Ethereum Open Interest Reaches All-Time High of $16.8 Billion

Data indicates that Ethereum Open Interest has reached an all-time high (ATH) of approximately $16.8 billion.

Ethereum Open Interest Trend

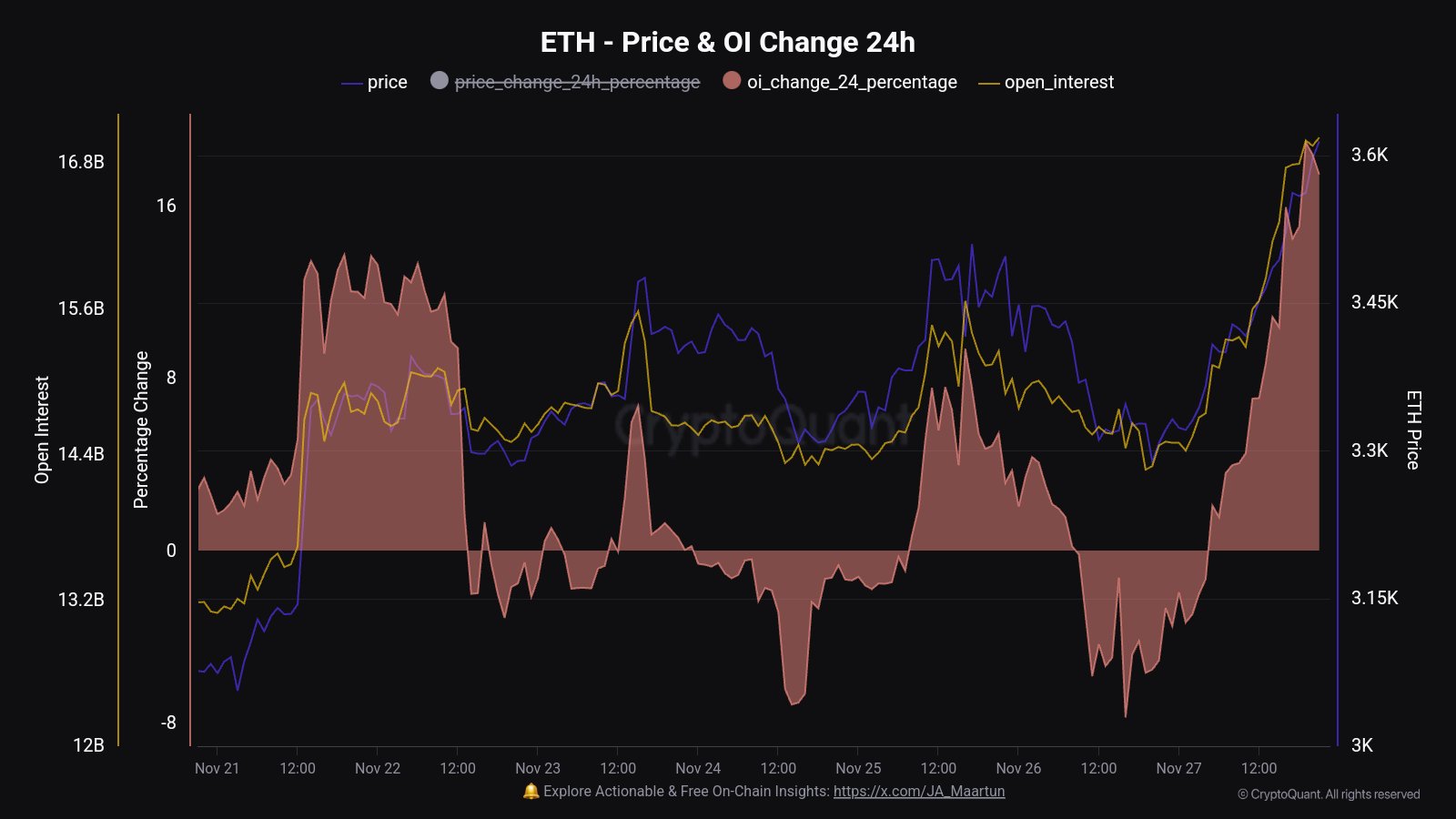

CryptoQuant analyst Maartunn highlighted the recent trend in Ethereum Open Interest, which measures total ETH-related derivatives positions open on centralized exchanges. The following chart illustrates this metric's progression over the past week:

The chart reveals a significant increase in Ethereum Open Interest over the past day, indicating that investors have opened numerous new positions in the derivatives market. An uptick in new positions typically raises the overall leverage in the market, increasing the likelihood of mass liquidation events.

