5 0

Ethereum Approaching Local Bottom as Binance Open Interest Declines

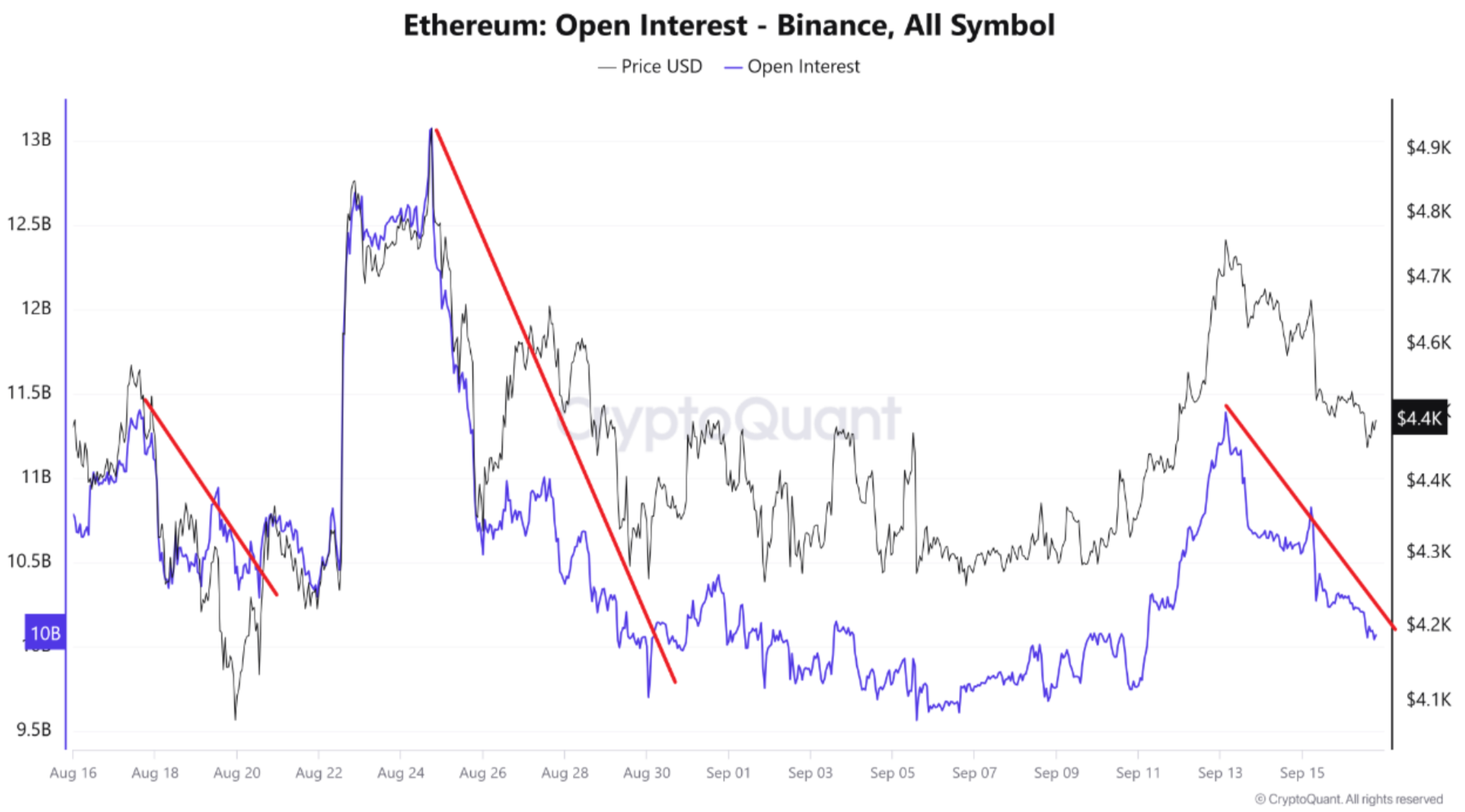

Ethereum (ETH) is approaching a potential local bottom as indicated by a decline in Binance open interest. This could signal an upcoming price increase as ETH aims to surpass the $5,000 mark.

Key Insights

- Binance ETH Open Interest (OI) has shown a 14.9% average decline over three months, often preceding spot market corrections averaging 10.7%.

- Notable OI declines included a drop from $11.4 billion to $10.2 billion on August 17 and from $13 billion to $9.7 billion on August 20.

- The latest significant decline was on September 13, with OI falling from $11.39 billion to $10.4 billion.

- Current speculation suggests Binance ETH OI might decrease to $9.69 billion, indicating a local bottom zone for ETH.

Potential Price Targets

- The Fund Market Premium (FMP) has been neutral or positive, suggesting institutional demand and supporting ETH’s stability above $4,400.

- Analysts target $6,800 if current trends continue, supported by depleting ETH exchange reserves.

- ETH has already surged from $2,500 to $4,400 since July 2025.

At present, ETH trades at $4,491, marking a 0.8% increase in the past 24 hours. Analysts remain cautious due to the pause in ETH's rally momentum, but institutional support is a positive sign for future growth.