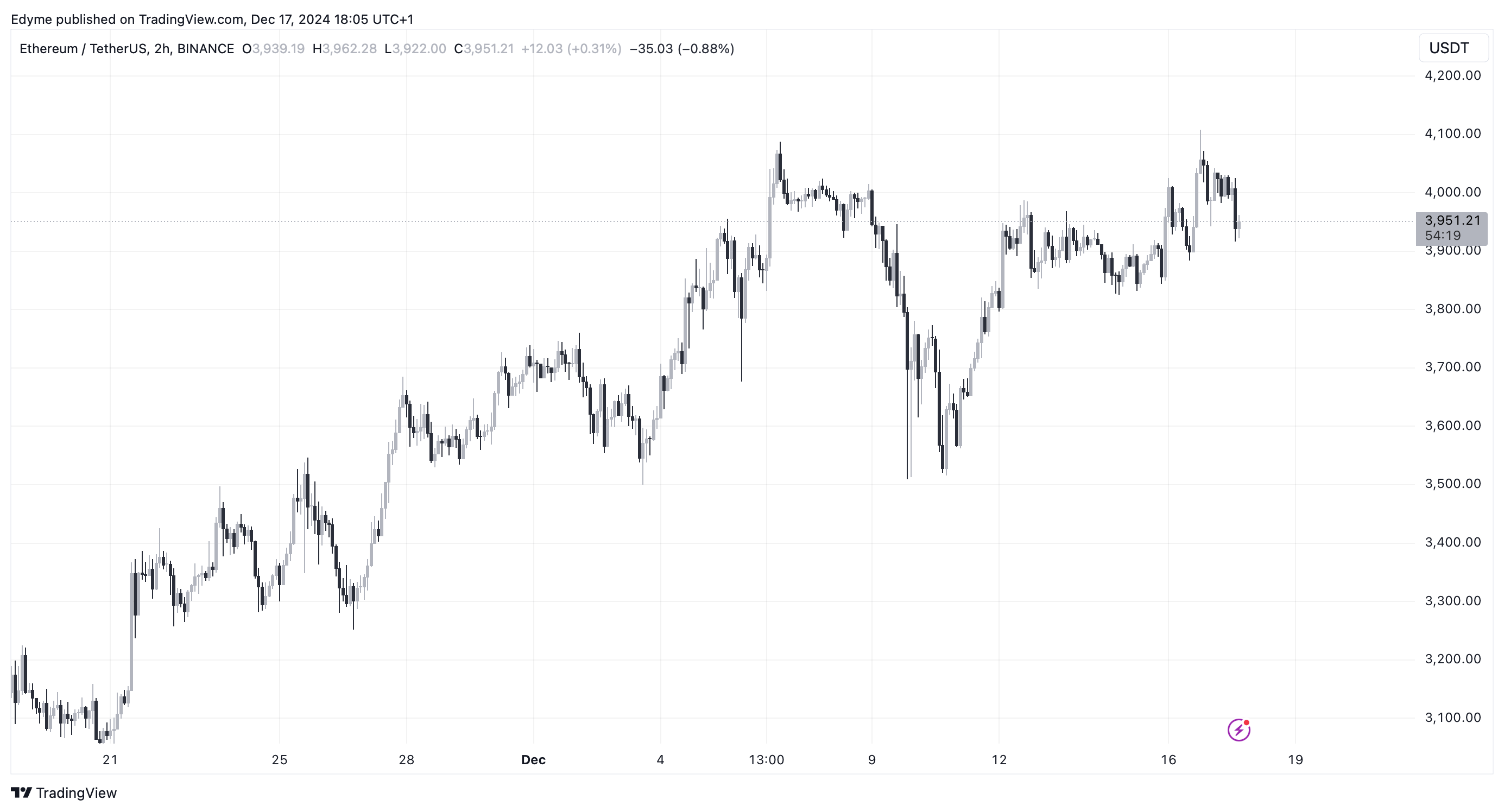

Ethereum Records Significant Net Outflows on Spot Exchanges

As Ethereum attempts to rally alongside Bitcoin, analysts are examining its fundamentals to understand the current market dynamics.

