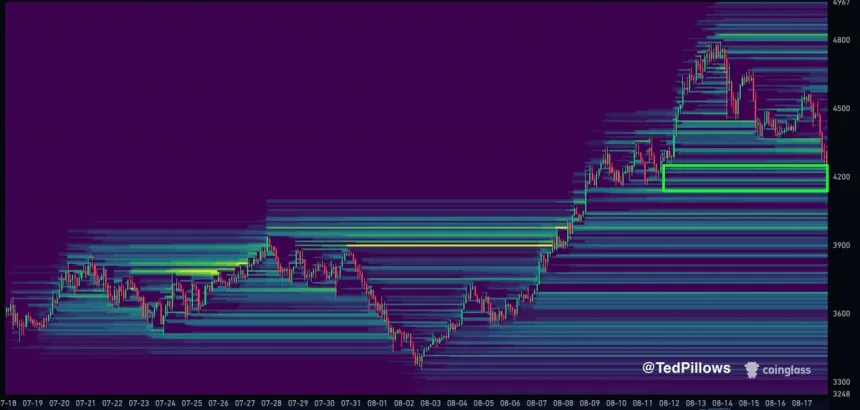

Ethereum Price Retraces to $4,270 After Reaching $4,790 High

Ethereum is experiencing volatility after hitting a multi-year high of nearly $4,790 and subsequently retracing to around $4,200, marking an 11% decline. Analysts are divided on ETH's next steps.

- A warning exists that failure to hold the $4,200 support could lead to further declines towards the $3,900–$4,000 range.

- Some analysts believe excess leverage has been flushed out, positioning Ethereum for renewed strength, with bullish indicators including institutional demand and strong ETF inflows.

- Top analyst Ted Pillows identified the $4,350 zone as critical for liquidity, crucial for establishing a stable base for a potential rally.

If ETH maintains the $4,350 level, it may push toward $4,800 and possibly exceed $5,000. Conversely, falling below this level could lead to retesting supports near $4,000, delaying any breakout.

- Supply on exchanges is declining, indicating strong accumulation.

- Institutional adoption is increasing, with ETFs seeing record inflows.

- Improved regulatory clarity in the US is easing concerns for large-scale investors.

Market analysts suggest that Ethereum could set new all-time highs above $5,000 once current volatility stabilizes.

Weekly Chart Analysis

Ethereum's weekly chart shows a pullback to around $4,270 after the recent high, reflecting a healthy correction following a significant rally. The asset remains well above its long-term moving averages, indicating bullish momentum.

Long-term investors might view this retracement as a reset, potentially paving the way for another upward movement toward $4,790 and beyond $5,000 in the coming months.