2 0

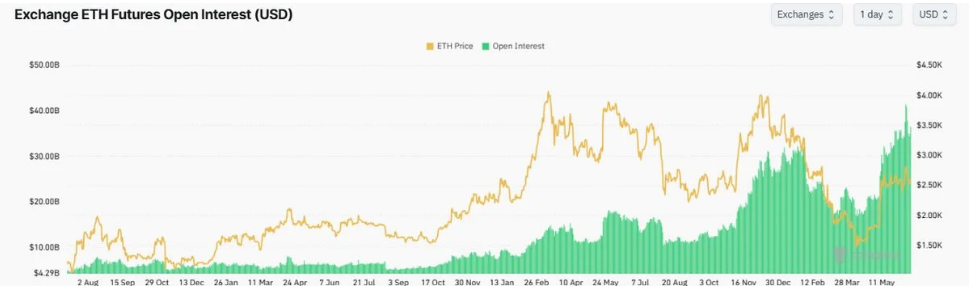

Ethereum Futures Open Interest Reaches Yearly High of $36.56 Billion

Ethereum (ETH) is experiencing significant market activity as futures open interest reached a yearly high of $36.56 billion on June 16, with prices rising above $2,600.

Futures Open Interest Reaches New High

- Open interest in ETH futures increased sharply over three days, marking the highest level since last year.

- This indicates traders are utilizing borrowed funds to speculate on Ethereum's price direction.

Price Tests Key Resistance Level

- ETH rose approximately 4.5% in one session, approaching a long-standing descending trendline.

- The price is positioned just above the 50-week moving average, with the 200-week average below.

- Clear movement and sustained trading above these levels could indicate potential upward momentum.

- Weak trading volume may require more support from bulls for continued growth.

ETF Flows Indicate Strong Support

- US spot funds linked to Ethereum saw a small outflow of $2.18 million, the first in 19 days.

- Weekly inflows totaled $528.12 million, raising total assets under management in ETH ETFs beyond $10 billion.

Institutional Engagement Grows

- Major asset managers like BlackRock and Fidelity are launching tokenized treasury products and stablecoin-backed funds tied to ETH.

- These products aim to provide access for large institutions previously hesitant to engage with Ethereum.

- They signify Ethereum's potential beyond DeFi, extending into real-world applications.

As of June 16, Ethereum traded at $2,630, reflecting a 4% increase in the past 24 hours. Futures markets show rising volumes as large players enter ETH contracts, indicating potential volatility ahead due to speculative positions that may lead to forced liquidations.