1 0

BEARISH 📉 : Ethereum’s Drop to $2,000 Sees Record Token Transfers Signaling Stress

Ethereum Market Overview

- Ethereum is maintaining its position above the $2,000 mark after a period of significant selling pressure that pushed prices lower.

- The market is in a consolidation phase, with investors unsure if the decline is temporary or indicative of a larger bearish trend.

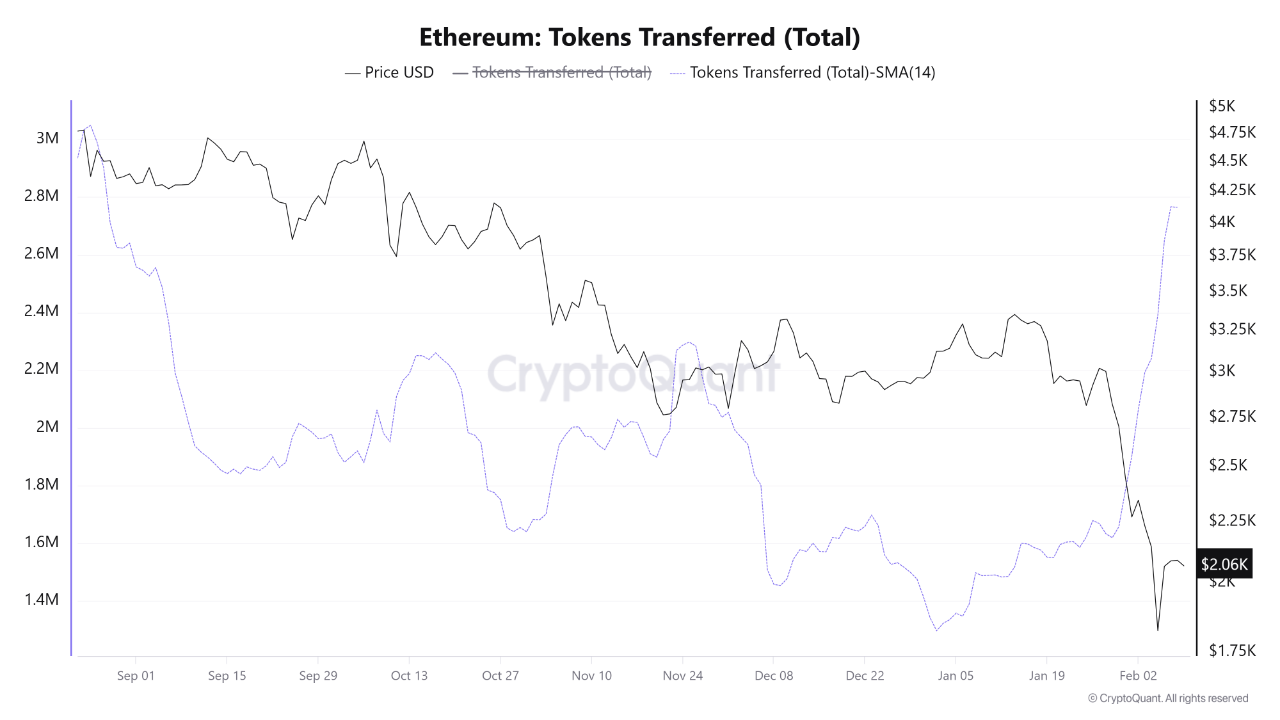

- On-chain data reveals an unusual increase in token transfers despite the price drop, signaling market stress rather than recovery.

Token Transfer Activity

- There is a notable rise in Ethereum network activity, with token transfers increasing from 1.6 million to 2.75 million within a week, the highest since August 2025.

- This surge indicates elevated market stress, potentially due to repositioning, forced liquidations, or large-scale portfolio adjustments.

- Increased transfer volumes during price declines can reflect panic-driven movements, often preceding stabilization phases.

Market Sentiment and Technical Analysis

- Ethereum's price is now hovering above $2,000, facing critical support as it transitions into a broader consolidation phase.

- Price remains below major moving averages, indicating weakening momentum and bearish sentiment.

- Reclaiming the $2,400–$2,600 range would stabilize momentum, while a break below $2,000 could lead to increased volatility.