Ethereum Sees $133 Million in ETF Inflows and $4.81 Billion TVL Growth

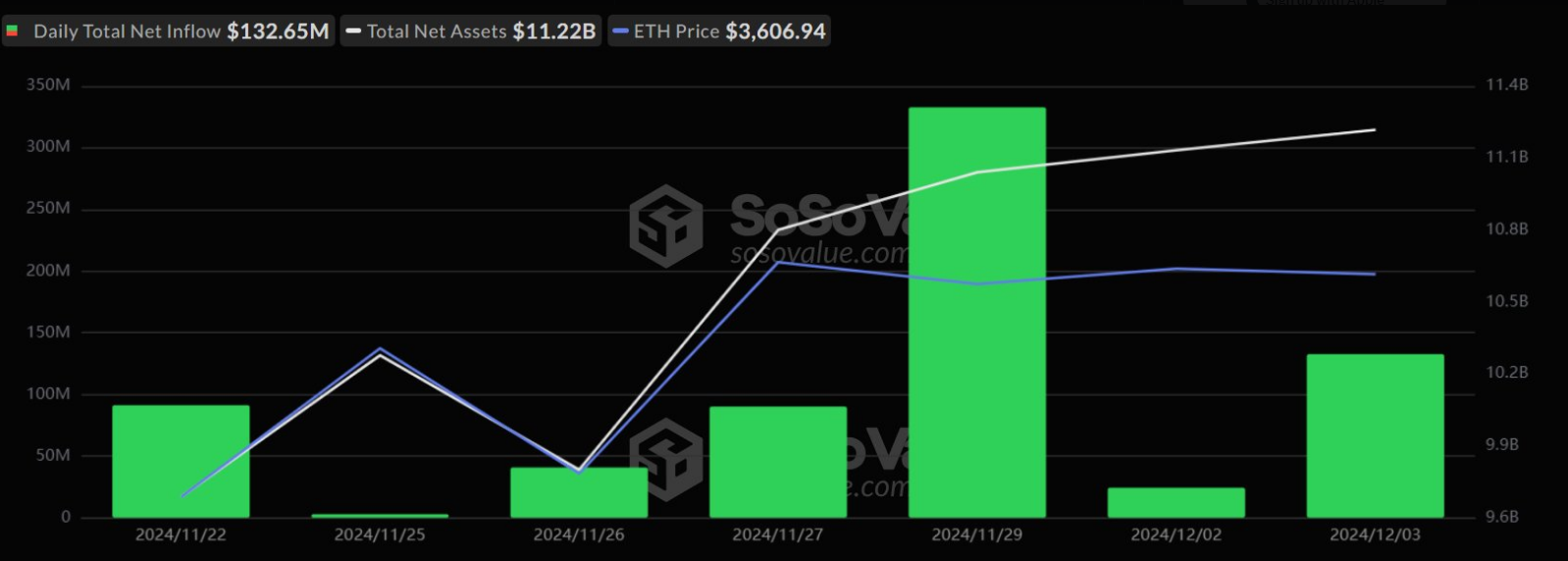

The increasing prominence of Ethereum is highlighted by substantial inflows into Ether-based ETFs. Recent data shows $133 million in net inflows over seven days, indicating significant institutional interest and investor confidence.

Institutional Confidence And Strong ETF Inflows

Interest in Ethereum spot ETFs has surged, with over $714 million entering the market in one week. The BlackRock ETHA and Fidelity FETH ETFs have collectively attracted approximately $140 million.

Support from major financial institutions is enhancing activity and demonstrating Ethereum's growing acceptance within traditional finance, suggesting potential for uniting centralized and decentralized systems.

Analysts Anticipate Mid-Term Target Of $6,000 For Ethereum

Market experts identify a support level for Ethereum at $3,300, presenting an attractive entry point for investors. Analysts project a mid-term price target of $6,000, with some anticipating a long-term price of $10,000.

If #Ethereum $ETH experiences a pullback, keep an eye on the $3,300 support level — a potential buying opportunity.

Our mid-term target remains $6,000, with a long-term outlook of $10,000! https://t.co/mQQOjrKBFM pic.twitter.com/OEvDIV0ZpD

— Ali (@ali_charts) December 4, 2024

According to CoinCodex, Ethereum's price is projected to increase by 6.17 percent to $4,052.34 by January 4, 2025. An Extreme Greed score of 78 on the Fear & Greed Index suggests a strong buying sentiment.

This high market confidence indicates growth potential, but it is essential to acknowledge the volatility associated with cryptocurrency investments.

Additional Stimulus & Growth In TVL

Ethereum's dominance in the DeFi market was reinforced by a total value locked (TVL) increase of $4.81 billion within a week. While other networks like Base and Hyperliquid also saw TVL growth, Ethereum retains its leading position.

Overall, Ethereum's outlook appears positive due to strong ETF inflows, bullish technical indicators, and rising TVL. Although reaching $6,000 may take time, the combination of institutional support and consistent momentum enhances its narrative.

Ethereum remains a critical component of the cryptocurrency market, merging investor confidence with innovation.

Featured image from Pexels, chart from TradingView