10 0

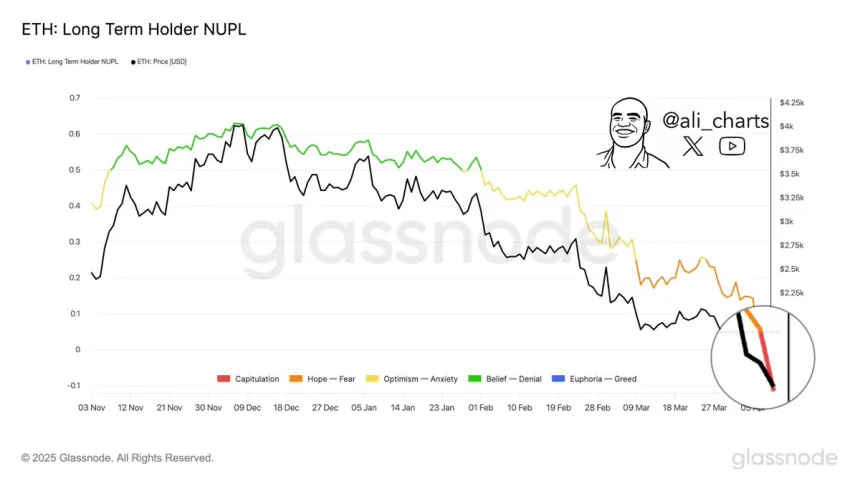

Ethereum Long-Term Holders Show Capitulation Amid Market Volatility

Ethereum Recovery Overview

- Ethereum surged over 21% from a low of $1,380 following US President Trump's announcement of a 90-day pause on tariffs for most countries.

- Long-term holders are selling at a loss, which historically signals potential market bottoms.

- Market volatility remains high due to geopolitical unrest and macroeconomic instability.

- Since late December, Ethereum has dropped over 60%, raising concerns about a bear market.

- Analyst Ali Martinez suggests current conditions may offer a buying opportunity for contrarian investors.

Current Market Conditions

- Ethereum recently bounced back from sub-$1,400 levels, signaling some bullish sentiment.

- A pivotal test is emerging to determine if the recovery will sustain or if further declines are imminent.

Technical Analysis

- Ethereum is forming an “Adam & Eve” bullish reversal pattern on the 4-hour chart.

- Key resistance at $1,820 needs to be reclaimed to confirm this bullish structure.

- Breakout through the convergence of the 200 moving average and exponential moving average around $1,900 could indicate sustained upward movement.

- If ETH fails to reclaim $1,800, it may remain rangebound between current levels and support near $1,300.