7 0

Ethereum Faces Diverging Trends as Retail Sells While Whales Accumulate

Ethereum (ETH) is currently experiencing mixed market signals as it approaches the $2,000 mark. Key points include:

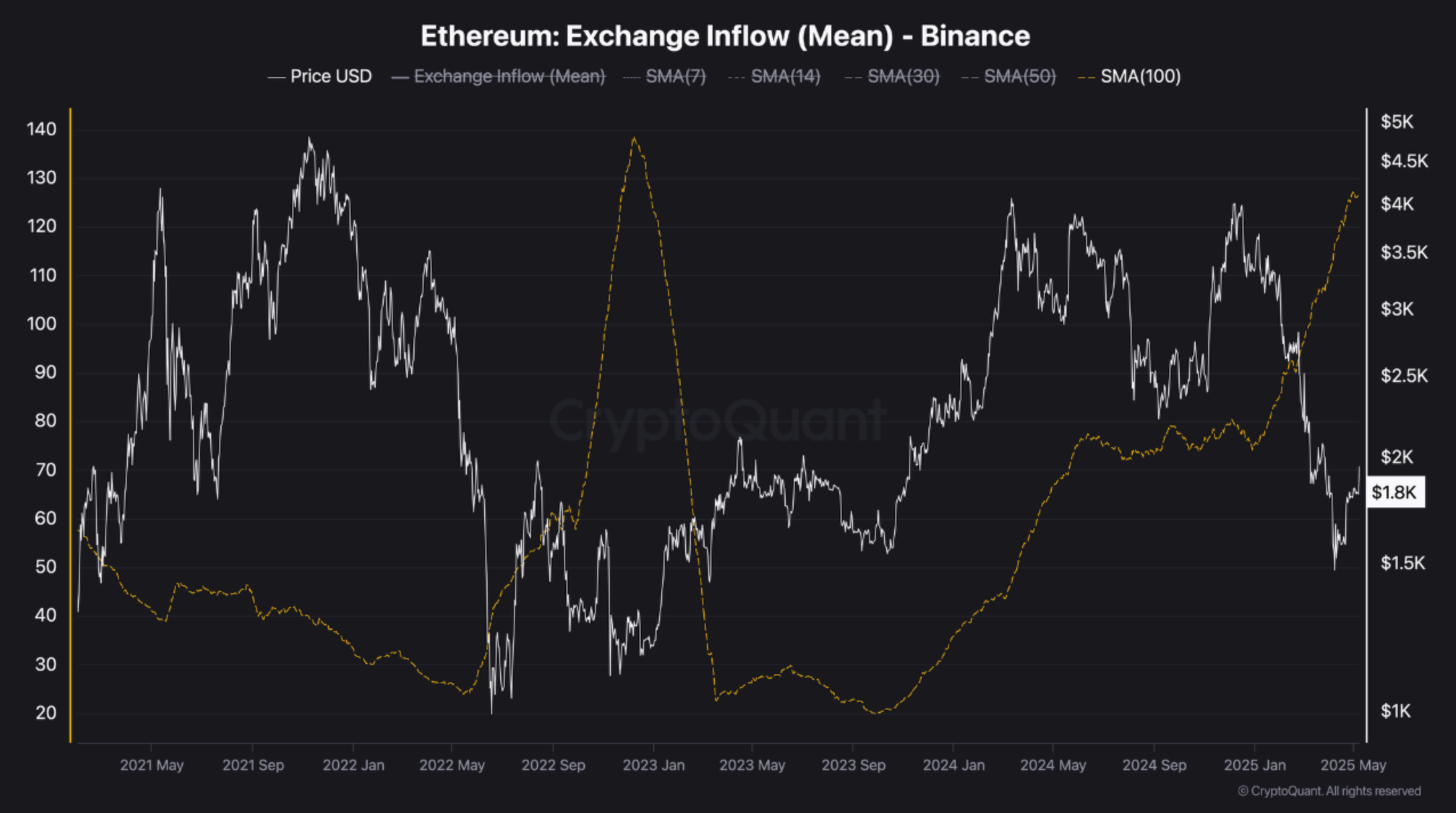

- Retail investors are sending ETH to exchanges, indicating potential selling pressure.

