3 0

BEARISH 📉 : Ethereum leverage at record high increases volatility risk

Ethereum's Volatility Amid High Leverage and Market Uncertainty

- Ethereum is struggling to reclaim the $3,000 level amidst market uncertainty.

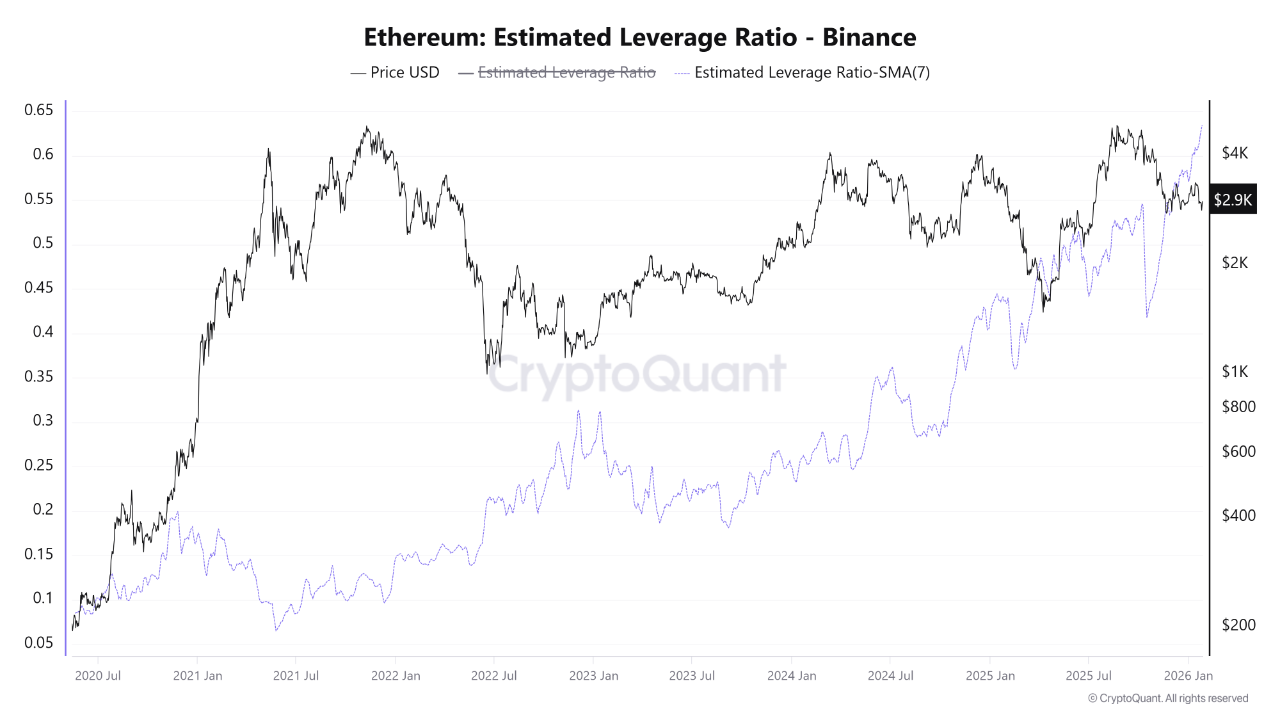

- High leverage and unstable derivatives behavior contribute to market fragility.

- The Estimated Leverage Ratio on Binance for Ethereum remains at a peak, indicating sensitivity to price swings.

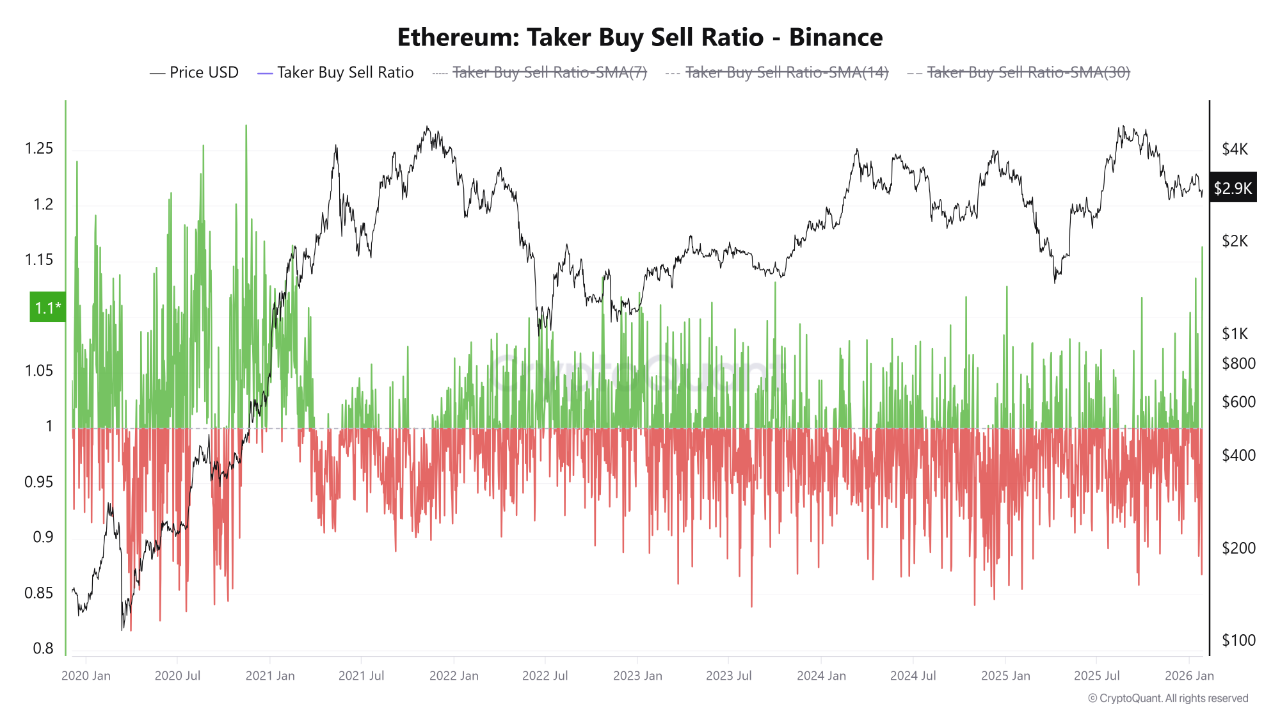

- Order-flow data shows erratic trader behavior, lacking market balance.

- The Taker Buy Sell Ratio recently shifted drastically from 0.86 to 1.16, highlighting short-term positioning dominance.

- ETH failed to surpass its all-time high of $4,800 and is consolidating near $2,800.

- Price compression and elevated leverage increase the risk of sudden market reactions.

- Ethereum's reliance on external or internal catalysts keeps volatility risks high without clear directional conviction.

- Currently trading near $3,000, ETH struggles with resistance below key moving averages.

- A break above $3,300–$3,400 is needed for a positive trend shift, while falling below $2,800 could lead to further declines toward $2,500–$2,600.