5 1

Ethereum Demand Remains Strong as New Whales Purchase $192 Million in ETH

Ethereum is experiencing a pullback from its recent peak of $4,790, currently testing critical demand levels around $4,200. Selling pressure is increasing, with analysts cautioning about the possibility of further corrections.

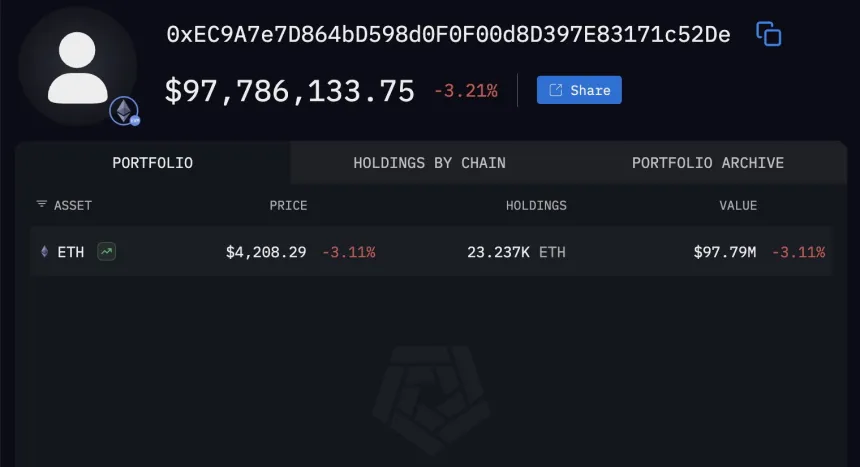

Despite this, institutional accumulation remains strong. Two whale accounts purchased nearly $200 million worth of Ethereum in the last 24 hours, indicating growing confidence among institutional investors.

- Two whale addresses acquired $192 million in Ethereum from Bitgo.

- Institutional players are increasingly adding Ethereum to their balance sheets as a treasury reserve asset.

- This trend signals accelerated global adoption of Ethereum for both DeFi and as a long-term store of value.

Price Action Details

Ethereum (ETH) is trading at $4,222, with attempts to stabilize above the key support level of the 100-day moving average at around $4,180. Recent selling pressure has pushed ETH below the 50-day moving average, indicating weakening momentum.

- If ETH maintains the $4,200–$4,180 range, a recovery towards $4,400–$4,500 may be possible.

- Failure to hold this level could lead to a deeper correction toward $3,950–$3,900, near the 200-day moving average.