2 0

Ethereum Net Flows Show Negative Trend Amid Price Rally Attempts

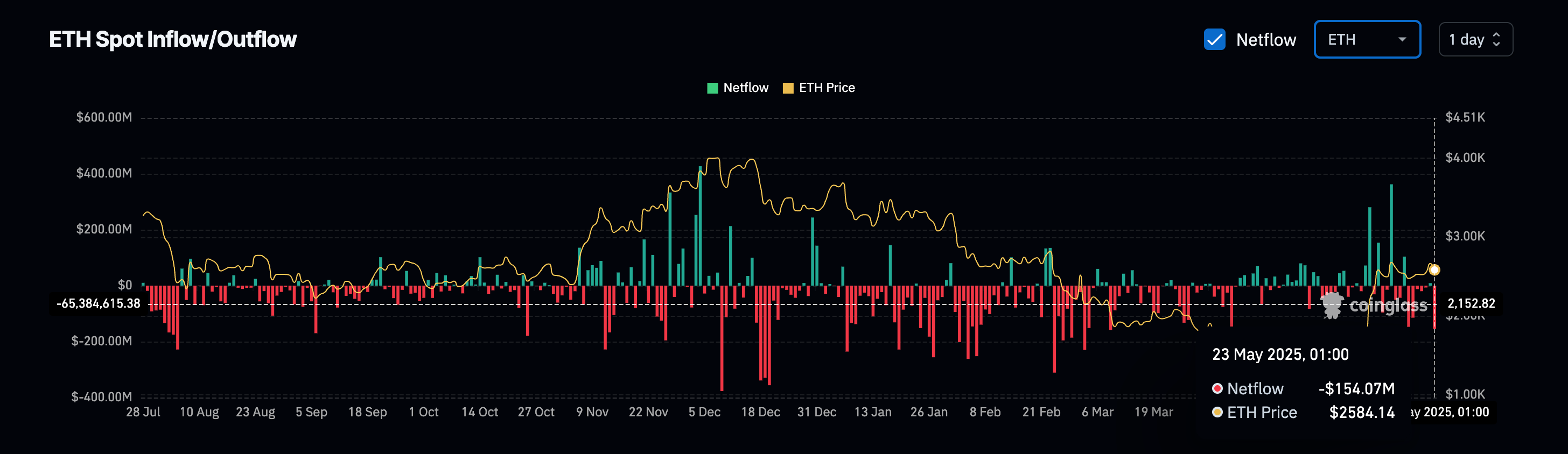

Ethereum has experienced mostly negative net flows over the past week, indicating a potential bullish momentum for its price. Key points include:

- Net flows represent the difference in coins entering or leaving exchanges; negative flows suggest higher buying pressure.

- Current data shows 24-hour net flows at -$182.86 million, with six out of the last seven days showing negative figures.

- In the past week, net flows totaled -$140 million as more ETH left exchanges than entered.

- For the past 15 days, net flows are positive at $186.48 million, contributing to a suppressed price despite Bitcoin's new all-time highs.

- The 30-day period indicates larger deposits into exchanges, with total net flows reaching $483.54 million.

If negative net flows continue, it may lead to increased buying pressure and a potential rally in Ethereum's price. Analyst Captain Faibik suggests that if buyers surpass sellers, Ethereum could rise above $3,500 if it breaks the 200-Day Simple Moving Average at $27,000.