Ethereum Shows Strong Market Confidence Amidst Positive Key Indicators

Ethereum (ETH) has remained a key player in the cryptocurrency market, although its price has not matched Bitcoin's recent gains. Despite not reaching a new all-time high, Ethereum exhibits several positive indicators that suggest strong potential for future growth. Analysts attribute this to underlying market confidence from both institutional and retail investors.

Key Market Indicators Highlight Ethereum Potential

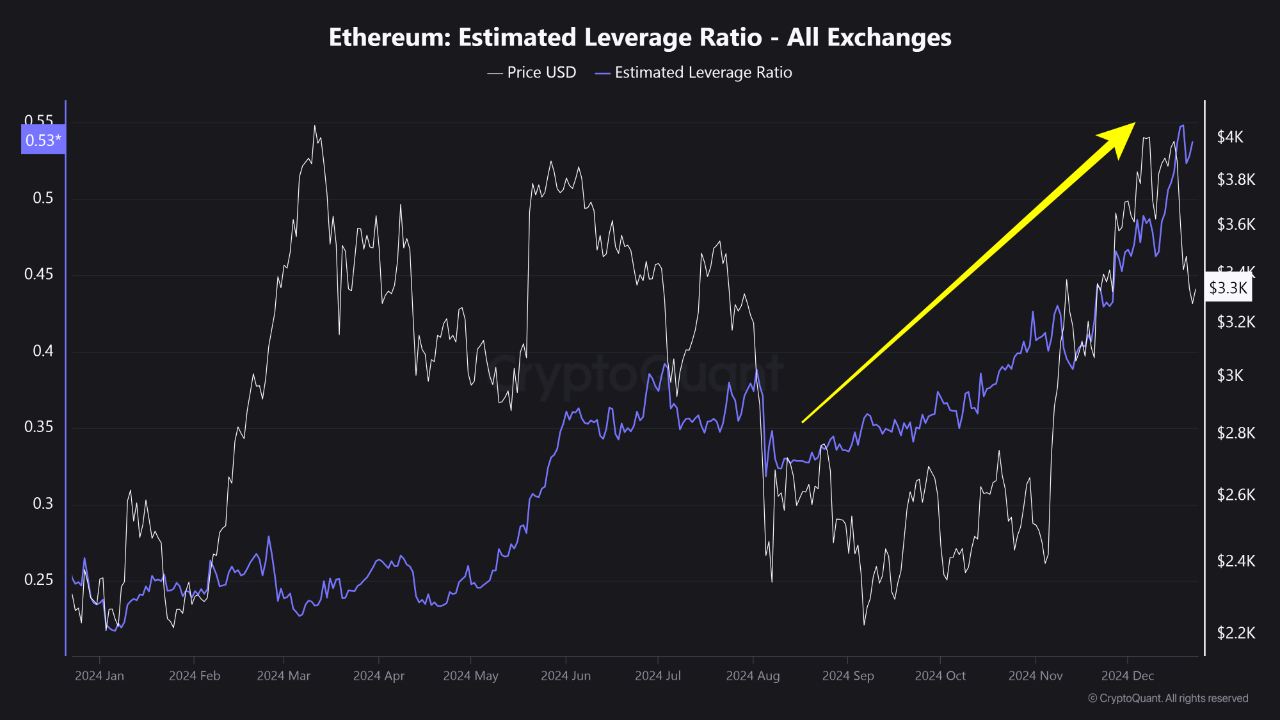

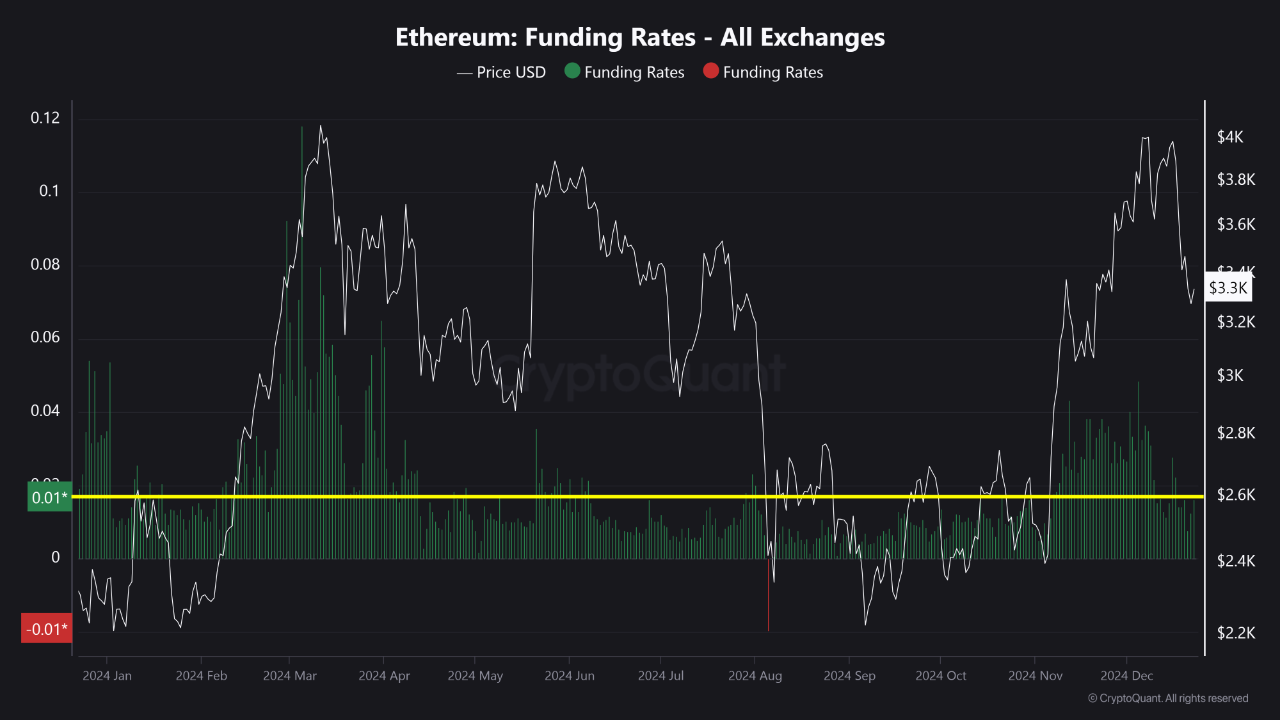

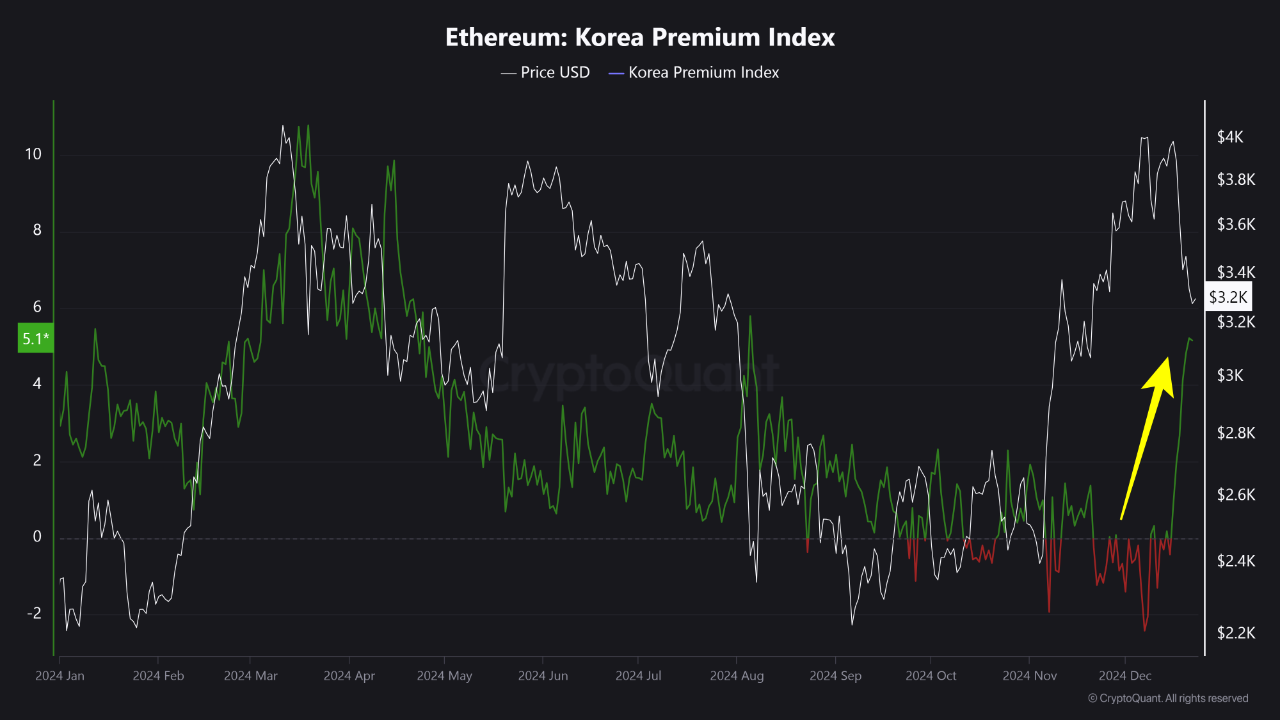

CryptoQuant analyst EgyHash notes various factors influencing Ethereum market sentiment. While Bitcoin has seen a stronger uptrend post-US elections, Ethereum's technical indicators show accumulation among traders and long-term holders. This is reflected in Ethereum's Estimated Leverage Ratio, funding charges, and regional trading premiums, indicating its survivability in downturns.

