Ethereum On-Chain Metrics Show Increased Activity Amid Price Surge

On-chain data indicates a recent spike in Ethereum's network activity metrics, potentially signaling further price rallies.

Transaction Volume & Whale Transfer Count Surge

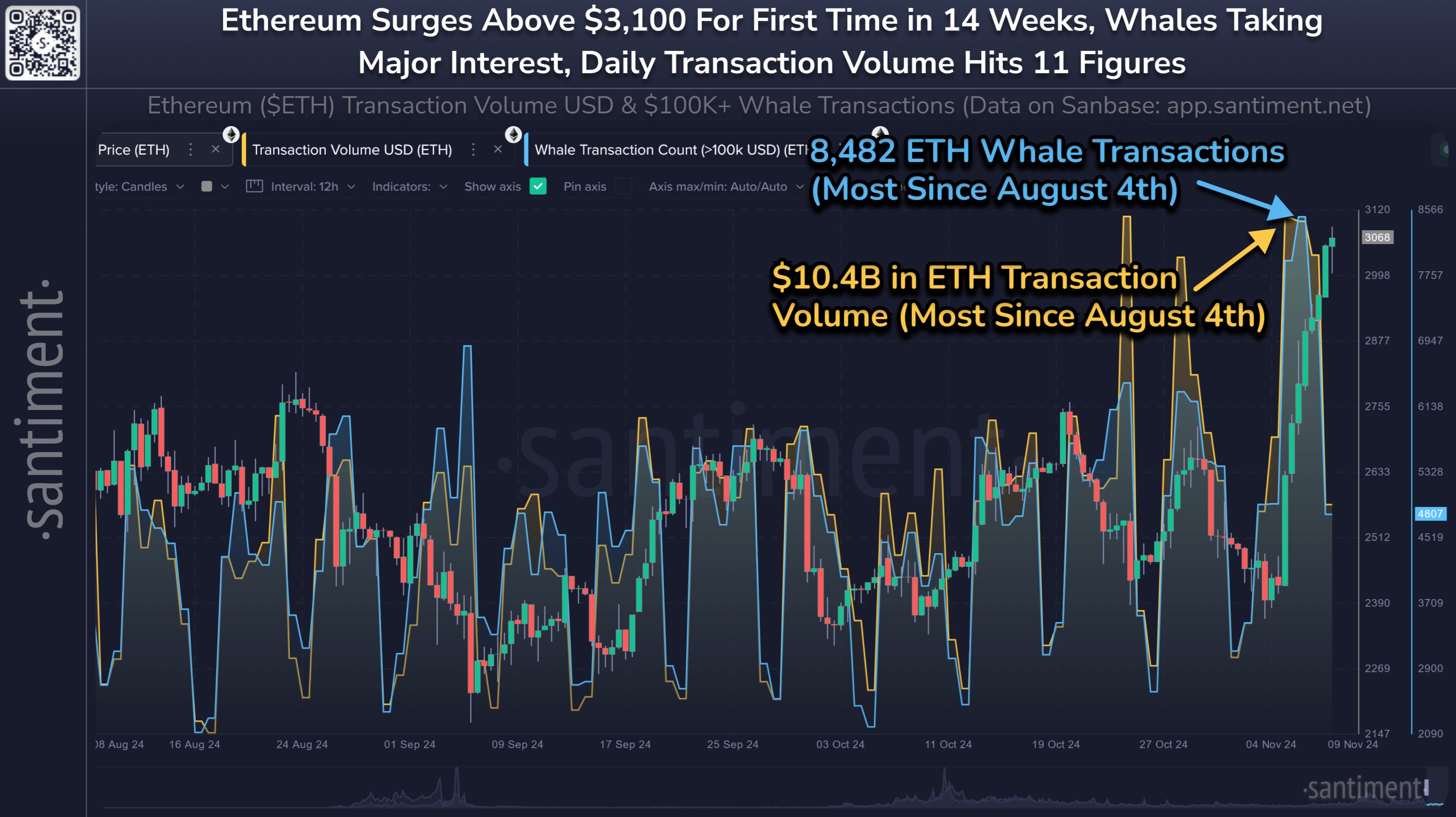

Data from the on-chain analytics firm Santiment highlights an increase in Ethereum's Transaction Volume and Whale Transaction Count.

The Transaction Volume metric tracks the total USD value of ETH transactions. A high value indicates active trading, while a low value suggests diminished interest among holders.

The following chart illustrates the recent trend in Ethereum's Transaction Volume:

The graph shows a significant uptick in Transaction Volume, indicating increased interest alongside rising prices. Sustained network activity is generally necessary for lasting price increases.

