5 1

Ethereum Drops 3% Amid Profit Booking, Trades at $4,500 Levels

Ethereum Price Movement

- Ethereum's price is experiencing selling pressure, dropping over 3% to around $4,500.

- This decline is due to profit booking and a broader crypto market selloff.

- Historically, September has been weak for Ethereum, with an average negative return of 12.47% since its launch.

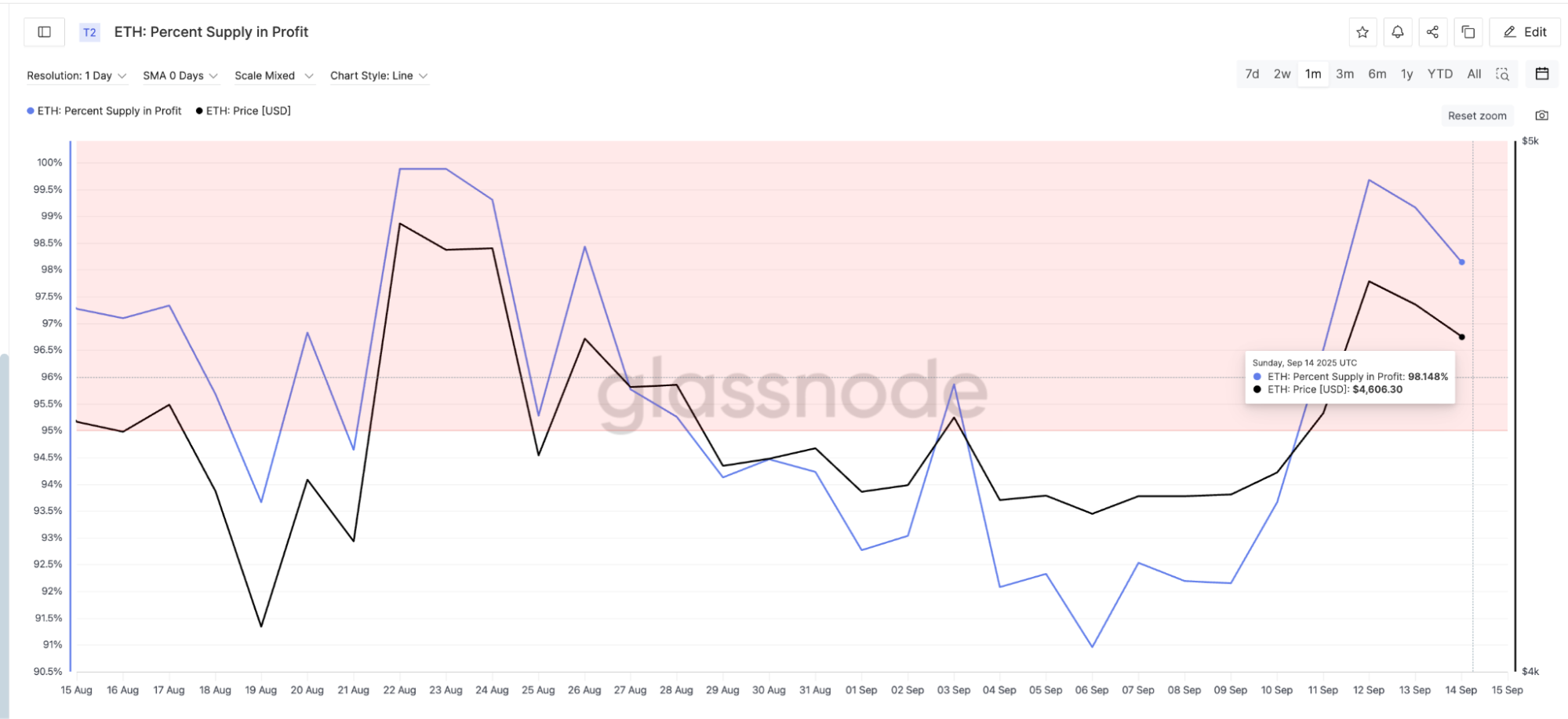

- The percentage of ETH supply in profit recently dropped from its second-highest level in a month, indicating potential corrections.

- The futures market data shows bearish trends, with the taker buy-sell ratio falling to 0.91.

- Daily trading volume rose by 29% to $36.65 billion, with $108 million in liquidations, predominantly long positions.

- Despite this, institutional interest remains strong, as firms like Bitmine Technologies and SharpLink Gaming continue purchasing ETH.

Future Outlook for Ethereum

- If Ethereum maintains above the $4,500 support, downside risks are limited.

- Analysts identify the $4,800-$4,880 range as critical resistance for potential upward movement.

- A daily close above $4,880 could trigger a significant breakout, according to analyst Nami.

- The $4,200-$4,400 range serves as solid support, protecting against further declines.

WEPE Meme Coin Overview

- Wall Street Pepe (WEPE), a new meme coin, is gaining attention on Ethereum and Solana networks.

- It combines humor and market insights, appealing to retail traders against whale manipulation.

- WEPE Supply: 200 billion

- Blockchain: Ethereum and Solana

- Meme coin activity is increasing on Solana, with WEPE gaining a supportive community base.

For more details, visit Coinspeaker.