Ethereum ETFs Reach $3.1 Billion in Total Net Inflows

Investment in spot Ether exchange-traded funds (ETFs) in the United States has turned positive, marking a significant shift since their launch in July. A major inflow into BlackRock’s iShares Ethereum Trust contributed to this reversal, logging its second-largest net gain of $131.4 million.

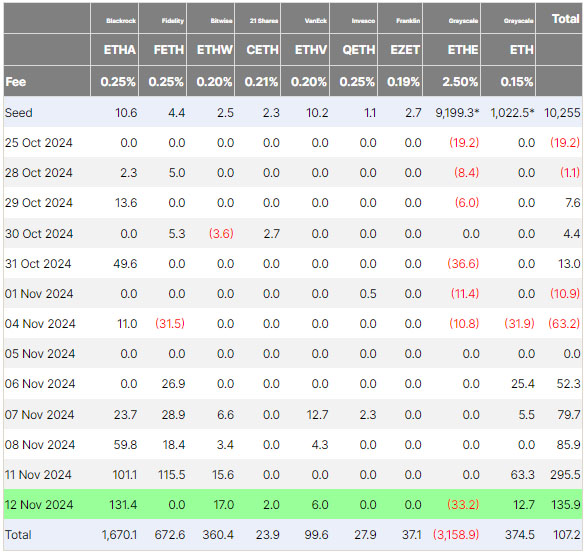

Source: Farside Investors

On November 12, the nine spot Ether ETFs collectively attracted $135.9 million in net inflows, according to Farside Investors. This positive trend followed a record inflow of $295 million on November 11. Cumulatively, these gains pushed total net flows for the funds to $107.2 million, a first since their initial launch.

Ethereum ETFs Inflows Reach $3.1 Billion Milestone

The Ethereum ETF market has now reached $3.1 billion in net inflows, significantly contrasting with Grayscale’s Ethereum Trust (ETHE), which is experiencing a decline of $33.2 million. BlackRock’s iShares Ethereum Trust (ETHA) has accumulated $1.67 billion in total inflows since its launch and has not recorded any days of net outflow, positioning BlackRock as a leader in the Ethereum ETF sector.

Nate Geraci, president of ETF Store, noted on X that BlackRock’s fund ranks among the top six ETF launches of 2024, indicating its growing influence over the market.

Bitwise’s Ethereum ETF (ETHW) reported an inflow of $17 million, while Grayscale’s Ethereum Mini Trust (ETH) saw $12.7 million in new funds. Smaller inflows were also observed for Ark 21Shares and VanEck’s funds. Over five consecutive trading days, Ether ETFs attracted nearly $650 million in inflows.

On November 13, Geraci highlighted the increasing connection between cryptocurrency and ETFs in asset management, stating that ETFs serve as a bridge for mainstream access to crypto markets. He suggested that once this bridge is fully established, the trend will be irreversible. The positive trend also extended to Bitcoin ETFs, which experienced aggregate inflows of $817.5 million on November 12.

Ethereum Price Surges, Market Cap Hits $400 Billion

Ethereum (#ETH) experienced a 22% price surge over the past week, reaching just above $3,150 on November 13, according to CoinMarketCap. This rally pushed Ethereum’s market capitalization beyond $400 billion, equivalent to Solana's full market cap within five days.

A favorable outlook in the United States, partly driven by Donald Trump’s presidential election win, contributed to optimism, resulting in a 37% increase in Ether’s value over the past week. According to CryptoQuant, Ethereum’s total open interest in the derivatives market rose from 9.8 million ETH on November 5 to 13 million ETH by November 13.

A trader named Alan noted on X that Ethereum has achieved an all-time high in futures open interest, emphasizing its continued significance in the crypto landscape.