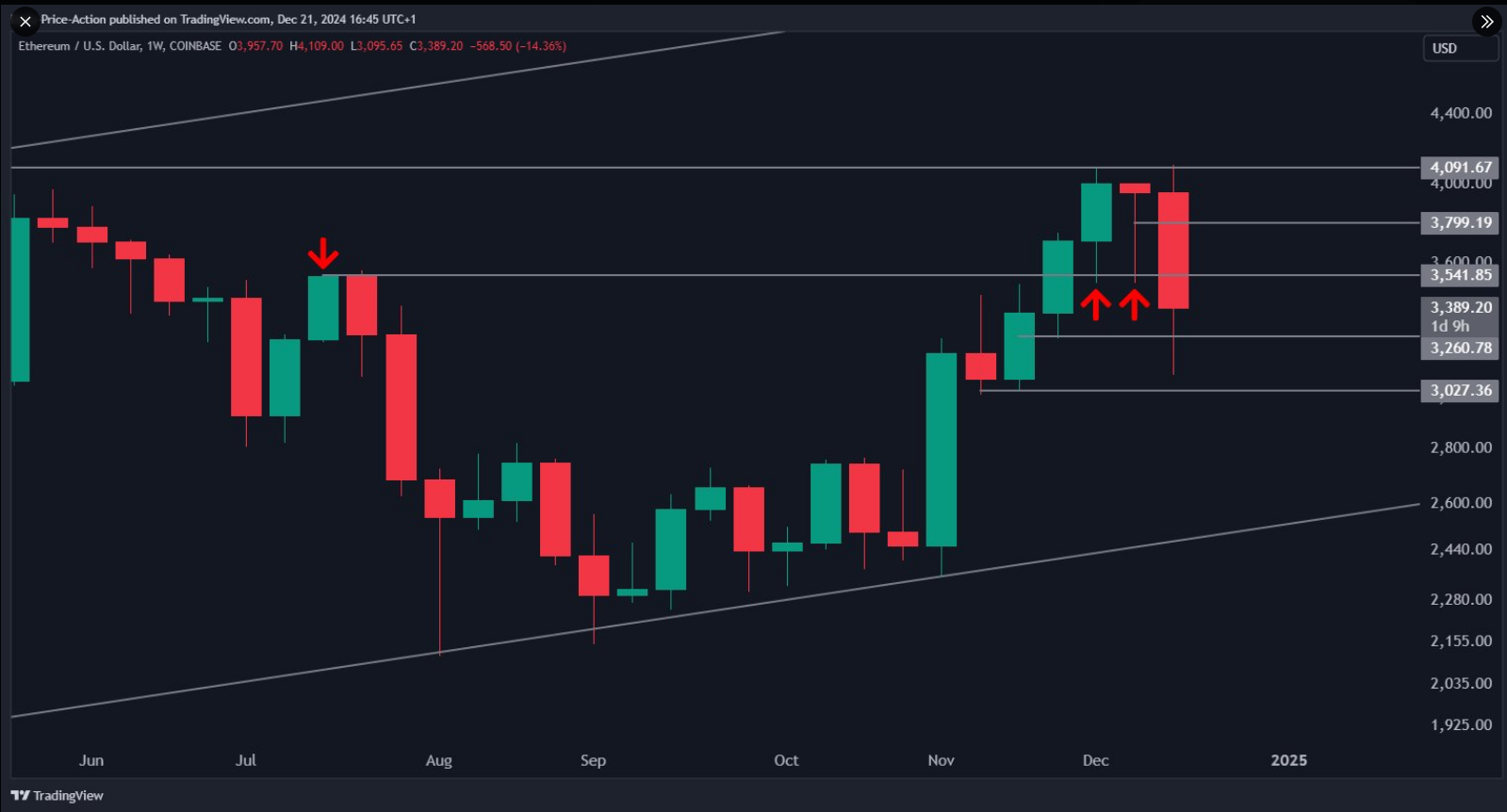

Ethereum Price Needs to Recover $3,540 for Bullish Momentum

As 2024 approaches its conclusion, Ethereum price movements are under close scrutiny. Market behavior is significantly shaped by key resistance and support levels, with experts suggesting a cautiously optimistic outlook.

Important Price Levels To Monitor

Justin Bennett highlighted the necessity for Ethereum to recover the $3,540 level on December 22 to signal potential market optimism. Failure to surpass this barrier may result in a decline below the critical support zone of $3,000, potentially leading to a drop towards $2,600, which would be detrimental for investors and speculators.

As bullish as I'm turning with the overall setup going into 2025, buyers still have work to do. $ETH needs to recover $3,540 on the weekly time frame to look bullish next week. Buyers have 33 hours to get it done.#Ethereum

— Justin Bennett (@JustinBennettFX) December 21, 2024

Market Sentiment And Analyst Predictions

Titan of Crypto's analysis using the Ichimoku cloud approach indicates potential recovery for Ethereum. The retesting of critical levels suggests that the current correction cycle may be concluding. The strength of Kumo Cloud's support line implies that Ethereum could establish a base for upward movement if it maintains existing levels.

Meanwhile, Ethereum whales have accumulated approximately 340,000 ETH, valued at over $1 billion, in a few days, indicating increased confidence among large investors.

Ethereum Whales Bought $1 Billion ETH In The Past 96 Hours – Details https://t.co/fZe8jWmQ3S

— Jose JM (@CryptoJoseJM) December 22, 2024

Additionally, spot Ethereum ETFs have attracted over $2 billion in inflows since their US market introduction, reflecting growing interest. Should regulatory authorities allow staking yields within these funds, projections suggest this trend could surpass Bitcoin ETFs by 2025.

Ethereum Price Forecast

Currently, Ether is trading at $3,330, down 0.7% and 15.7% over the daily and weekly periods, according to Coingecko. Despite recent declines, analysts predict a positive upward trend within the next week, even though Ether is currently priced at a 21% discount from expected future valuations.

Technical indicators such as the Relative Strength Index (RSI) and Moving Averages suggest a potential breakout that could test critical resistance levels. Analysts foresee robust growth for Ethereum, projecting a 35% increase over the next three months and a remarkable 100% growth within a year.

Featured image from DALL-E, chart from TradingView