5 1

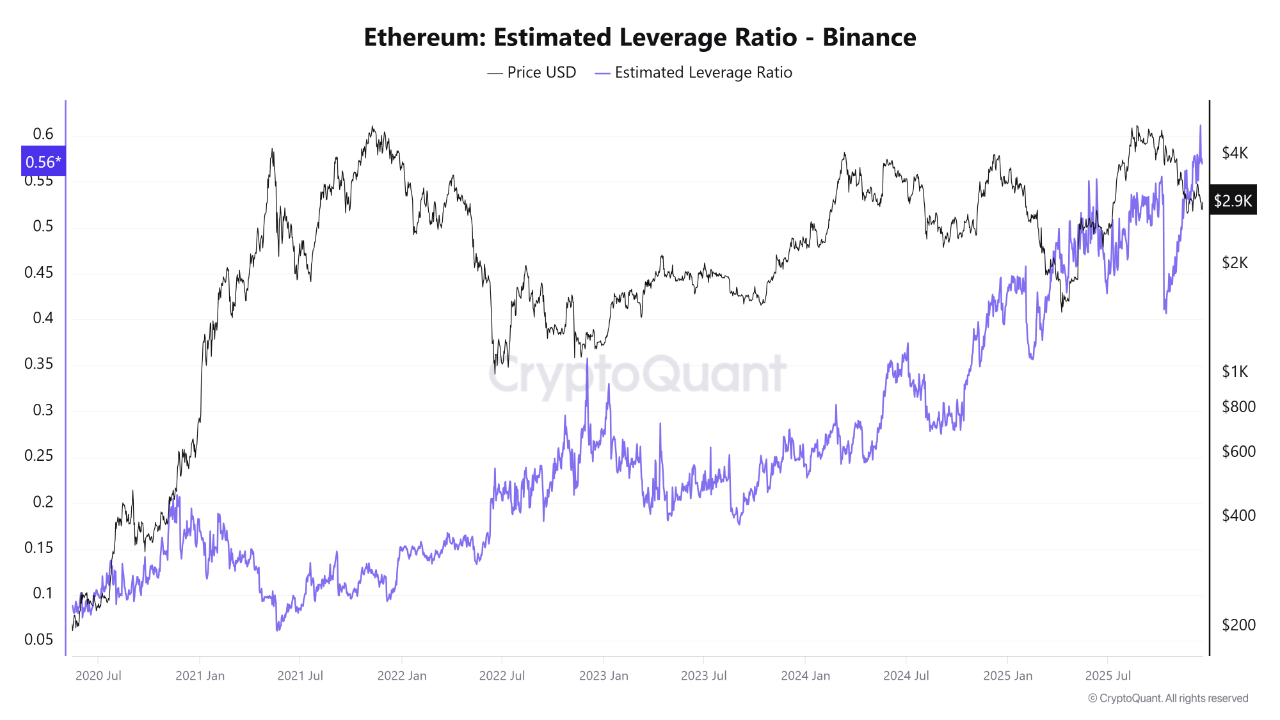

Ethereum Leverage Hits Record High Amid Rising Buying Pressure

Ethereum Market Overview:

- Ethereum's price struggles below $3,000 with repeated rejections.

- Market sentiment remains cautious amid low trading activity and short-lived relief rallies.

Derivatives Market Insights:

- CryptoQuant report indicates Ethereum's derivatives market on Binance is at record levels.

- Estimated Leverage Ratio (ELR) for ETH reached an all-time high of 0.611, indicating high leveraged positions.

- Taker Buy Sell Ratio spiked to 1.13, showing aggressive buying behavior.

Implications and Risks:

- High leverage suggests optimism but increases risk of volatility and potential long squeezes.

- Price pullbacks could lead to cascading liquidations due to elevated leverage.

Price Action and Technical Analysis:

- ETH trades around $2,950, struggling below key resistance levels.

- ETH remains below both the 100-day and 200-day moving averages.

- Failure to reclaim $3,200–$3,300 zone highlights ongoing downtrend.

- Immediate support lies between $2,800–$2,750; a break could lead to further declines toward $2,500.

- Reclaiming $3,200 and holding above moving averages with increased volume is essential for a bullish reversal.