Ethereum Price Surges Past $4,000 Amid Record ETF Inflows

Ethereum has recently surged above the $4,000 price level, generating optimism among crypto investors anticipating an altcoin season. This rally follows record Ethereum Spot ETF inflows of $428 million on December 5, as investors expect favorable regulatory changes under the incoming Trump administration.

This bullish trend is reflected in Ethereum's price chart, where it has broken above a significant triangle formation on the weekly timeframe, indicating a potential price rally.

$10,000 Target In Sight As Bull Run Builds Up Steam

Technical analysis by crypto analyst Captain Faibik indicates that Ethereum has broken out of a three-year triangular pattern. This breakout occurred after the cryptocurrency reached its all-time high of $4,878 in November 2021, characterized by lower highs and higher lows within a tightening range.

Following this breakout, Captain Faibik stated that Ethereum's anticipated 2024-2025 bull run has "officially started," with a price target of $10,000, marking new all-time highs.

On-Chain Data Points To New All-Time High

Ethereum's bullish momentum is supported by strong on-chain metrics, particularly a significant increase in large transactions. Data from IntoTheBlock shows that transactions worth $100,000 or more have risen over 300% in the past week, totaling $86.15 billion in seven days and $17.15 billion in the last 24 hours.

This rise in high-value transactions suggests increased participation from institutional investors and high-net-worth individuals, enhancing Ethereum’s price outlook towards $10,000.

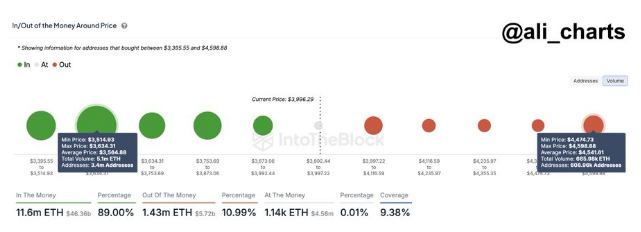

Additionally, Ethereum's profitability metrics indicate favorable conditions for growth. Analyst Ali Martinez noted that there are minimal resistance levels ahead, with only a minor resistance at $4,540. The $3,560 demand zone serves as strong support, suggesting a bullish trajectory for Ethereum.

Currently, Ethereum is trading at $4,010, reflecting an 8% increase in the past 24 hours.

Featured image from Medium, chart from TradingView