Ethereum Funding Rates Show Signs of Recovery Amid Market Decline

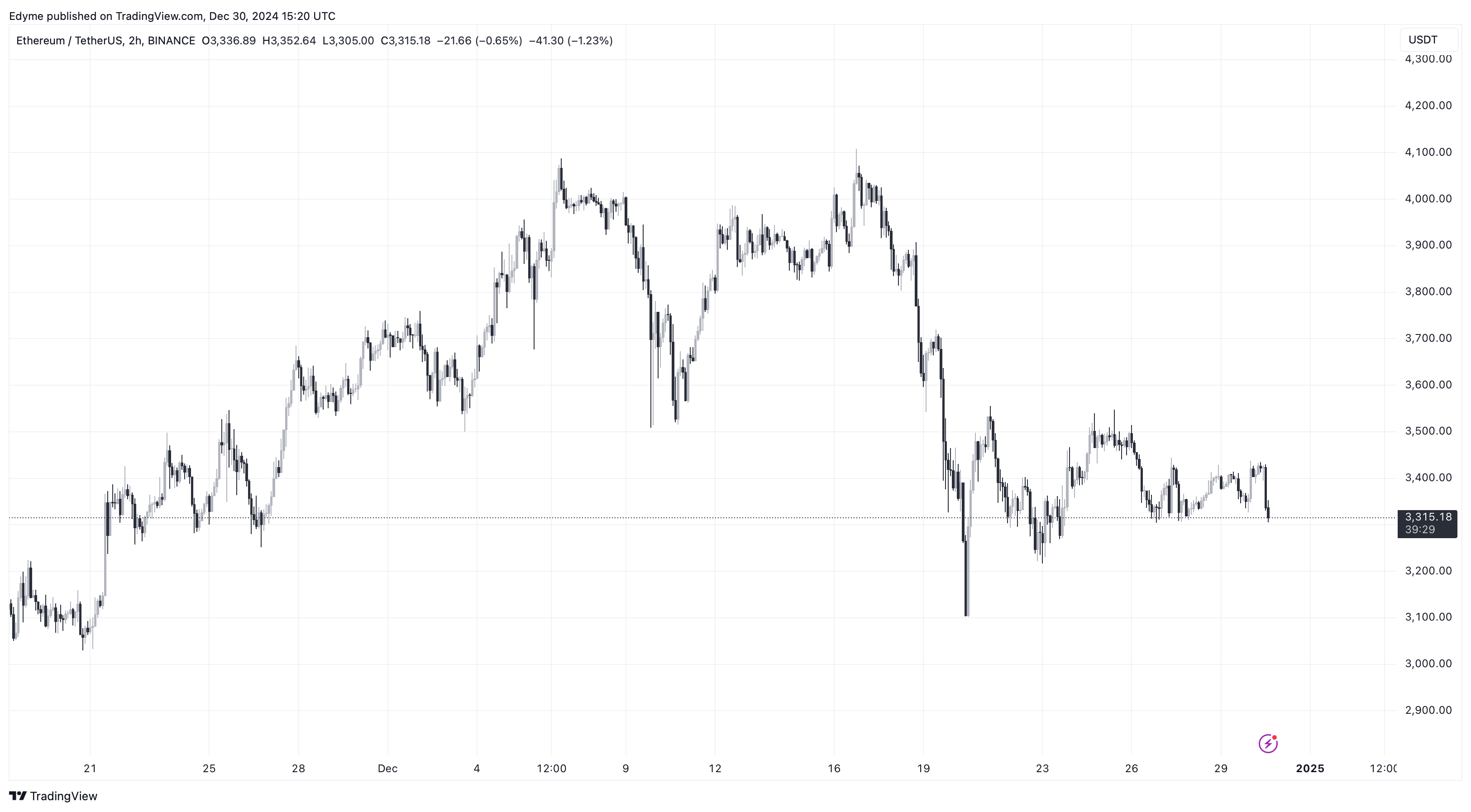

Ethereum has faced significant impacts amid the global decline in the crypto market, recently dropping below the $3,500 price level after underperforming during a recent bull run.