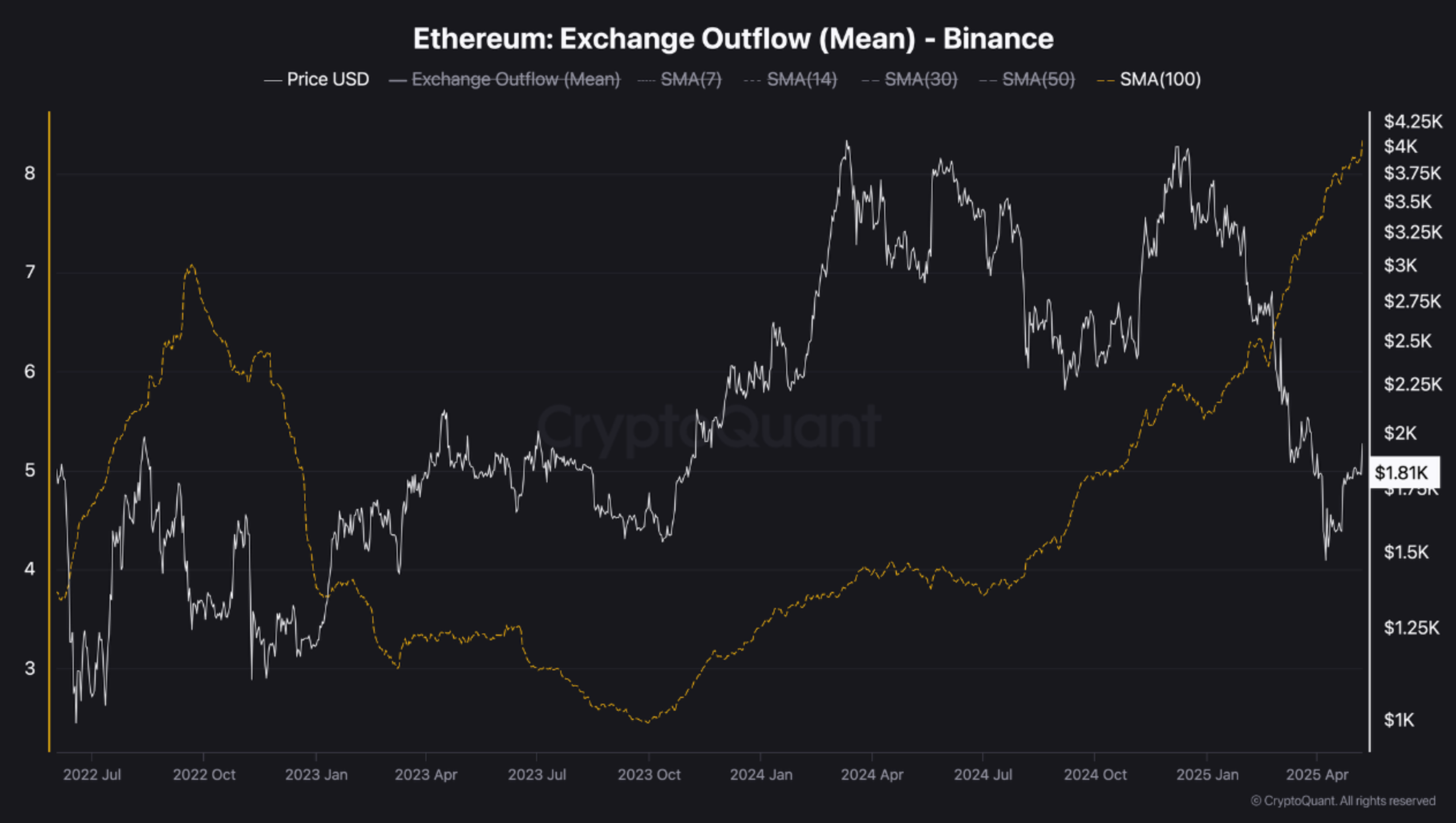

- Large investors are withdrawing ETH from exchanges, suggesting accumulation and confidence.

- Mean exchange inflows have surged since late 2024, reflecting increased sell pressure from retail traders.

- Mean exchange outflows are rising, primarily linked to whale wallets accumulating ETH.

