7 1

Ethereum’s Open Interest Holds Steady Amid Price Decline: Binance Data

Ethereum has regained the $3,150 level after a volatile session. Analysts are divided: some expect a continued downtrend, while others see potential for a bullish reversal.

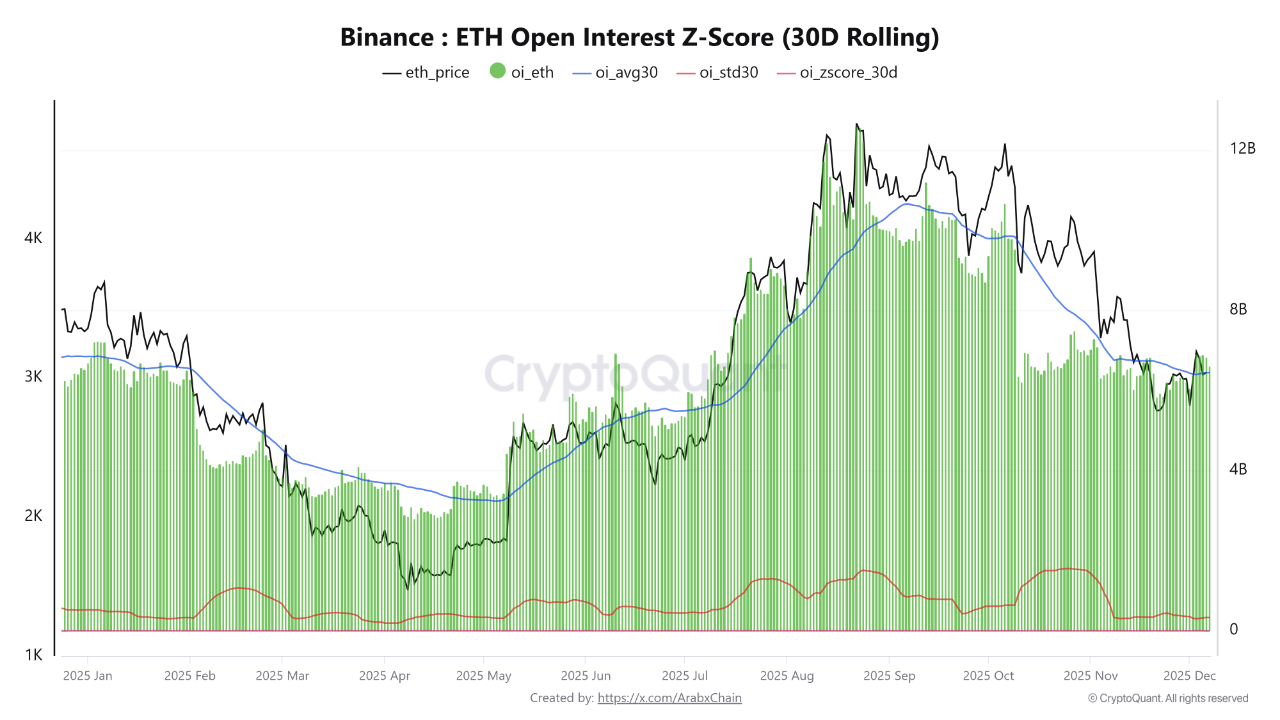

- Binance data shows Ethereum entering a critical phase with weakened price momentum but stable open interest (OI).

- The 30-day OI Z-Score at 0.50 indicates stability within normal volatility ranges, contrasting with past corrections marked by increased leverage or panic selling.

- Ethereum's $6.61 billion in open interest suggests traders maintain positions despite price drops from $3,900 to below $3,200, indicating market repositioning.

- The modest rise in OI doesn't indicate bearish leverage, showing active but not overheated market engagement.

- If large traders are mostly short, stable OI might support downward pressure; if long, it may set the stage for a rebound as momentum returns.

Testing Momentum as Bulls Attempt to Reclaim Control

Ethereum is trying to stabilize above the $3,150–$3,160 zone after a decline.

- ETH rebounded from a low near $2,750 but faces resistance with the 50-day SMA sloping downward.

- The 100-day SMA is declining around $3,350–$3,400, and the 200-day SMA provides resistance at $3,250–$3,300.

- Volume has decreased compared to November's sell-off, suggesting the rebound is due more to reduced selling than strong demand.

- Weak volume may hinder Ethereum's ability to sustain a recovery.