Ethereum Price Surge Leads to 90% of Investors in Profit

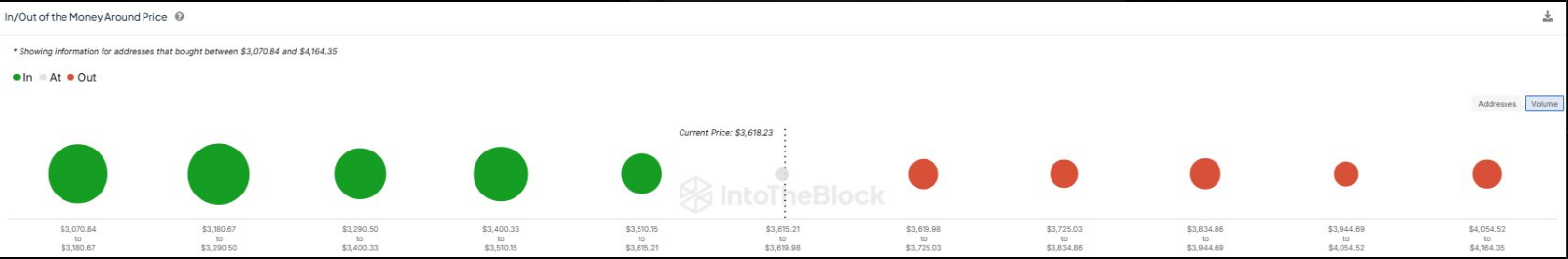

Ethereum (ETH) has seen positive market trends, with over 90% of users currently in profit due to a price rise to $3,680, the highest since June. This increase follows Bitcoin's recovery above $96,000. While ETH remains 25% below its all-time high of $4,890, strong fundamentals suggest a favorable outlook.

90.8% of $ETH holders are now in profit, the highest since June.

Interestingly, the 9.2% of holders still at a loss hold just 2.8% of the total supply. This suggests that potential sell pressure from this group may have a limited impact as $ETH continues to trend upward. pic.twitter.com/qG4Xgi0Cq3

— IntoTheBlock (@intotheblock) November 28, 2024

Whale Confidence and Long-Term Holding

Investment patterns show that only 9.2% of ETH holders are losing money, holding just 2.8% of the total supply, indicating minimal impact from potential selling pressure. Additionally, approximately 74% of ETH holders have held their tokens for over a year, reflecting confidence in Ethereum's long-term value. Only 23% of ETH was purchased last year, and just 3% last month, suggesting a focus on long-term holding.

Decreasing Supply, Bullish Momentum

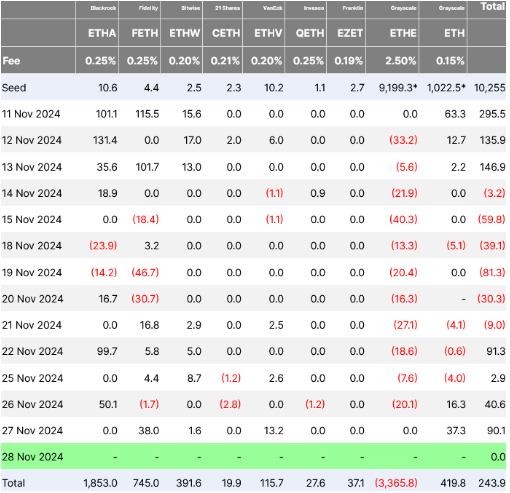

The declining supply of ETH on centralized exchanges supports a bullish outlook. Analysts note that reduced reserves will lead to higher prices if demand outpaces supply during a bull run. Recent inflows into spot ETFs exceeding $90 million further demonstrate rising institutional trust in Ethereum's future.

Ethereum: Path to ATH Appears Clear

Ethereum has outperformed the broader crypto market with a weekly gain of 12%. The ETH/BTC ratio has increased by 18%, indicating strength against Bitcoin. Analysts suggest that surpassing the $4,000 resistance could pave the way to reaching its all-time high. Currently, Ethereum's price is approximately $3,610, having decreased slightly despite recent gains.

Featured image from DALL-E, chart from TradingView