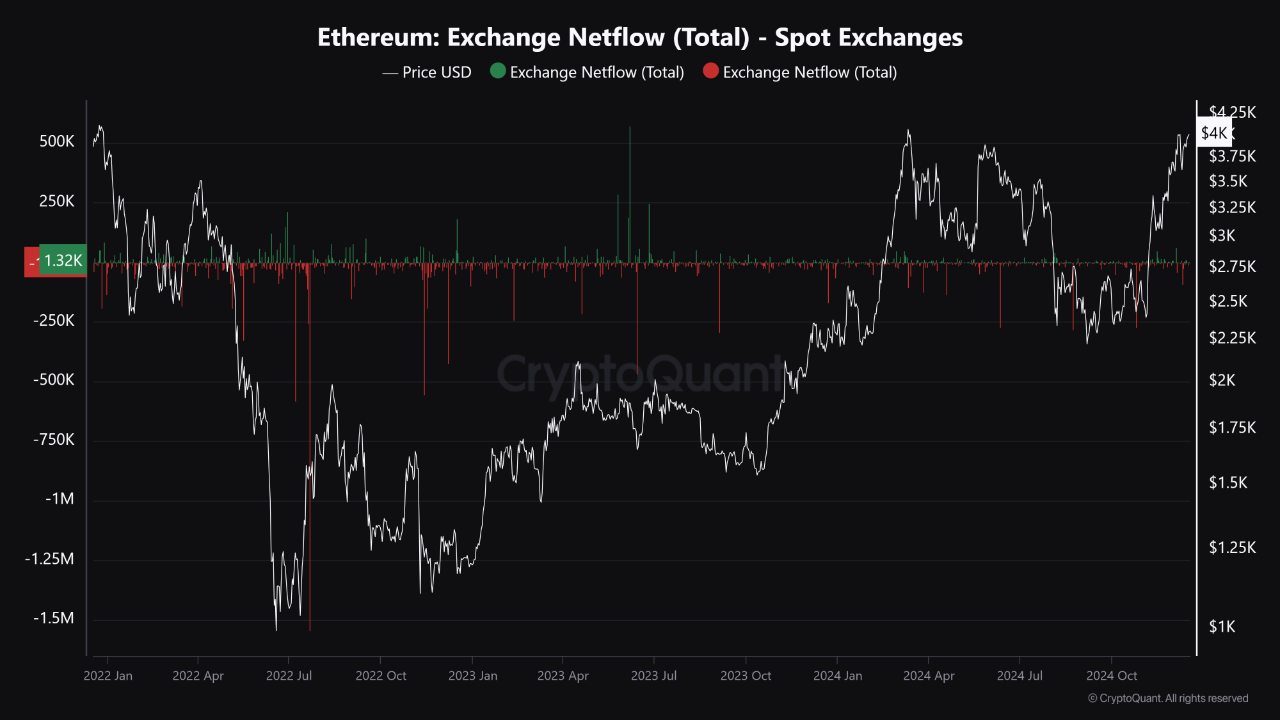

A significant factor affecting ETH's price is the relationship between net flows on spot exchanges and investor behavior. Net flows indicate the balance of Ethereum entering and exiting exchanges, serving as a critical metric for potential price trends, according to recent analysis.

Net Outflows and Conditions for Ethereum Price Growth

Net outflows generally signal bullish sentiment as investors move their ETH to cold wallets, reducing market selling pressure. Conversely, increased net inflows often suggest readiness to sell, which can create downward pressure.

CryptoQuant analyst cryptoavails notes that these patterns in Ethereum’s net flow data have significantly influenced past price cycles.

For instance, during early 2022, when Ethereum's price fell from $4,000 to $1,000, net inflows prevailed, indicating increased selling activity. The trend shifted in July 2022, with net outflows contributing to Ethereum's gradual recovery.

To sustain an upward trend, the analyst emphasizes the importance of consistent net outflows. When ETH is withdrawn from exchanges, circulation tightens, leading to reduced selling pressure. This supply-demand imbalance may favor higher prices as investor confidence rises. A steady pattern of net outflows suggests long-term holding of Ethereum, indicating potential for price appreciation.

However, cryptoavails cautions that Ethereum’s growth momentum remains susceptible to sudden market shifts. A substantial influx of ETH back onto exchanges could increase selling pressure, leading to short-term corrections. The analyst stated:

This dynamic supports upward pressure on the price. However, sustainability is crucial—sudden net inflows can lead to short-term selling pressure, weakening the trend.

Implications for the Altcoin Market

Ethereum’s performance has broader implications for the altcoin market. As a leading altcoin, its movements often influence other altcoins' trends.

The CryptoQuant analyst suggests that a strong Ethereum rally supported by consistent net outflows could trigger an “altcoin season,” where altcoins experience notable price gains following Ethereum’s upward trajectory.

During such phases, positive investor sentiment across the broader crypto market drives demand for smaller-cap assets. Cryptoavails concluded:

Ethereum’s strong performance is essential for the anticipated altcoin season. ETH’s movements will significantly influence the future performance of altcoins. Thus, Ethereum’s net flow data on spot exchanges is a critical indicator for investors.

Featured image created with DALL-E, Chart from TradingView