The Whale Transaction Count measures ETH transfers exceeding $100,000, reflecting the activity of large investors. The recent spike in this metric suggests that both small and large investors are engaging with the asset.

While these indicators do not specify whether investors are buying or selling, the sharp price rally likely reflects accumulation activity.

According to the analytics firm,

Any growth in Bitcoin during this bull run may lead to profits being redistributed into Ethereum, potentially driving it toward its all-time high, supported by healthy network activity.

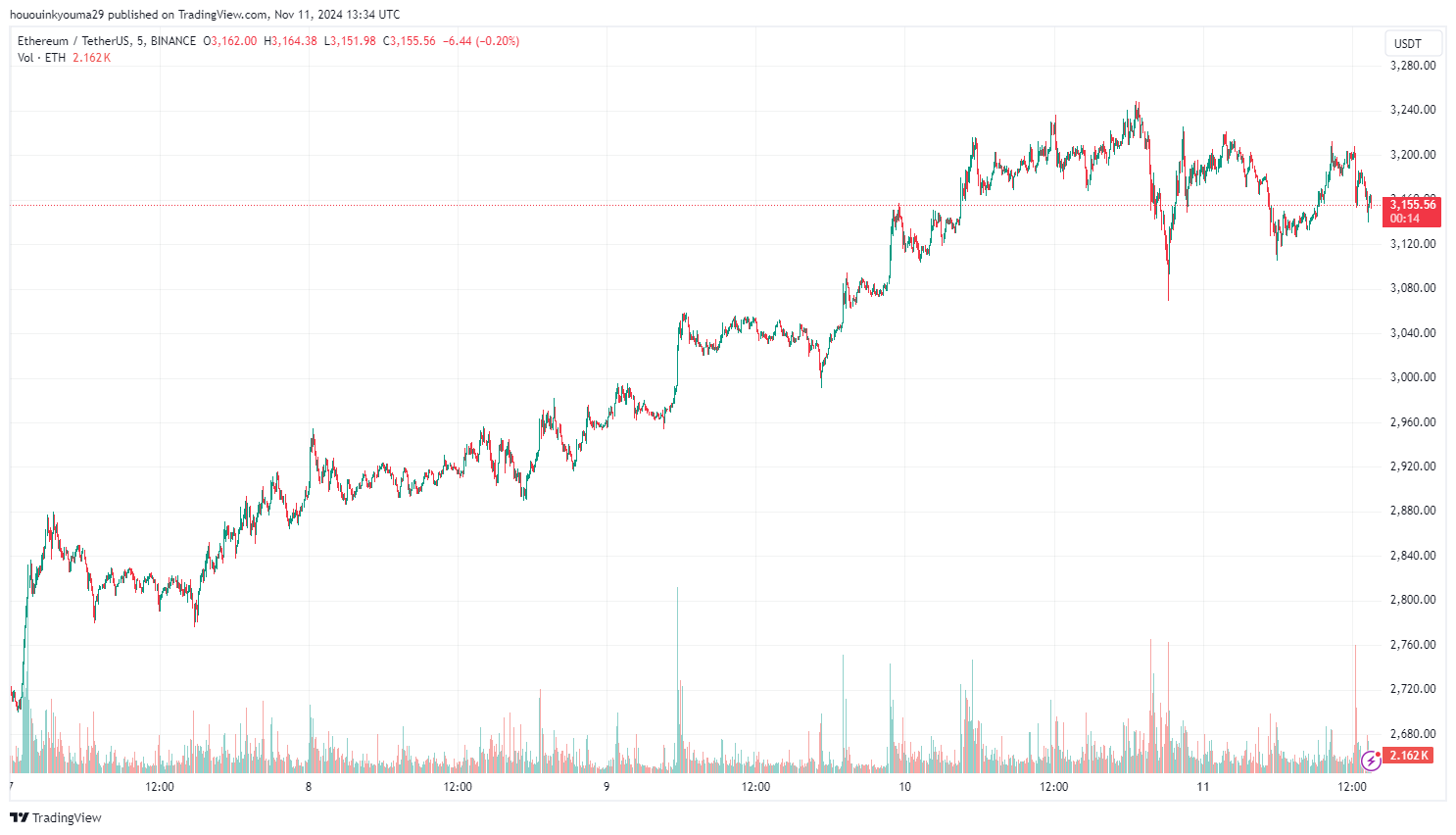

ETH Price Movement

Ethereum has experienced a surge of over 27% in the past week, surpassing the $3,150 mark.