Ethereum On-Chain Demand Zones Indicate Support Above $4,000

The market intelligence platform IntoTheBlock has identified strong on-chain demand zones for Ethereum, indicating potential support above $4,000.

Ethereum Has Two Major Support Centers Just Below Current Price

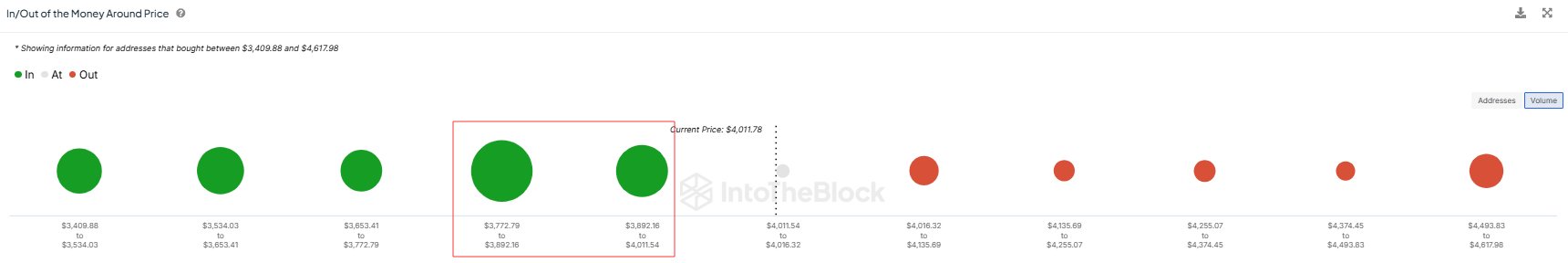

IntoTheBlock recently shared insights on Ethereum's on-chain demand zones. The accompanying chart illustrates the supply purchased by investors at price ranges near the current ETH value.

The graph indicates minimal supply purchases at higher price levels. In contrast, significant buying activity occurred in the ranges of $3,772 to $3,892 and $3,892 to $4,011, where 7.2 million ETH (approximately $28.4 billion) was acquired.

Demand zones are critical in on-chain analysis due to investor psychology. An investor's cost basis serves as a pivotal level, influencing their trading decisions during retests. Profit-taking or loss-cutting behaviors may emerge depending on an investor's position relative to their cost basis.

Widespread participation in buying and selling can lead to noticeable market fluctuations. The highlighted price ranges meet this criterion, suggesting that a retest could trigger significant buying activity, reinforcing Ethereum's price support.

Recently, Ethereum dipped into these regions, raising questions about whether demand will push its price back above $4,000.

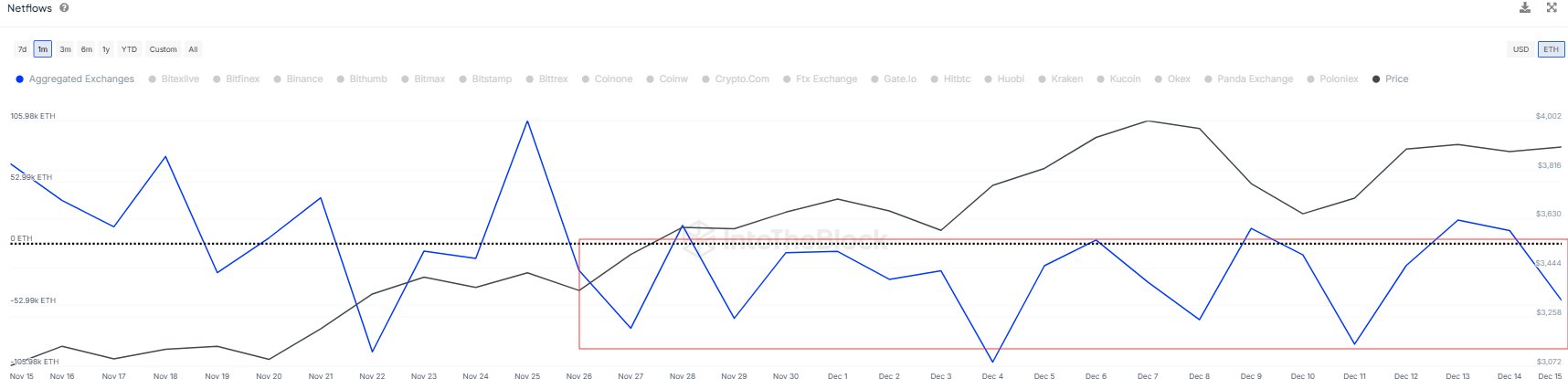

Additionally, Ethereum's Exchange Netflow has remained negative since early December, according to another post by IntoTheBlock.

The Exchange Netflow tracks the net flow of Ethereum into and out of centralized exchange wallets. Since December 1st, over 400k ETH has exited exchanges, indicating a trend of accumulation.

ETH Price

Currently, Ethereum is trading around $3,950, reflecting a 10% increase over the past week.