25 January 2025

2 0

Ethereum Posts 6% Price Increase Amid Rising Futures Open Interest

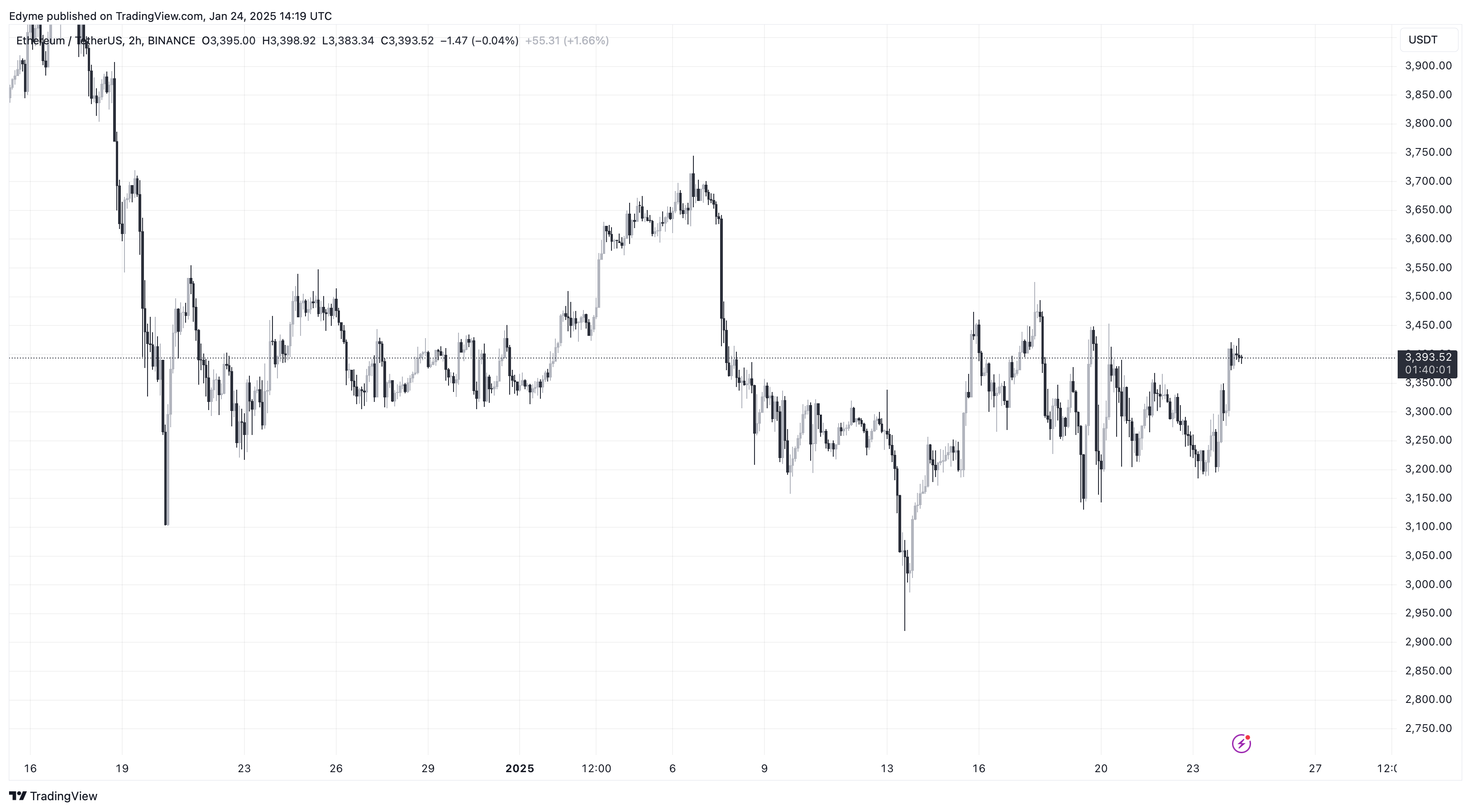

Ethereum has experienced a 6% price increase in the past day, driven by positive market sentiment following a US executive order for a national digital asset stockpile.

