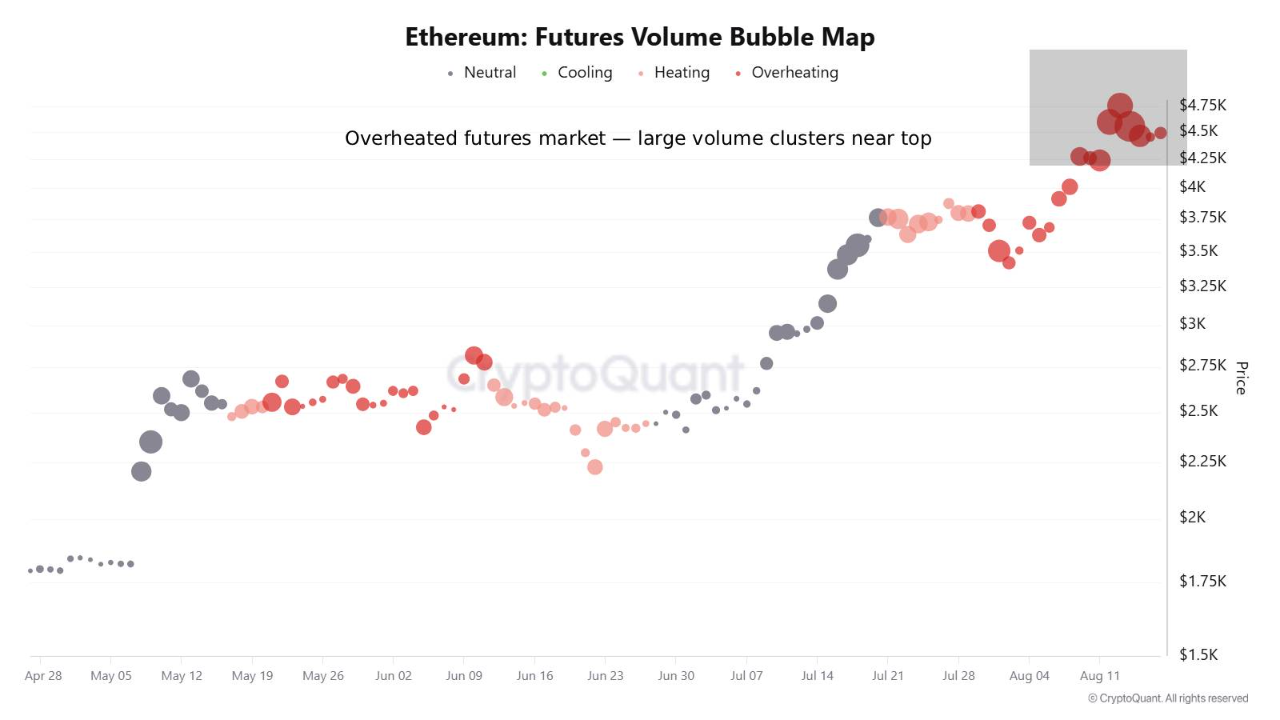

- Retail participation in Ethereum’s futures market has surged, raising concerns about potential market overheating.

- Futures trading frequency indicates entry into "Many Retail" and "Too Many Retail" zones, typically seen near the end of strong uptrends.

