9 0

Ethereum Nears Historical Accumulation Level, 8% From Long-Term Holder Basis

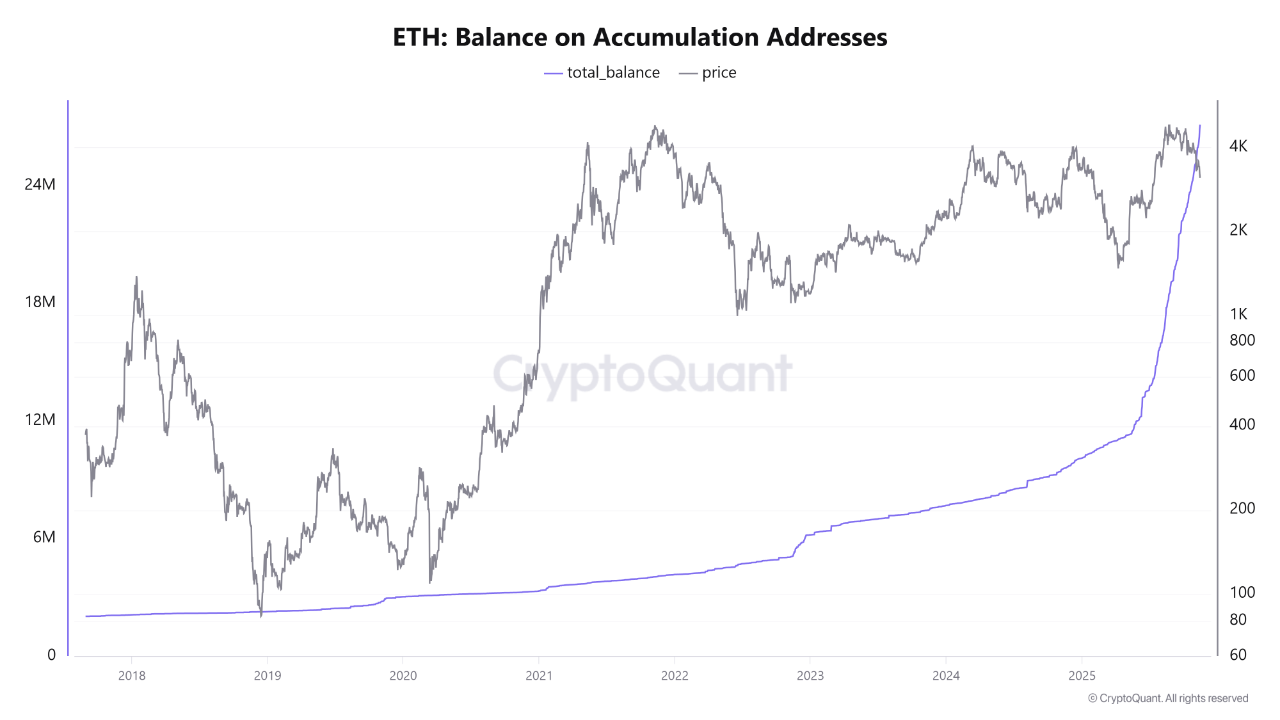

Ethereum is trading around key demand levels amidst market uncertainty, currently near $3,150 after prolonged selling pressure. New data indicates Ethereum may be approaching a crucial accumulation zone at $2,895, linked to long-term holder activity and historical market bottoms.

- Ethereum's price is 8% from the Accumulation Addresses Realized Price of $2,895, an average cost basis for long-term investors.

- A decline toward this level historically supports price stabilization and recovery, attracting strategic buyers.

- Long-term holders remain stable, viewing fear-driven sell-offs as opportunities for accumulation.

- Past dips below this level, like during the April 2025 tax-tariff crisis, saw significant ETH inflows into accumulation addresses.

Ethereum holds above a critical support zone near $3,000, briefly dipping but recovering quickly. The weekly chart shows potential stability around the 200-week moving average, with the 50-week moving average at $3,500 acting as immediate resistance.

- Breaking above $3,500 could signal renewed bullish momentum.

- Losing $3,000 might trigger further declines toward $2,800–$2,900, aligning with the Accumulation Realized Price.

The current market phase mirrors past corrections where Ethereum tested long-term supports before rebounding. This suggests close monitoring by long-term holders and institutional investors.