4 0

Ethereum Drops 6% Amid Sell-Off, Potential Rally on Horizon

Ethereum Price Drop

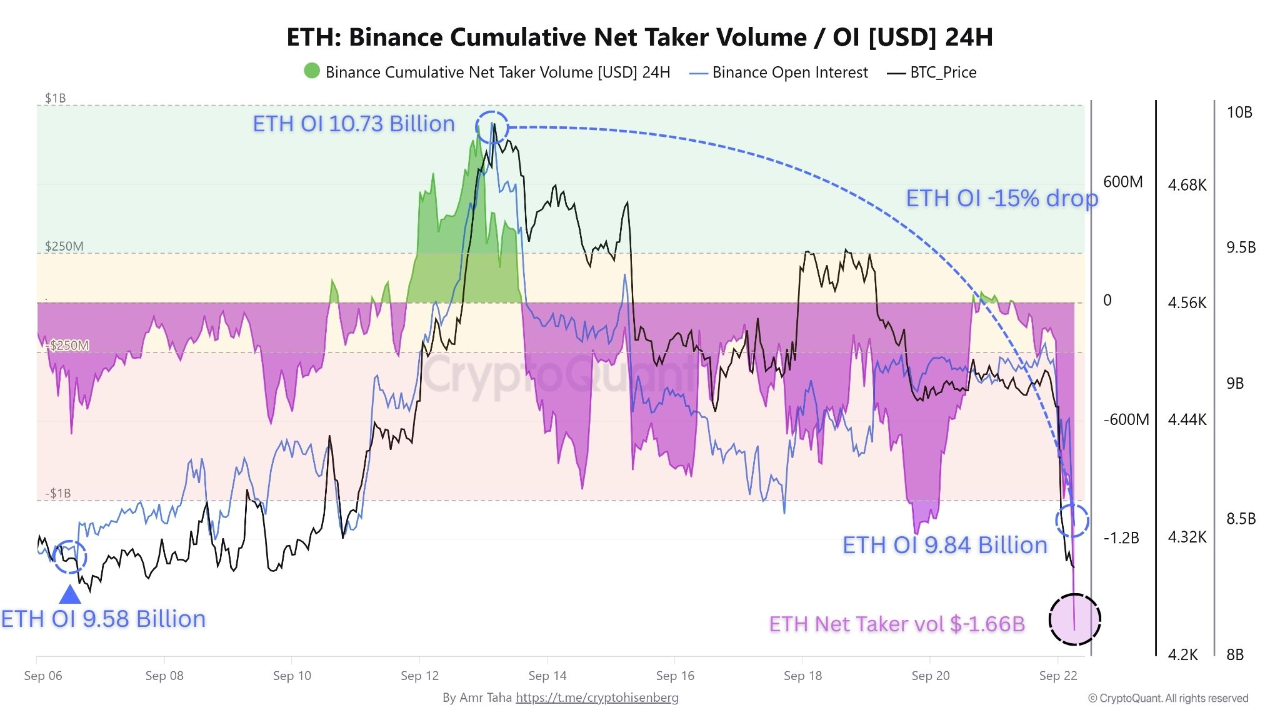

- Ethereum's price fell from just below $4,500 to around $4,180, marking a 6% decline within 24 hours.

- The drop coincided with decreased derivatives activity, with Open Interest (OI) on major exchanges falling to $9.84 billion.

- Net Taker Volume registered at -$1.66 billion, highlighting aggressive selling trends.

- Funding rates turned negative, indicating short sellers are paying longs, a sign of market pessimism.

- A whale wallet historically known for poor timing sold 1,000 ETH, valued at about $4.19 million.

Technical Indicators

- ETH's daily chart suggests oversold conditions, with the price touching lower Bollinger Bands and an RSI near 30.

- Key support is at $4,100, with potential further declines towards $3,700-$3,800 if this level breaks.

- The MACD indicator shows slowing bearish momentum, with resistance near the 20-day moving average at $4,440.

PepeNode Updates

- PepeNode has raised $1.3 million in its ongoing presale, offering high staking rewards.

- The project aims to gamify crypto mining on the Ethereum network.

- PepeNode uses a deflationary token model, burning 70% of tokens used for purchases.