12 1

Ethereum OG Deposits $500M in ConcreteXYZ and Stable Vaults

Ethereum is facing challenges breaking past the $4,000 mark due to uncertain market sentiment and volatility. Attempts to build momentum have been unsuccessful, indicating resistance at key levels.

- An Ethereum holder with 736,316 ETH deposited $500 million USDT into vaults by ConcreteXYZ and Stable before their announcement, suggesting strategic positioning.

- ConcreteXYZ offers a liquidity protocol linking institutional and DeFi capital through tokenized vaults for yield-bearing strategies within Ethereum's ecosystem.

- The whale's actions signal potential insider moves or high-conviction participation, indicating shifting liquidity dynamics at the DeFi and institutional finance intersection.

Whale Dominance in Aave and Stablecoin Vaults

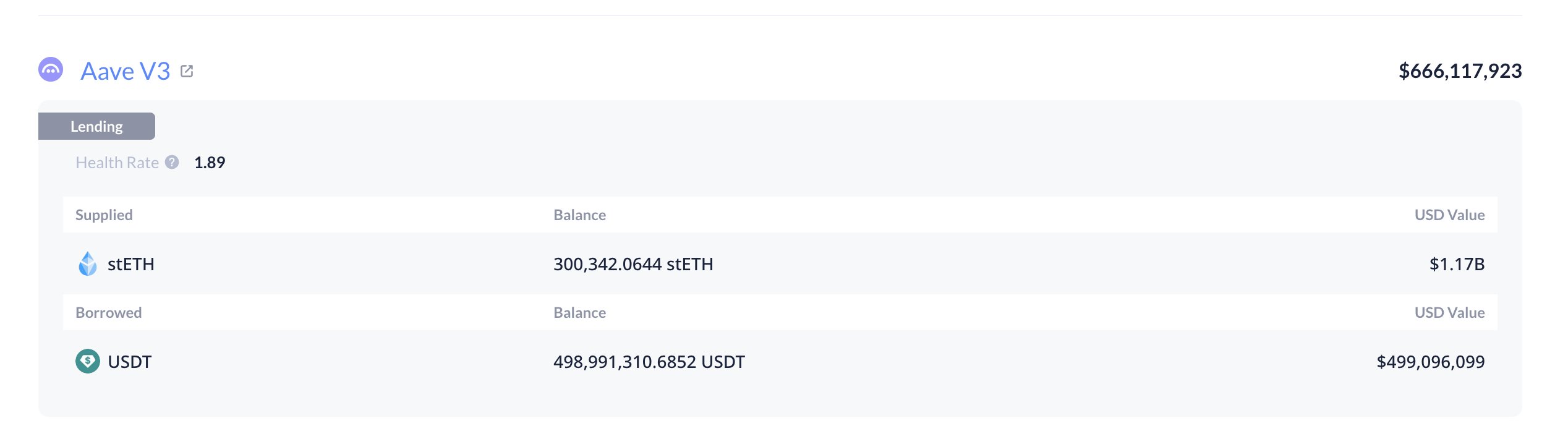

- The same Ethereum OG deposited 300,000 ETH into Aave and borrowed $500 million USDT, accounting for 64.5% of total liquidity in the new vaults.

- This strategy unlocks liquidity without selling ETH, allowing deployment into yield opportunities while maintaining ETH exposure.

- Such large-scale activity raises questions about market influence and systemic risk due to concentrated liquidity.

If used for yield farming, it could strengthen Ethereum’s fundamentals by boosting DeFi activity. However, falling collateral values might lead to liquidations, increasing volatility.

Ethereum Faces Resistance Near $4,000

- ETH is trading around $3,964, attempting recovery but remains below the $4,000–$4,200 resistance zone.

- The 50-day and 100-day moving averages converge in this area, often causing rejections during consolidations.

- The 200-day moving average near $3,200 provides support, yet failure to surpass $4,000 might invite selling pressure.

- A decisive close above $4,200 is needed for a bullish outlook; otherwise, a retest of $3,600–$3,500 could occur.