5 0

Ethereum Drops Below $4,000 as Open Interest Sees Major Reset

Ethereum has dipped below $4,000 for the first time since early August, losing nearly 20% of its value since September 13. This decline reflects a broader market correction and shifting sentiment.

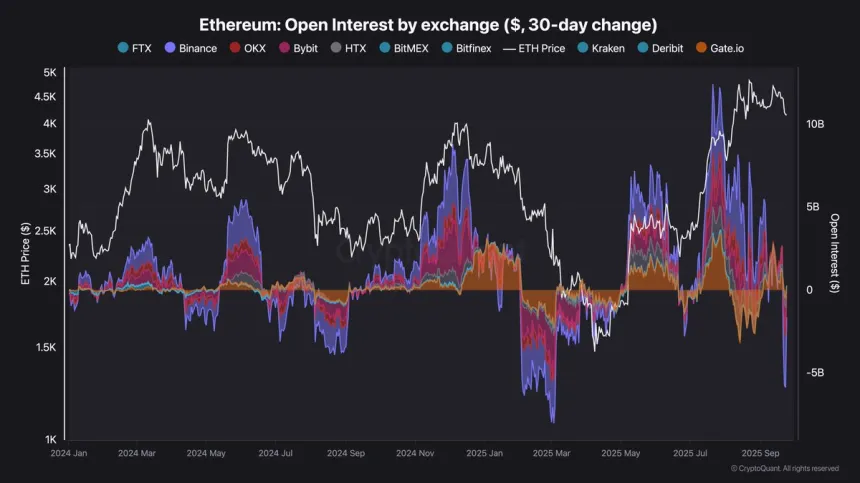

- Analyst Darkfost notes a significant reset in Ethereum’s Open Interest, with a sharp reduction in leveraged positions.

- This reset is particularly evident on Binance, where much recent ETH trading occurred.

- The reset could reduce cascading liquidations, allowing for market stabilization.

Turning Point in Ethereum’s Open Interest

Recent shifts in Ethereum’s Open Interest represent one of the most significant resets since early 2024. Excessive leverage had pushed interest to unsustainable levels, driven by ETF enthusiasm and accumulation patterns, leaving ETH prone to liquidations.

- Binance saw over $3 billion wiped from Open Interest on September 23rd, followed by another $1 billion decrease.

- Bybit experienced a $1.2 billion reduction, while OKX dropped around $580 million.

- This reset may lead to a healthier phase for Ethereum, focusing on organic demand and fundamentals.

Price Action Insights: Testing Critical Levels

Ethereum (ETH) trades near $3,939 after falling over 5% recently, breaking the key $4,000 level for the first time since August. The price formed a double top pattern around $4,700–$4,800, indicating bearish momentum.

- ETH approaches its 50-day moving average, which previously served as strong support.

- A decisive close below this average could lead to further declines toward the 200-day moving average at $3,100–$3,200.

- As long as ETH stays above $3,500–$3,600, the long-term trend remains positive.

- Bulls need to reclaim $4,200 to regain momentum; failure might increase selling pressure.