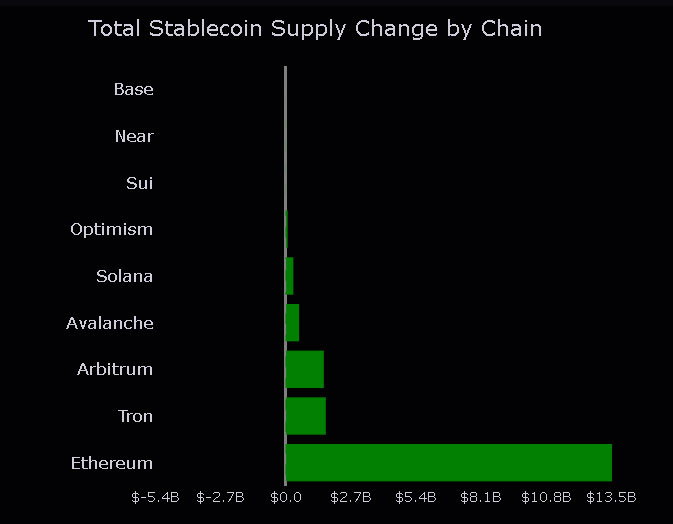

Ethereum Layer-2 Networks Reach $13.5 Billion in Stablecoins Locked

The stablecoin ecosystem is experiencing significant growth, particularly on Ethereum's layer-2 networks. As of December 20, stablecoins valued at $13.5 billion are locked on these platforms, driven by increased adoption in crypto payments and remittances, according to Tie Terminal.

Photo: The TIE Terminal

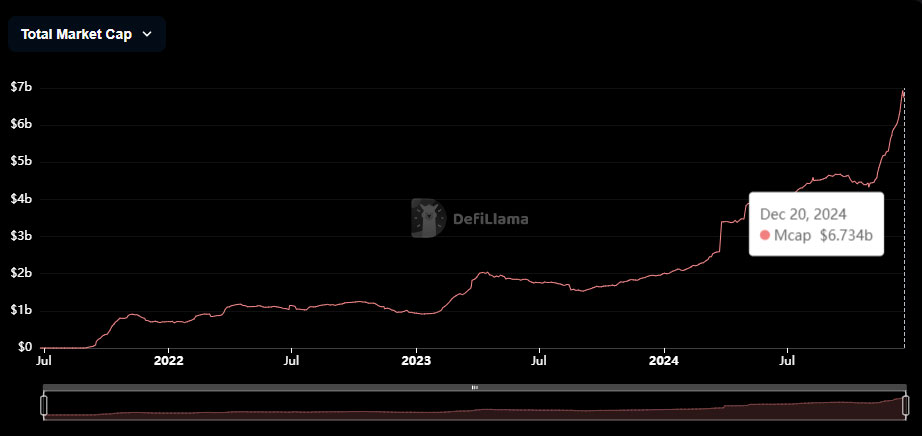

Arbitrum One and Base are major contributors to this growth. Data from DefiLlama shows Arbitrum holds $6.73 billion in stablecoins, while Base has $3.56 billion. This contributes to an overall stablecoin market capitalization of $205 billion across all blockchains.

Photo: DefiLlama

The rise in stablecoin usage underscores their significance in the cryptocurrency landscape. Matthias Seidl, co-founder of growthepie.xyz, notes that stablecoins are a key use case, with layer-2 platforms achieving record locked values.

One of cryptos killer use-cases in this cycle are Stablecoins. Layer 2s just reached a new ATH in stables locked on them.

Almost $12B is now used on all Layer 2s combined.

For perspective:

– BSC has $6.6B

– Solana has $4.7B

– Avalanche has $2.3B pic.twitter.com/7CcYHGTNAD— matze | growthepie.xyz 🥧📏 (@web3_data) December 16, 2024

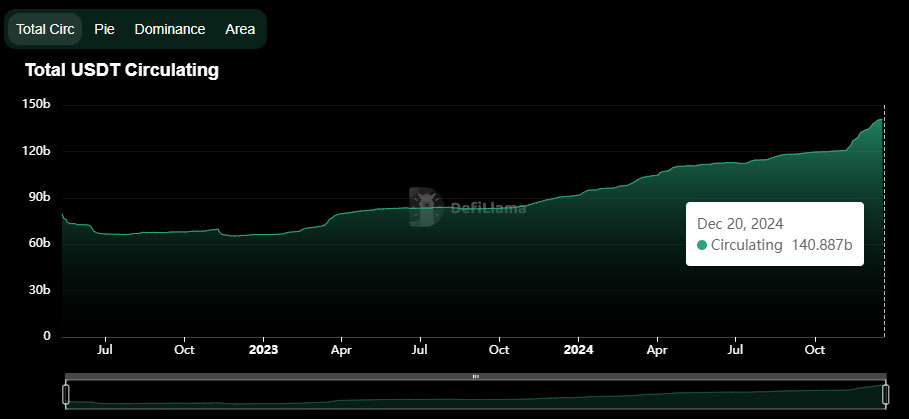

Tether (USDT) Surpasses $140 Billion by Year End

Tether dominates the stablecoin market, starting 2024 with a market cap of $91.7 billion and growing to over $140.88 billion by December 19. Circle’s USD Coin peaked at $42 billion in 2024 but remains below its all-time high of $55.8 billion from June 2022.

Photo: DefiLlama

Stablecoin adoption has steadily increased since November 7, when the global market cap was $123 billion, indicating growing confidence in stablecoins as a medium of exchange within the crypto ecosystem.

The broader Ethereum ecosystem benefits from the rising utility of stablecoins in real-world applications, such as remittances and global transactions.

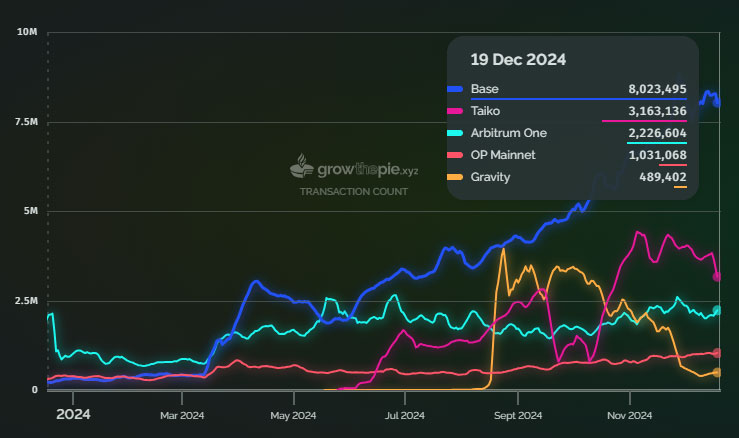

Ethereum Upgrades Shift Activity to Layer-2 Networks

Layer-2 solutions gained traction following Ethereum’s Dencun upgrade, which lowered transaction costs and increased roll-up activity. Base now reports over 8 million daily transactions, up from 400,000 in March, while Taiko logged over 3 million daily transactions, according to Growthepie.

Photo: Growthepie

Conversely, Linea experienced a decline in daily transactions, dropping to 200,000 from over 800,000. Despite this, Layer-2 rollups enhance Ethereum's activity and contribute to temporarily deflationary ETH supply. The introduction of Blobs during the Dencun upgrade has burned over 1,200 ETH since implementation.

Arbitrum leads in stablecoin market share, followed by Base and Optimism. The addition of Blobs, which reduce costs by temporarily storing data, reinforces the importance of Layer-2 solutions in Ethereum's future strategy. Vitalik Buterin views this as essential for maintaining ETH deflation.