A mass liquidation event, known as a squeeze, involves simultaneous liquidations that can exacerbate price movements. The recent rally in Ethereum suggests speculative interest, but the magnitude of the Open Interest increase—around 19% within 24 hours—may raise concerns about potential volatility.

This rapid growth in Open Interest could lead to significant price fluctuations for Ethereum. Analyst Maartunn noted that such developments often ensure "heavy fireworks." While volatility could swing prices in either direction, the concurrent rise in ETH price suggests that the majority of new positions are likely long.

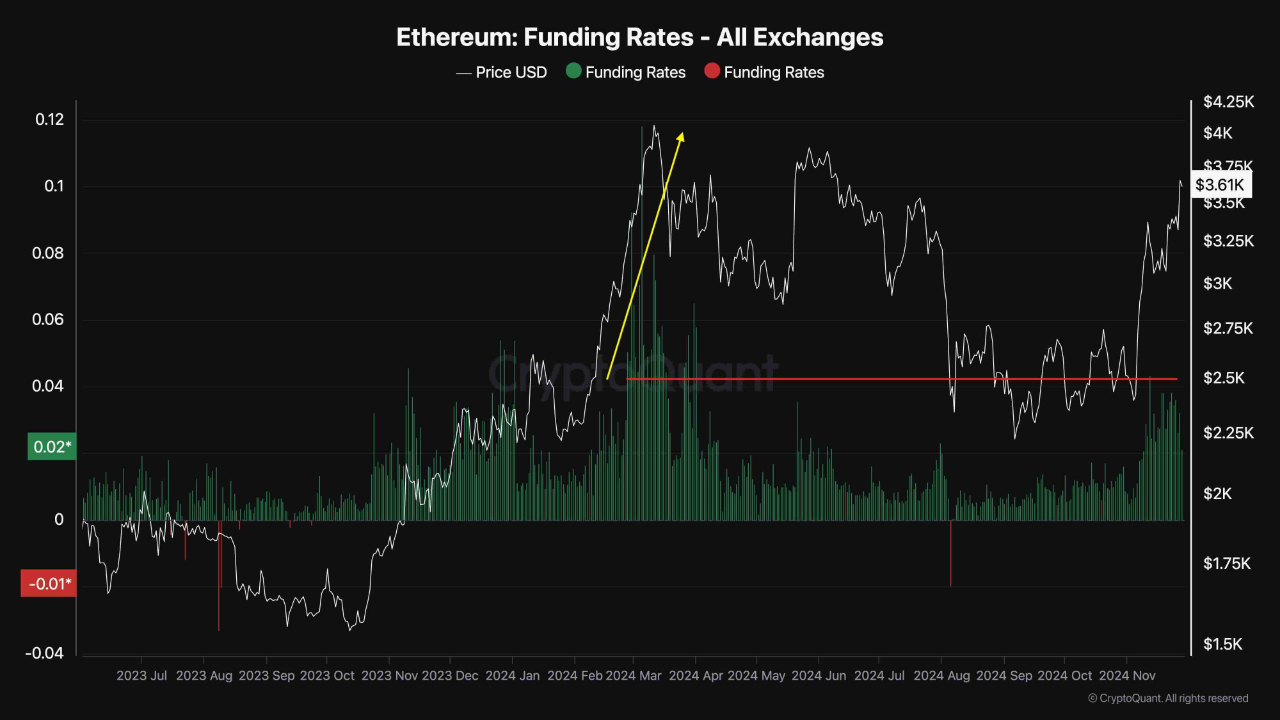

Further analysis from CryptoQuant indicates that Ethereum Funding Rates have been positive, signifying an increase in long positions relative to short ones:

A squeeze is more likely to impact the side of the market with greater positions. Thus, if the overheated derivatives market experiences a downturn, Ethereum may face a decline in price.

Current ETH Price

Currently, Ethereum trades at around $3,500, reflecting an increase of nearly 7% over the past week: