10 1

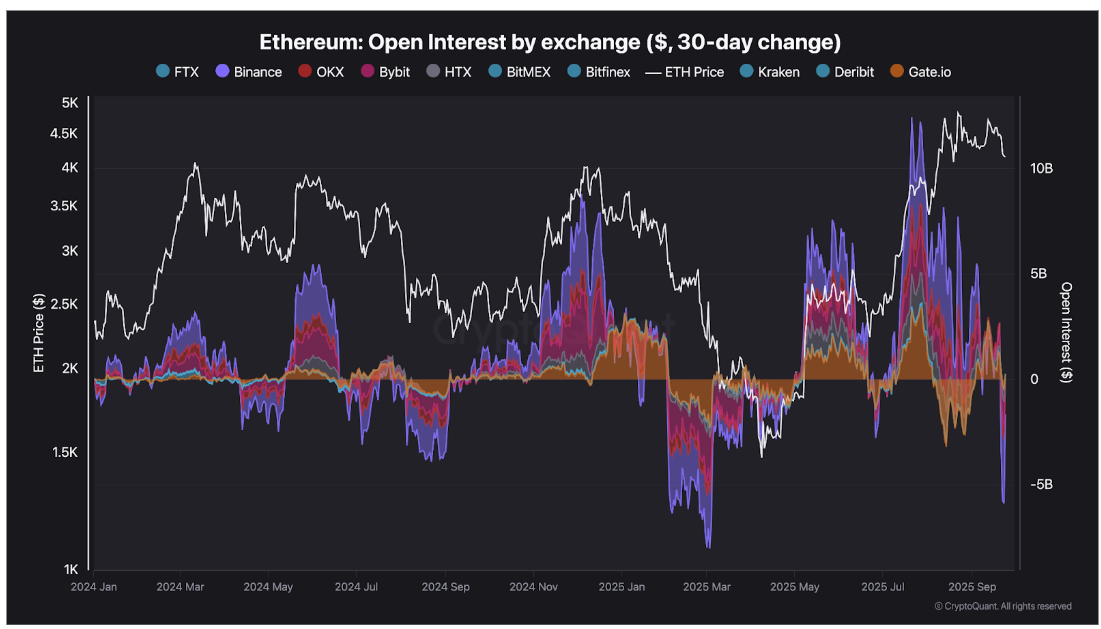

Ethereum Open Interest Plummets, Billions Wiped as Price Falls Below $4,000

Ethereum Market Correction

- Ethereum's price fell below $4,000, triggering a significant market reset.

- This led to a substantial reduction in futures open interest, with billions in positions wiped out across major exchanges.

Open Interest Decline

- Massive reductions in leveraged trades occurred, particularly on Binance, which saw over $3 billion erased on September 23.

- Bybit and OKX also experienced declines of $1.2 billion and $580 million, respectively.

- Overall open interest has dropped to its lowest since early 2024.

Impact of Spot Ethereum ETF Outflows

- Ethereum ETFs in the US saw outflows of $795.56 million over five days, marking the largest weekly withdrawal since their launch.

- Investor caution is heightened due to uncertainties about regulatory approval for staking features in these ETFs.

- This has increased volatility and pressure across Ethereum’s trading ecosystem.

Ethereum briefly dipped to $3,845 but recovered to $4,002. Despite this recovery, it remains down about 10% from last week's $4,490 level. The outlook depends on whether ETH can consistently stay above $4,000.