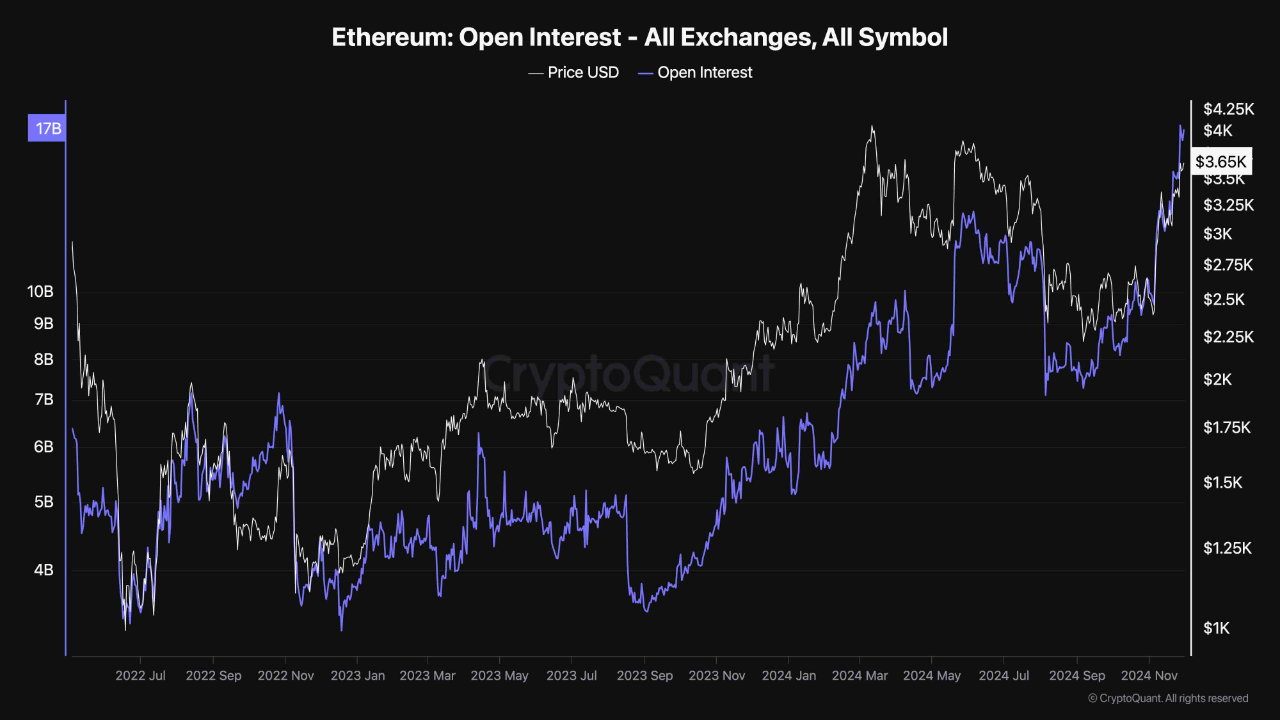

Ethereum Open Interest Reaches Record High of $17 Billion

The price of Ethereum has surpassed $3,500 for the first time since July 2024, marking a significant weekly performance after a slowdown earlier in November. Current indications suggest potential upward movement; however, on-chain signals indicate a possible market pullback. The ETH open interest recently reached an all-time high.

Is ETH Price At Risk With Surging Open Interest?

Analyst ShayanBTC from CryptoQuant highlighted that while Ethereum's price appears bullish, caution is advised due to "alarming divergence" in ETH futures market metrics. Open interest measures the total number of open futures contracts for Ethereum and indicates investor activity in the futures market.

According to data from CryptoQuant, Ethereum's open interest has reached $17 billion. Typically, rising open interest suggests increased speculation among traders about market movements.

ShayanBTC noted that the spike in open interest did not coincide with a new price peak for Ethereum. This divergence could lead to increased volatility and potential liquidation cascades if prices fall or consolidate.

If Ethereum’s price faces a sudden downturn or consolidation, overleveraged futures positions could trigger forced liquidations, resulting in rapid price declines.

The current price of Ethereum is just below $3,700, reflecting a more than 3% increase in the past 24 hours and nearly 8% growth over the last week, according to CoinGecko.

Ethereum Whales Load Their Bags

Contrarily, recent on-chain data presents a bullish outlook for Ethereum. Analyst Ali Martinez reported on the X platform that significant Ethereum investors have been active in the market.

Data indicates that Ethereum whales holding between 100,000 and 1,000,000 coins purchased over 280,000 ETH in four days, which may signal positive sentiment for the cryptocurrency.