7 February 2025

0 0

Ethereum Outflows on Derivative Exchanges Drop Below -300,000 ETH

Ethereum is experiencing challenges amid a general decline in the cryptocurrency market. Despite attempts to recover from losses, it struggles to maintain upward momentum.

Record Outflows Impacting Ethereum

Amr Taha from CryptoQuant reported that Ethereum's netflow on derivative exchanges has dropped below -300,000 ETH for the first time since August 2023. This shift may affect price direction and overall market structure.

- Large outflows often indicate traders are closing leveraged positions or moving funds to cold storage.

- This reduction can ease selling pressure, potentially allowing prices to rise if demand remains stable.

- However, such outflows can also lead to short-term volatility, especially if driven by liquidations of long positions.

- A more balanced market structure may emerge over time despite initial dampened buying demand.

Liquidity Conditions and Key Metrics

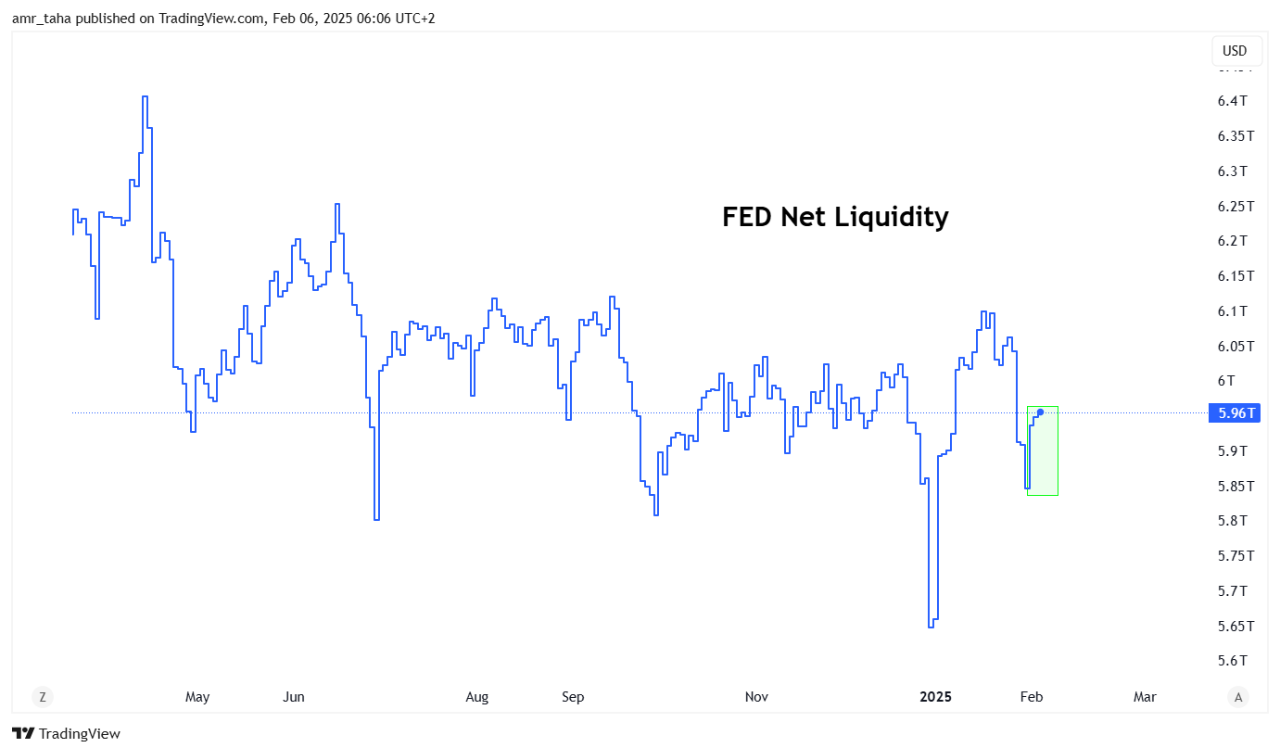

Taha emphasized the importance of liquidity conditions. The Fed Net Liquidity metric recently increased from 5.85 trillion to 5.95 trillion, indicating more capital available for markets like cryptocurrency. Higher net liquidity typically correlates with rising asset prices, which could benefit Ethereum.

- Monitoring Ethereum's liquidation map is crucial; certain price levels might trigger capitulation of short positions if ETH rises.

- The trajectory of net liquidity will be essential as it reflects broader sentiment toward risk assets.