EgyHash reported that the Estimated Leverage Ratio for Ethereum remains at elevated levels, reflecting trader leverage in derivatives markets relative to holdings. A high leverage ratio indicates sustained risk appetite among market participants.

Ethereum’s Silent Surge: Key Metrics Turn Bullish

“These factors point to a persistent bullish outlook for Ethereum, as market participants appear ready to maintain, and potentially increase, their exposure to the asset.” – By @EgyHashX

Link

https://t.co/biIhFoyzBd pic.twitter.com/3kfghQ7EDX

— CryptoQuant.com (@cryptoquant_com) December 23, 2024

Funding Rates, Premiums, And Institutional Inflows Hint at Bullish Trend

Funding rates for ETH derivatives remain moderately positive, indicating that long positions dominate the market without approaching overheated levels that could lead to liquidations. EgyHash stated that this moderation allows for potential price increases without significant liquidation risks.

The Korea Premium Index for ETH measures the price gap between South Korean exchanges and global markets. A positive premium indicates increased buying activity in South Korea, historically correlating with periods of strong upward momentum for Ethereum.

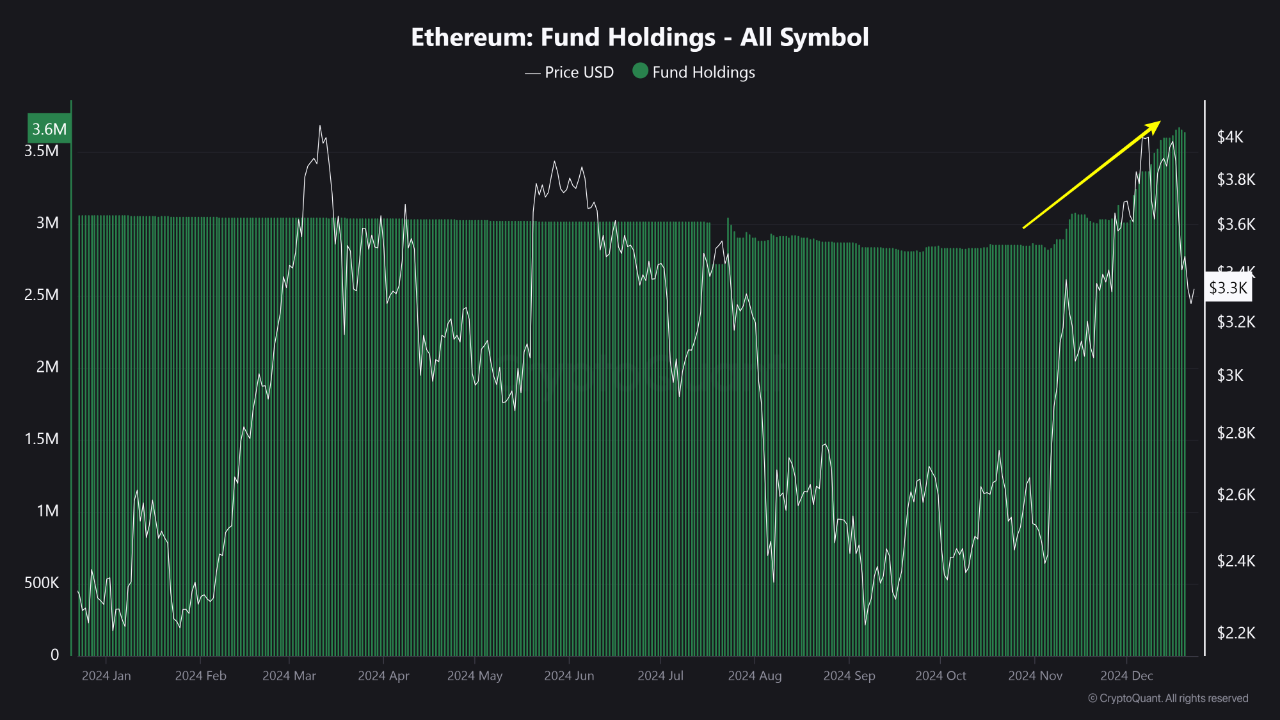

EgyHash observed that institutional investor interest in Ethereum remains robust, with steady increases in fund holdings despite market corrections. This trend signals ongoing confidence from institutional players who typically adopt a long-term perspective on asset performance.

Rising fund inflows indicate that institutional investors are accumulating ETH in anticipation of future price appreciation. Retail traders and smaller investors also contribute to Ethereum's stability.

Featured image created with DALL-E, Chart from TradingView