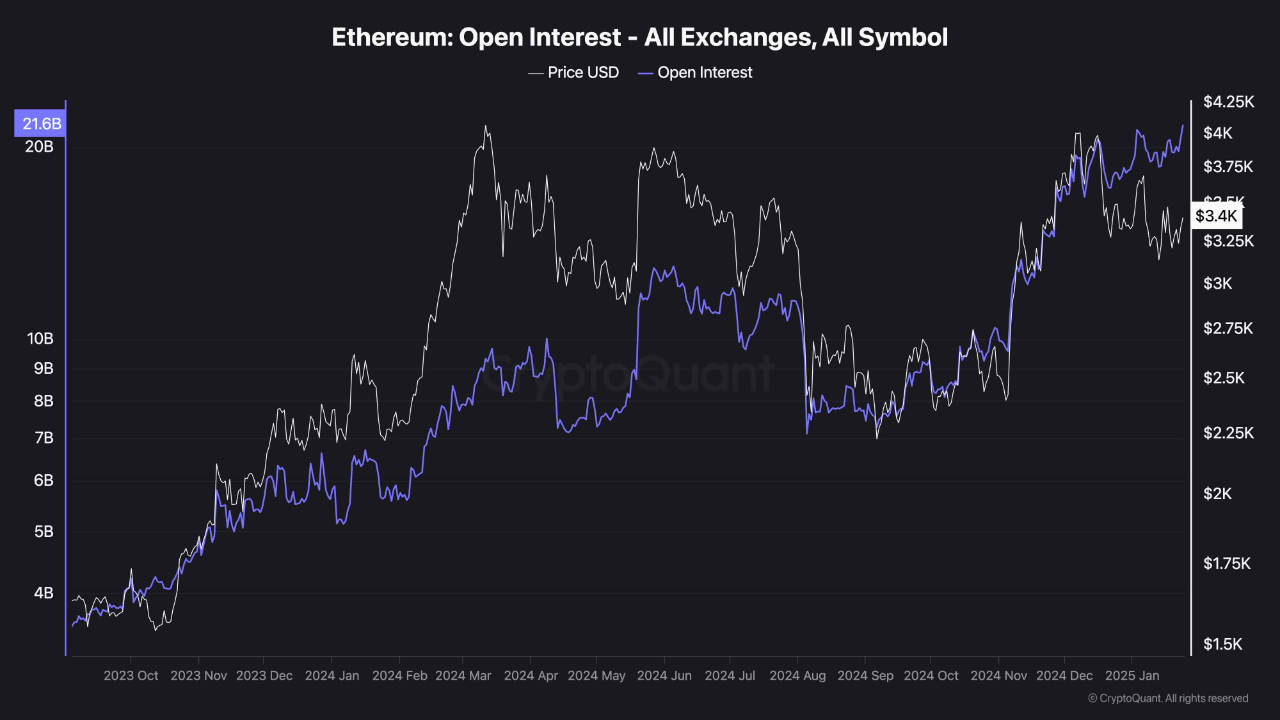

Futures Market Activity

- Open interest in Ethereum futures has reached recent highs, signaling increased trader participation.

- A divergence exists between rising open interest and Ethereum's price, which hasn't yet broken previous highs.

- The disconnect indicates a potential imbalance between market expectations and actual price movement.

- High open interest may lead to volatility due to potential liquidations of positions.

- A bullish breakout could occur if Ethereum surpasses critical resistance levels.

Bearish Sentiment Indicators

- Another analyst, Darkfost, highlights bearish trends, noting increased Ethereum inflows to exchanges since September 2024.

- This trend suggests selling pressure, with more Ethereum moved to exchanges potentially indicating an intent to sell.

- Binance’s taker buy-sell ratio remains bearish, indicating dominance of sell orders.

- These metrics reflect cautious market sentiment as some investors lock in profits or shift capital.