Despite diminished investor interest, data from CryptoQuant indicates a potential turnaround, with key indicators suggesting renewed market confidence.

Funding Rates Indicate Renewed Confidence Among Traders

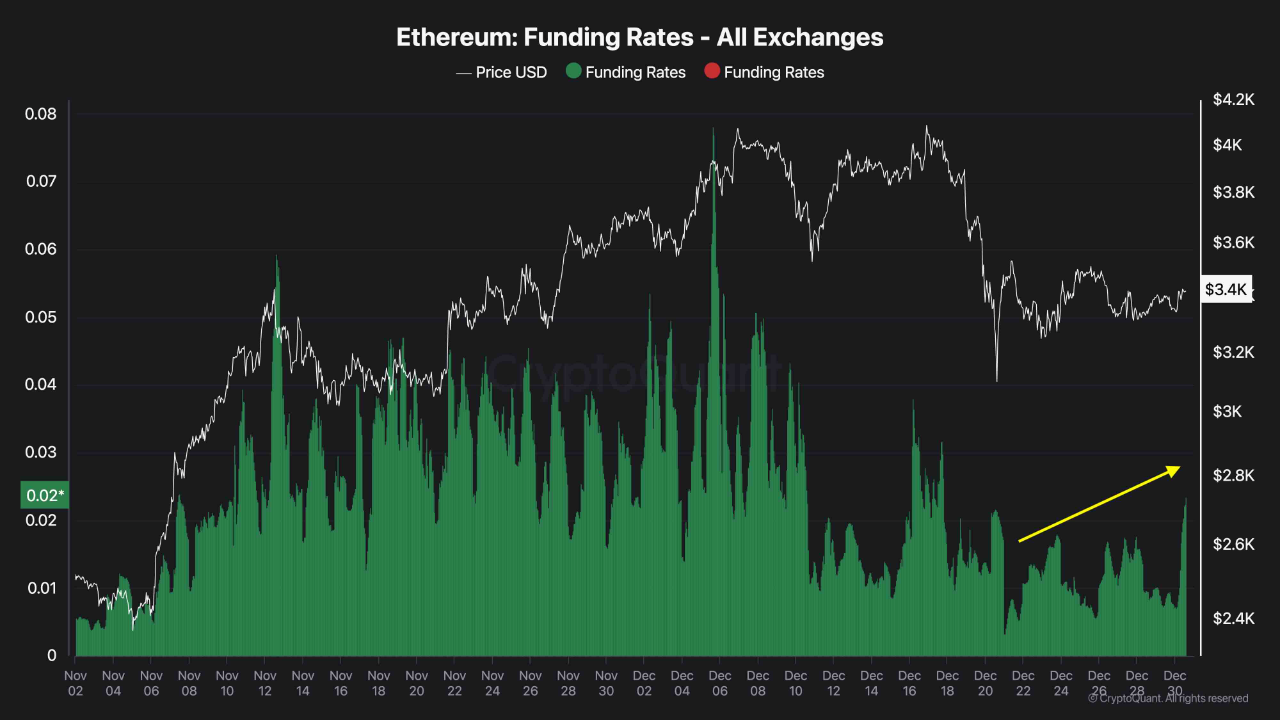

CryptoQuant analyst ShayanBTC analyzed Ethereum's futures market, noting that funding rates have stabilized post-correction, indicating a potential recovery. Increased funding rates suggest heightened trader interest in long positions.

Funding rates reflect market sentiment in perpetual futures contracts; rising rates typically indicate bullish outlooks among traders. The current spike in funding rates points to increased demand for Ethereum around the $3,000 mark, with expectations of a bounce-back.

The recent spike in funding rates suggests an influx of buyers, which, if sustained, could drive a substantial bullish rebound. This renewed buying pressure has the potential to push Ethereum toward the crucial $4K resistance in the short to mid-term.

Ethereum Market Performance

Ethereum is currently priced at $3,310, reflecting a 1.5% decrease over the past day and a 32.2% drop from its all-time high (ATH) of $4,878 recorded in November 2021.

Despite the price decline, Ethereum's trading volume has seen an increase, rising from below $15 billion to $20.6 billion within the past day.