6 0

Ethereum Positioned as Key Platform in BlackRock’s Tokenization Strategy

BlackRock CEO Larry Fink has emphasized the necessity for a unified blockchain to enhance transparency and reduce corruption in global markets. Ethereum is positioned as a potential settlement layer for tokenized capital markets due to its capabilities in handling institutional-scale liquidity, compliance, and settlement.

Asset Managers' Infrastructure Preferences

- Fink highlighted the importance of tokenization and digital financial systems at the World Economic Forum.

- BlackRock's initiatives point towards Ethereum as a core platform for asset tokenization.

- The firm's BUIDL tokenized money market fund on Ethereum has reached over $2 billion in total value locked.

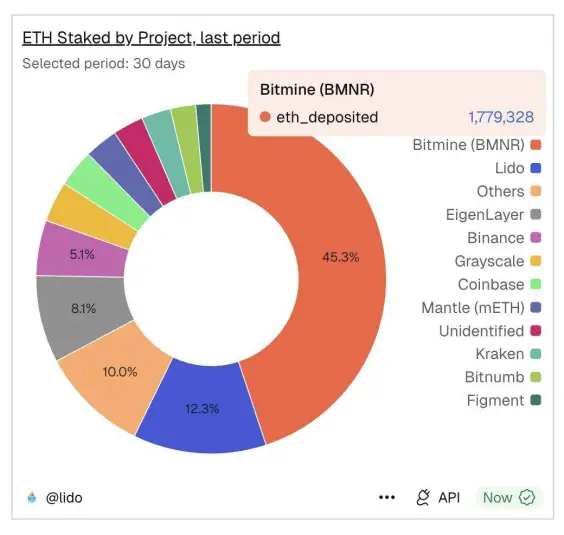

Bitmine has significantly contributed to Ethereum staking, with 1.83 million ETH staked, valued at approximately $6 million. Plans to scale this to 4.2 million ETH reflect strong confidence in Ethereum's future economic prospects.

Large-scale staking reduces liquid supply, adding structural pressure as demand remains steady.

Support Through Market Cycles

- Ethereum is maintaining a critical support zone around $3,000, just above its long-term rising structure.

- The $2,750 level has consistently served as a reliable floor during market pullbacks.

- As long as Ethereum holds above this level, its multi-year uptrend continues.