Ethereum Eyes Potential Rally with Critical Support at $2,400

Ethereum is positioned for a potential rally, contingent on maintaining a critical support level. Since July 2023, Ethereum has operated within an ascending channel, characterized by higher highs and higher lows. It is currently testing the lower boundary of this channel, which could determine its trajectory in upcoming months. The channel indicates a possible upward move toward its upper boundary, targeting approximately $6,000, provided bullish forces can uphold the lower trendline against bearish pressures.

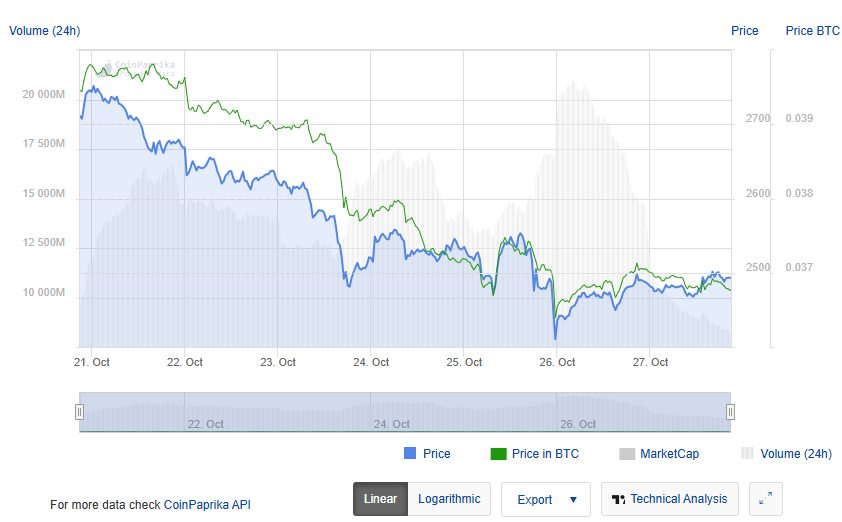

Currently, Ethereum is trading near a key support zone following a recent decline. This drop has brought it closer to the bottom of the ascending channel, raising concerns among market observers. Analyst Ali Martinez emphasizes the significance of the $2,400 support level. If Ethereum holds above this level, it could create a strong foundation for future growth, potentially leading to a rebound that sustains the bullish pattern.

Martinez’s analysis indicates that maintaining the $2,400 level could initiate a rally toward $6,000, marking a considerable increase from current levels. Achieving this would surpass Ethereum's previous all-time high and signal a robust bullish trend. Conversely, failing to maintain this support may result in further losses, prompting Martinez to recommend setting a stop-loss at lower price points to mitigate risks.

Another analyst, Javon Marks, perceives Ethereum as poised for substantial upward movement. He identifies various bullish targets, suggesting possible increases of 61%, 94%, and up to 240% from current price levels. Attaining these targets could also stimulate growth across other cryptocurrencies, potentially initiating a broader altcoin surge.

A crucial factor in Ethereum’s potential rise is the activity of large investors, or "whales," which can significantly impact market dynamics. Recent data from on-chain analytics platform Santiment reveals a notable rise in whale activity, reaching its highest point in six weeks. This accumulation by large holders may provide a solid foundation for Ethereum’s anticipated rally, reinforcing its upward momentum. As these investors build their positions, their actions could be pivotal in shaping the broader market direction.

In summary, Ethereum stands at a critical juncture, with prospects for a strong rally if it sustains its support levels. The outcome relies on whether bulls can counteract bearish pressure and secure a vital foothold in the market. The results could significantly influence the crypto market, particularly if they incite increased interest in other digital assets.