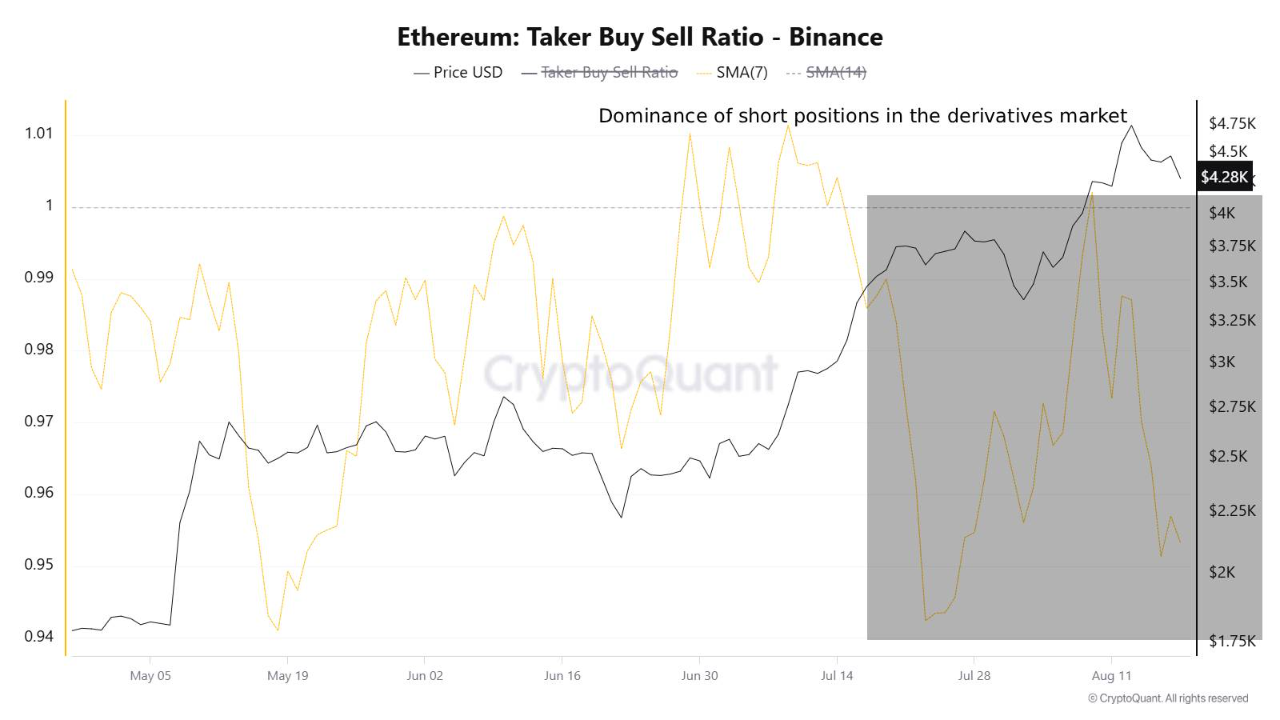

- Open interest on Binance futures reached nearly $12 billion before dropping to approximately $10.3 billion, suggesting some traders are reducing exposure.

- The taker buy/sell ratio on Binance remains below 1, indicating dominance of selling pressure.

Spot Market Insights

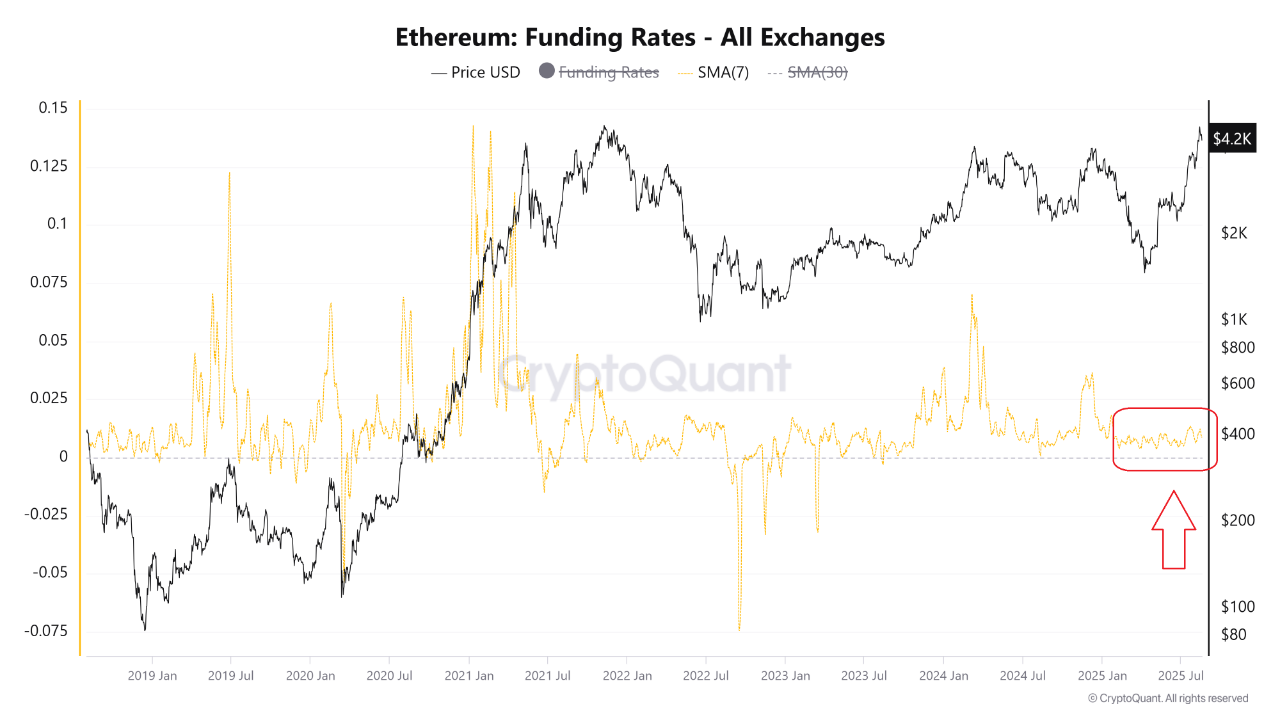

- Funding rates for ETH perpetual futures are flat around zero, contrasting with earlier bull runs when they spiked significantly.

- This suggests current price increases are driven by spot buying rather than leverage, indicating a healthier market environment.

- A funding rate surge above 0.05 could signal short-term tops to watch.