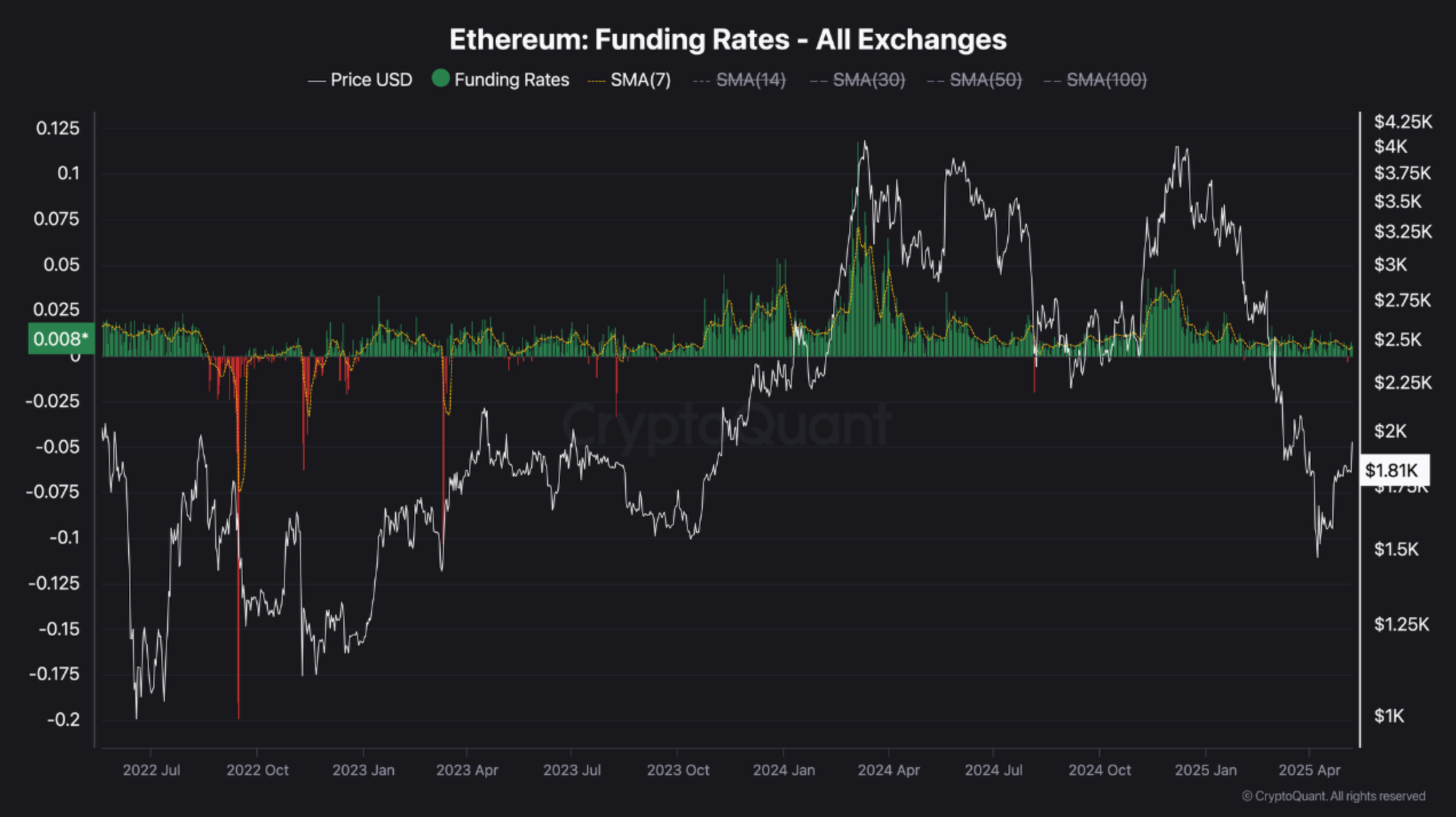

- Funding rates are neutral, with no clear leverage bias; a short squeeze could occur if short interest increases.

- The taker buy/sell ratio indicates stabilizing conditions, suggesting sellers may be exhausted.

- ETH is down 34.3% over the past year but shows signs of a potential bullish trend reversal, including a recent golden cross on the daily chart.

- Predictions suggest possible price fluctuations, with estimates ranging down to $1,500 amidst current trading at $1,966, up 7.8% in the last 24 hours.