1 0

BEARISH 📉 : Ethereum suffers 28% drop as market deleverages aggressively

Ethereum Price Decline

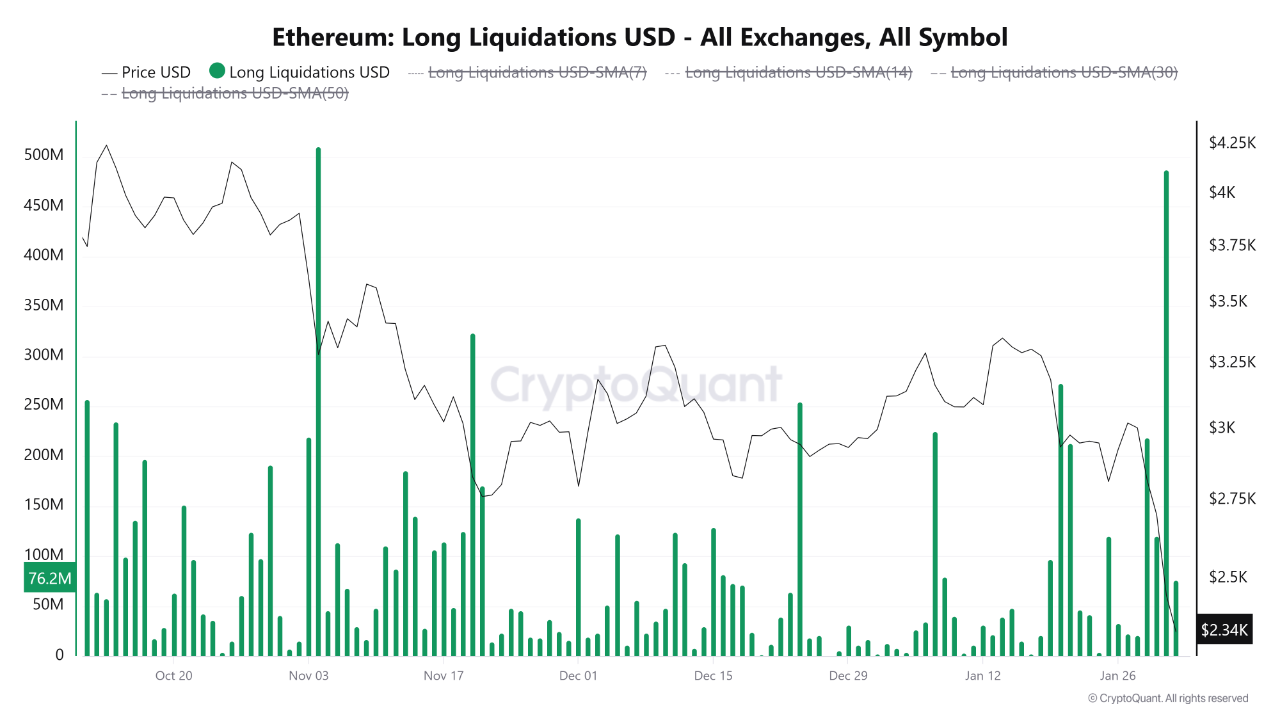

- Ethereum experienced a 28% price drop, falling sharply from above $3,000 to around $2,350.

- This significant decline indicates forced selling and triggered stop-loss orders and liquidations.

- The crash erased recent bullish positioning and signaled a shift in market sentiment.

- Investors are now assessing whether this marks a temporary correction or the start of a larger downward trend.

Market-Wide Deleveraging

- On-chain data shows Ethereum's sell-off was due to a market-wide leverage flush.

- Total long liquidations reached approximately $485 million, the second-largest event since October.

- Binance accounted for less than 10% of these liquidations, indicating stricter risk management compared to other exchanges.

- This deleveraging purges speculative excess and may lead to market stabilization.

Bearish Momentum and Price Structure

- Ethereum's price broke down below key support levels, accelerating bearish momentum.

- ETH is trading below its short- and medium-term moving averages, indicating a bearish trend.

- The 50-day and 100-day moving averages now act as resistance, with the broader trend shifting away from bullishness.

- Elevated volume during the sell-off signals forced selling rather than organic distribution.

- The $2,300–$2,200 zone is critical for potential stabilization; failure to hold could lead to deeper retracements.