Ethereum ETFs Achieve Record $2.85B Inflows Amid Strong Demand

Ethereum is experiencing volatility after recently breaking multi-year highs and testing resistance just below $4,800. Despite a pullback, institutional demand remains strong, supporting ETH’s long-term outlook.

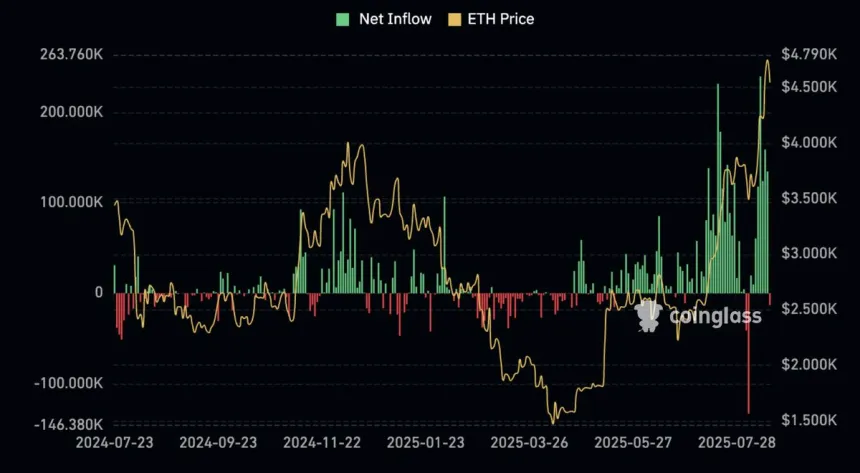

- Ethereum ETFs reported record inflows of $2.85 billion last week.

- Public companies are adopting Ethereum in treasury strategies, signaling a structural shift in market dynamics.

- Key resistance level at $4,900 could define ETH's price trajectory moving forward.

Ethereum ETF Inflows Signal Strong Institutional Demand

Analyst Ted Pillows notes that the historic inflows into Ethereum ETFs indicate robust institutional interest. The current market correction is viewed as healthy and part of an upward trend, with ETFs reshaping demand and supply dynamics.

Onchain data supports this bullish sentiment, showing a decline in exchange supply and tightening OTC reserves as institutions buy in. This indicates short-term selling pressure is being absorbed by long-term buyers.

Price Consolidates Below Key Level

Currently trading near $4,423, Ethereum faced rejection at $4,792, highlighting strong resistance near previous highs while maintaining a bullish overall trend.

Price remains above key moving averages, indicating sustained momentum. A clean breakout above $4,900 could lead to new price discovery.